Why Is My Credit Score Dropping? Find Out Now

That sinking feeling when your credit score drops is all too real. But don't panic. A dip in your score is usually just a signal that something has changed in your financial data, not a permanent black mark. Most of the time, it comes down to a handful of common culprits, like a recent late payment, a sudden jump in your credit card balances, or even closing an old account you thought was useless.

Figuring out which of these triggers is responsible is the first real step to getting your score heading back in the right direction.

Your Guide to Sudden Credit Score Drops

Think of your credit score like a fitness tracker for your finances. It's not a static number; it fluctuates based on your monthly habits. A sudden drop isn't a sign that you've failed. It's just a new data point telling you that something in your routine has shifted, and lenders are taking notice.

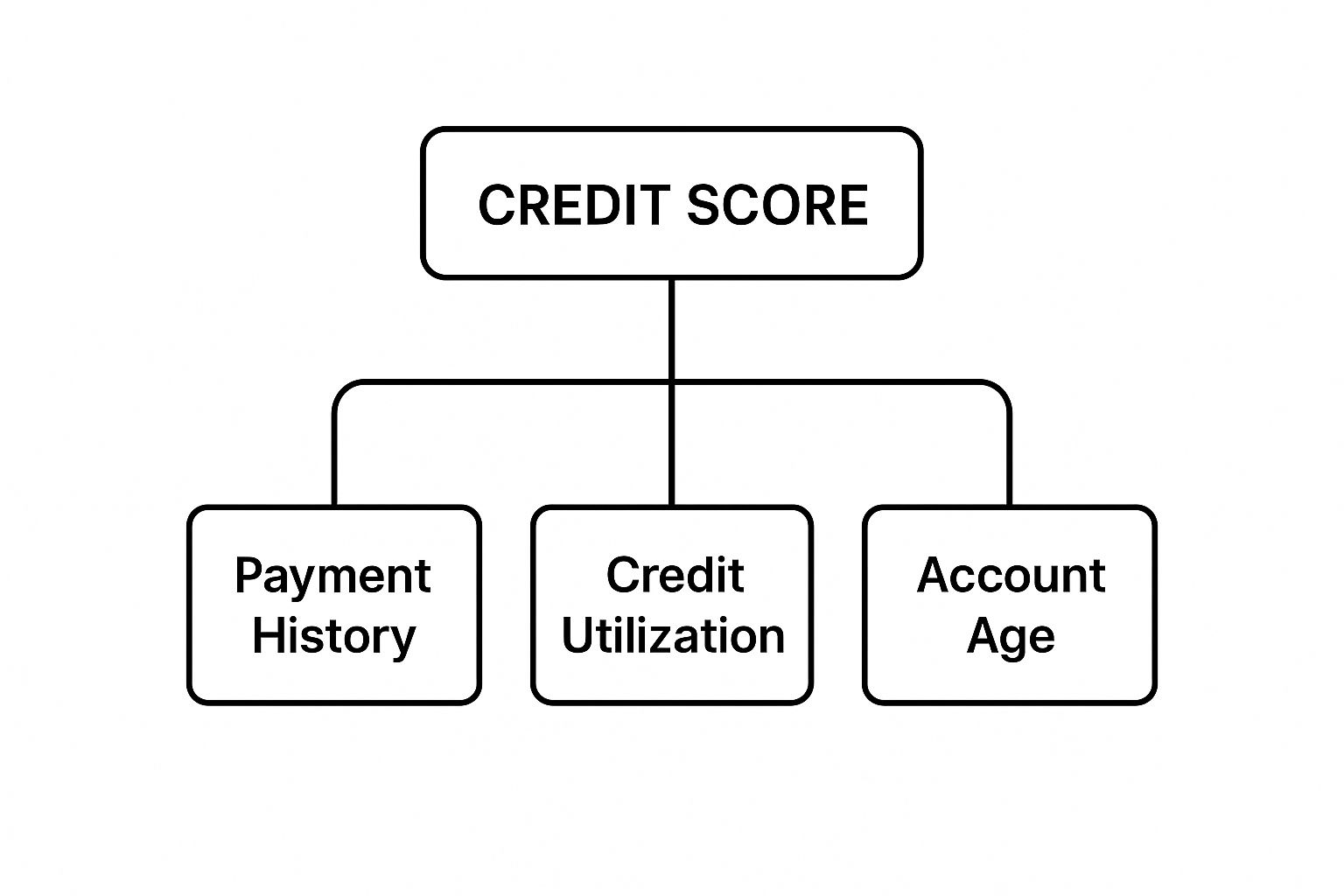

The key to fixing the problem is to understand what lenders actually care about. They're looking at a few core behaviors to decide how reliable you are with credit. These are the big ones:

This infographic really puts into perspective how the different factors are weighted.

As you can see, your payment history and how much debt you're carrying (credit utilization) carry the most weight by a long shot. These should always be the first two places you look when you're trying to figure out why your credit score is dropping.

Since this information is gathered by different agencies, it’s a smart move to learn how to check the reports from all three credit bureaus to get the full story on your financial health.

Quick Guide to Diagnosing Your Score Drop

To get started, here's a quick reference table. Use it to quickly match a potential cause with its likely impact and find out what your very first move should be.

This table is your starting point. Below, we'll dive into each of these factors in more detail and lay out the exact steps you can take to start making improvements today.

How High Credit Balances Can Hurt Your Score

Of all the things that can knock your credit score down, this one catches a lot of people by surprise. You can be paying every single bill on time, without fail, yet still see your score drop simply because you’re using too much of your available credit.

This all comes down to a metric called your credit utilization ratio. It’s a huge deal in the world of credit scoring, making up about 30% of your FICO® Score.

Think of your total available credit—across all your cards—as a big fuel tank. The more of that credit you use, the closer the needle gets to 'empty'. To lenders, a nearly empty tank looks risky. It signals that you might be stretched thin financially, which could make it harder for you to handle your payments down the road.

Let's say you have one credit card with a 10,000 limit. If you're carrying a balance of 7,000, your utilization is a whopping 70%. That’s a massive red flag to credit scoring algorithms. It’s often the hidden answer to the frustrating question, "Why is my credit score dropping when I'm doing everything right?"

Keeping Your Utilization Ratio Low

So what’s the magic number? The standard advice is to keep your credit utilization below 30%. But if you're really aiming for a top-tier score, getting that number below 10% is the goal. This rule applies to your overall utilization (the total balance on all your cards combined) and the ratio on each individual card.

That’s right—a high balance on just one card can drag your score down, even if your other cards have zero balances. Lenders are looking at both the big picture and the small details of how you manage your debt.

This is a growing concern for many. Recent data projects that total U.S. credit card balances are on track to hit $1.09 trillion, with over 554.5 million cards now active. As credit becomes a bigger part of daily life, keeping an eye on your utilization is more important than ever. For a deeper dive, you can see the complete consumer credit forecast.

Actionable Strategies to Manage Your Balances

The good news? A high utilization ratio is one of the fastest credit problems to fix. Most credit card companies report your balance to the bureaus just once a month. This means if you pay down your debt, you could see your score bounce back pretty quickly, often within 30-45 days.

Here are a few practical ways to get your utilization back in check:

The Damage From a Single Late Payment

Of all the things that make up your credit score, nothing carries more weight than your payment history. It accounts for a massive 35% of your FICO® Score, making it the bedrock of your entire financial reputation. A single late payment is like a crack in that foundation—it might not look like much at first, but it can seriously compromise the whole structure.

When you miss a due date, a clock starts ticking. Thankfully, lenders usually give you a bit of a grace period. They typically won't report the late payment to the credit bureaus until the bill is a full 30 days past due. But once that 30-day mark passes, the negative information gets stamped on your credit report, and you can expect your score to take a hit almost immediately.

The Escalating Timeline of Damage

The trouble doesn't stop at the 30-day mark. The longer a bill goes unpaid, the worse the damage gets, because each milestone signals a more serious problem to potential lenders.

This kind of negative mark can haunt your credit report for up to seven years. It’s one of the most common reasons people find themselves wondering, "why is my credit score dropping?" long after they forgot about that one missed bill. We're even seeing this on a national scale. The average U.S. FICO Score recently dropped by two points, partly because federal student loan delinquencies started being reported again after a long pause. You can read more about these FICO score trends to see how small changes can have a big impact.

What to Do if You Miss a Payment

If you suddenly realize you’ve missed a payment due date, don't panic—but do act quickly. The faster you move, the more you can limit the damage.

It can feel like a good spring cleaning for your finances—closing that old, dusty credit card you never use. It seems like a responsible way to simplify your wallet and remove the temptation to spend, right? The problem is, this move can often do more harm than good, leaving you wondering, "why is my credit score dropping?"

Closing an old account can sting your credit score in two key ways. It cuts down your total available credit, which can hurt your utilization ratio, and it can eventually chop down the average age of your credit history. Both are big deals to credit scoring models.

How It Impacts Your Credit Utilization

The first hit you'll take is to your credit utilization ratio. When you close a card, its credit limit disappears from your total available credit. Instantly, the amount you owe looks bigger in comparison to the credit you have.

Imagine your total available credit is a large water tank. Your balances are the water inside. If you close a card, it's like shrinking the size of that tank. The amount of water hasn't changed, but it's suddenly much closer to the brim.

Let's put some numbers to it. Say you have three credit cards, each with a 5,000 limit. That's a total of **15,000** in available credit. You're carrying a combined balance of 4,500, which puts your credit utilization at a respectable **30%** (4,500 is 30% of $15,000).

Now, you decide to close one of those cards you haven't touched in years. Your total credit limit plummets to **10,000**. Your balance is still 4,500, but your utilization ratio just jumped to 45%. That kind of sudden spike is a red flag and can pull your score down.

What Happens to Your Credit History Length

The second, more delayed impact has to do with the age of your accounts. The length of your credit history accounts for about 15% of your FICO® Score. Lenders love to see a long and stable credit history; it shows them you have experience managing debt responsibly.

Now, when you close an account, it doesn't just vanish overnight. If the account was in good standing, it will typically stay on your credit report for up to 10 years, and it will continue to age and help your score during that time. The problem comes later. Once it finally drops off your report, the average age of all your accounts will go down, which could lead to a score drop years down the road.

A simple trick here is to keep old, no-annual-fee cards open. You don't have to use them all the time. Just making a small, planned purchase once or twice a year and paying it off immediately is enough to keep the account active, preserving both your credit limit and that valuable history.

Finding and Fixing Errors on Your Credit Report

Sometimes, the frustrating answer to why your credit score dropped has nothing to do with what you did. The real culprit could be an error lurking on your credit report, quietly dragging your score down without you even knowing it's there. It's a surprisingly common problem, and these mistakes can do serious damage.

We’re not talking about small typos, either. An error could be an entire account that isn't yours, a payment you made on time that's incorrectly marked as late, or a single debt that's listed twice. To a lender, these phantom mistakes look like genuine financial missteps, potentially costing you loan approvals and locking you into higher interest rates.

This is exactly why just watching your score isn't enough. You have to go deeper and regularly review your full credit reports from all three major bureaus: Experian, Equifax, and TransUnion. Each one keeps a separate file on you, so an error might only show up on one or two of them.

How to Spot Common Credit Report Errors

Catching these mistakes requires a bit of detective work. When you get your reports, don't just give them a quick glance. You need to look closely for specific red flags that could be torpedoing your score. Being vigilant is always smart, but it's especially critical when the economy is uncertain and lenders get nervous.

Keep an eye out for these common inaccuracies:

Your Action Plan for Disputing Errors

If you spot an error, don't panic. The Fair Credit Reporting Act (FCRA) gives you the right to challenge it. The process is pretty straightforward, but you'll need to be persistent.

Once your dispute is filed, the credit bureau generally has 30 days to investigate and give you a resolution. If they confirm the information is inaccurate, they are legally required to correct or remove it. Getting that mistake wiped clean can give your score a much-needed boost.

To stay on top of any changes and catch new errors as they appear, consider exploring credit monitoring for all three bureaus.

How Applying for New Credit Affects Your Score

Every time you formally apply for a new credit card or loan, you can expect a small, temporary dip in your credit score. It's nothing to panic about, but it’s important to understand what’s happening behind the scenes.

When you ask for credit, lenders perform what’s called a hard inquiry. This is basically a deep dive into your credit history to see how you've handled debt in the past and whether you're a good candidate for a new loan. Having one or two of these inquiries over a couple of years is completely normal and won't hurt your score much.

But if you start applying for everything all at once, lenders get nervous. A sudden burst of applications can look like you're desperate for cash or trying to take on more debt than you can realistically manage. This is a classic reason people see their score drop, even when they're paying all their bills on time.

Hard Inquiries vs. Soft Inquiries

It's really important to know the difference between the two kinds of credit checks, because only one of them actually dings your score.

The Smart Way to Shop for Loans

Luckily, the credit scoring models are smart. They know that when you're making a big purchase, like a house or a car, you're going to shop around for the best interest rate.

Because of this, they give you a "rate-shopping" window. If you're applying for a specific type of loan (like a mortgage), multiple hard inquiries within a short period—usually 14 to 45 days—are grouped together and counted as just one single inquiry. This is a huge advantage, as it lets you compare offers from different lenders without taking a hit for each application.

So go ahead and shop for that loan. Just be strategic about it and get all your applications in around the same time.

Common Questions About Falling Credit Scores

After seeing your score take a hit, it's completely normal to have a flood of questions. Working through the "why" behind the drop is the first step toward turning that confusion into confidence and getting back in control. Let's walk through some of the most common questions people have when they see a sudden change in their score.

How Fast Can I Rebuild My Credit Score After a Drop?

Honestly, it all depends on what caused the drop in the first place. Think of it like a physical injury. A small scratch heals in a few days, but a broken bone takes dedicated time and care to mend properly.