What Is Credit Score Range? Understand Your Financial Standing

Ever wondered what that three-digit number lenders are so obsessed with actually means? That’s your credit score, and it’s basically your financial reputation summed up in a single figure. The scale runs from a low of 300 to a perfect 850, and where you land on that spectrum tells lenders a lot about how you handle your money.

Think of it as a quick summary of your credit history. A higher score tells them you're a reliable borrower, while a lower score might raise a few red flags. This single number can be the deciding factor in getting that car loan, a new credit card, or even a mortgage for your dream home.

So, What's a Good Score?

While the entire scale goes from 300 to 850, it's broken down into smaller, more meaningful ranges. The most common model you'll see is the FICO Score, which sorts scores into five key brackets. Knowing where you stand is the first step to improving your financial health.

Lenders use these tiers to quickly size up your application. Here’s how it generally breaks down:

Each of these levels opens up different doors. A great score can land you the best interest rates and premium credit cards, while a lower one might mean higher costs or fewer options. Even a small jump from one tier to the next can save you thousands over the life of a loan.

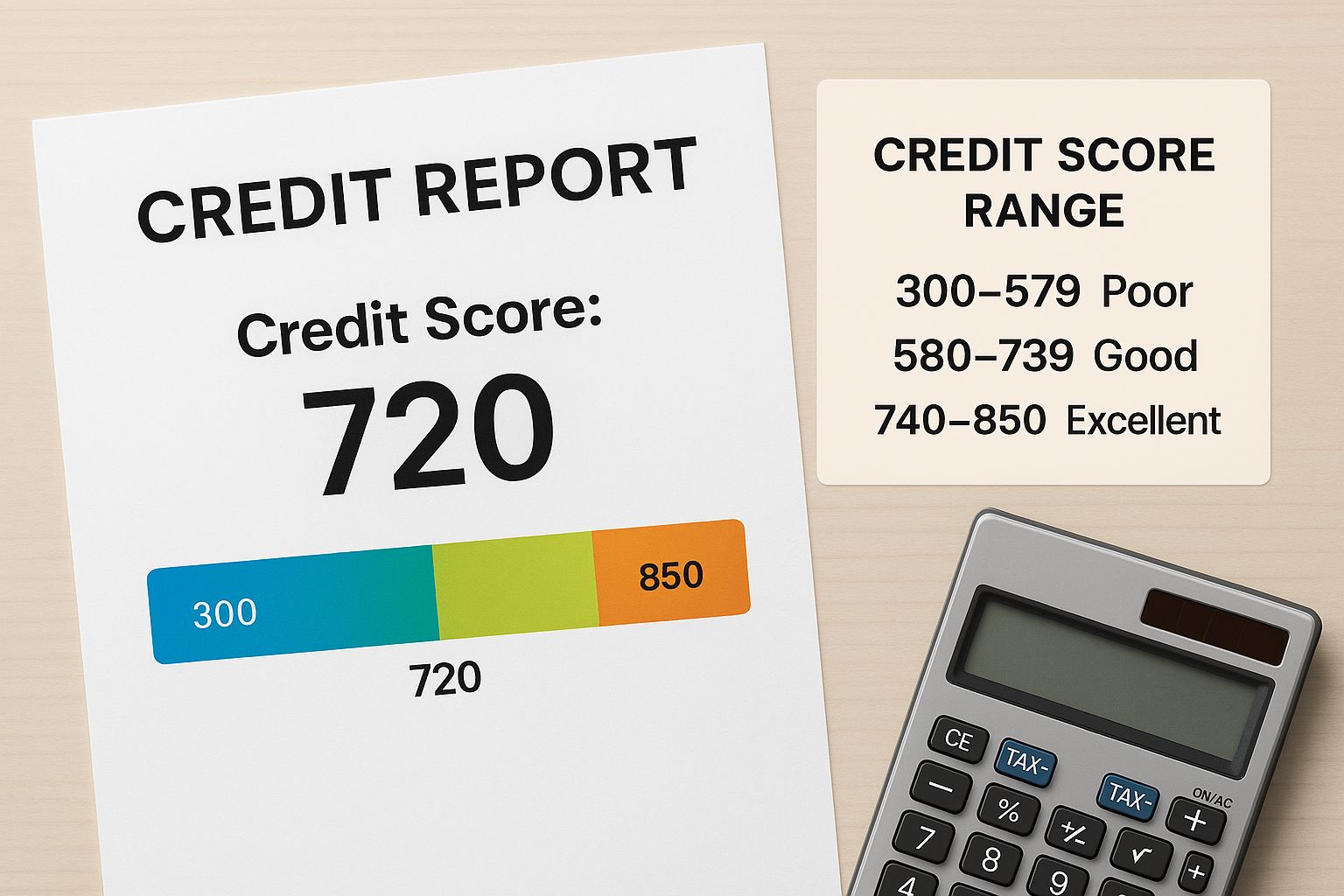

For a quick reference, here’s a simple breakdown of what each credit score range typically signals to a lender.

Credit Score Ranges at a Glance

This table shows just how much your score matters. It’s the difference between getting a great deal and getting turned down completely.

Breaking Down Each Credit Score Tier

It’s easy to get hung up on your credit score as just a single number, but that doesn't paint the full picture. Lenders don't just see a number; they see a category, or a tier. Knowing which tier you fall into is the key to understanding what financial doors are open to you.

This visual guide gives you a quick breakdown of the standard credit score ranges and what they mean to a lender.

As you can see, each range tells a story—from high-risk to a lender’s dream borrower. Let’s dig into what each of these tiers really means for your wallet.

Exceptional: 800 to 850

This is the top of the mountain. If your score is in this range, you're what lenders call a prime borrower. They see you as an extremely safe bet, which means you get the red-carpet treatment: the absolute best interest rates on mortgages, car loans, and credit cards.

You’ll be offered premium perks and the highest credit limits because you’ve proven you’re a pro at managing debt. A score this high doesn't happen by accident; it’s the result of years of consistent, positive financial habits.

Very Good: 740 to 799

Landing in the "Very Good" bracket still makes you a very attractive customer to lenders. You might not always snag the absolute rock-bottom promotional rates reserved for the 800+ club, but you'll have no trouble qualifying for highly competitive offers.

Most of your applications will be approved with great terms, and you'll have a huge variety of financial products to choose from. A score in this range tells lenders you’re reliable and know how to handle your credit.

Good: 670 to 739

This is where a huge chunk of the U.S. population lands. A "Good" score is considered average, and it’s solid enough to qualify you for most standard loans and credit cards without much fuss.

While you won't face major roadblocks, your interest rates will likely be a bit higher than those offered to people in the top two tiers. It might not seem like much at first, but it can add up to thousands of dollars over the life of a big loan.

The widely used FICO® score model runs on a scale from 300 to 850 and is broken into five main segments. As of September 2024, 13.2% of consumers have Poor scores, 15.5% are in the Fair range, 21.0% are considered Good, 27.8% are Very Good, and 22.5% have achieved Exceptional scores. You can see a more detailed breakdown of these national averages in Experian’s analysis.

Fair: 580 to 669

Once your score dips into the "Fair" range, you start being seen as a "subprime" borrower. It doesn’t mean you can’t get credit, but your options will be fewer and much more expensive.

Lenders see you as a higher risk, and they’ll offset that risk by charging you higher interest rates and fees on any loans or cards you qualify for.

Poor: 300 to 579

At the bottom of the scale, a "Poor" score sends up major red flags for lenders. It usually points to a history of serious credit problems, like defaults or a pattern of missed payments.

Getting approved for a traditional, unsecured credit card or loan will be extremely difficult. If you are approved, it will almost certainly be for products with sky-high interest rates, very low limits, and strict terms, like a secured credit card that requires you to put down a cash deposit first.

Ever wonder what's actually in your credit score? It’s not some random number plucked from the air. Think of it as a financial report card, graded on a very specific curve. The exact formulas used by models like FICO are kept under wraps, but they're open about the "subjects" that matter most.

Knowing what goes into the calculation is the key to understanding your score—and, more importantly, how to improve it. Two factors, in particular, do the vast majority of the heavy lifting, making up almost two-thirds of your entire score.

Payment History and Amounts Owed

First up is the big one: your payment history. This single piece of the puzzle accounts for a whopping 35% of your FICO Score. It's a straightforward measure of your reliability. Are you consistently paying your bills on time? Lenders see that as a sign of a responsible borrower. On the flip side, late payments, even by just a few days, can really pull your score down.

Next in line, at 30% of your score, is amounts owed. This isn’t just about the total dollar amount of your debt. What really matters here is your credit utilization ratio—that's the amount of credit you're using compared to your total available credit.

For instance, if you have a single credit card with a 10,000 limit and a 1,000 balance, your utilization is a healthy 10%. But if that balance creeps up to $8,000, your utilization skyrockets to 80%. High utilization can make lenders nervous, as it might suggest you're stretched too thin.

The Supporting Factors

While payment history and utilization are the stars of the show, three other factors play crucial supporting roles.

Why Your Credit Score Range Matters in Real Life

Your credit score is way more than just a three-digit number. Think of it as your financial reputation—one that can either open doors or put up roadblocks in your life. The specific range you land in can literally save you or cost you thousands of dollars over time.

Let's get practical. Imagine you're buying a house or a new car. The interest rate you get is almost entirely tied to your credit score. Someone with a "Very Good" score might snag a fantastic low-interest mortgage. But a borrower with a "Fair" score could end up paying a much higher rate for the exact same loan.

This isn't a small difference. We're talking about significant savings every single month, potentially adding up to tens of thousands of dollars over the life of the loan.

Beyond Loans and Credit Cards

But the story doesn't end with getting a loan. Your credit score's influence creeps into a surprising number of everyday financial situations. A shaky credit history can create hurdles you might not even see coming.

For instance, your credit can impact:

Since your score is a blend of information from different credit bureaus, keeping an eye on all of them is crucial. It’s worth learning how to get all 3 credit reports to get the full story on your financial standing. Ultimately, a strong score is a powerful asset that gives you more choices, better terms, and a whole lot more financial freedom.

Habits of People with Exceptional Credit Scores

https://www.youtube.com/embed/H0G4dZ6rKL0

Landing in the exceptional credit score club doesn't happen by chance. It’s the direct result of consistent, disciplined financial habits practiced over many years. People with scores of 800 or higher aren't using secret tricks; they’ve just mastered the fundamentals of credit management.

Their success boils down to a few powerful, non-negotiable rules. First and foremost, they pay every single bill on time, every time. This flawless payment history is the bedrock of their excellent score.

On top of that, they are masters of their credit utilization ratio.

Mastering Credit Utilization and History

People with top-tier scores are incredibly intentional about keeping their credit card balances low compared to their total credit limits. While the standard advice is to stay below 30% utilization, these folks often keep their usage in the single digits. This signals to lenders that they aren’t reliant on debt and have their finances under complete control.

They also play the long game. These individuals almost always:

These habits are shared by the 23% of Americans who have a FICO score of 800 or higher. An even more exclusive group—just 1.76% of consumers—achieves a perfect 850 score, showcasing the pinnacle of financial discipline. You can find more details on this topic by reading about how many Americans have an 800 credit score on Experian.com.

How Credit Scores Work Around the World

The 300-850 credit score might feel like a universal language, but it’s really just the standard here in the United States. The idea of measuring someone's reliability with money, however, is a global concept. Financial institutions everywhere need a way to figure out the risk of lending money, even if the numbers and models look a little different from country to country.

So, while the score itself might change when you cross a border, the fundamentals of building good credit don't. A solid history of paying your bills on time and managing debt wisely is valued by lenders no matter where you are.

A Look at International Credit Systems

Every country has its own key players—the credit bureaus—and its own unique scoring scale. Seeing how they differ really drives home the point that credit scoring is a universal practice, just with local dialects.

Here are a few examples:

These systems prove that the answer to "what is a credit score range" truly depends on your location. The end goal, though, is always the same: to give lenders a clear, simple number that represents financial risk.

Regardless of the country, these scores all come from data collected by credit reporting agencies. In the U.S., it's essential to understand who these agencies are and how they operate. You can learn more about all three credit bureaus to get a full picture of your own financial profile.

Still Have Questions About Credit Scores?

Even with the basics down, you might still have a few questions rattling around. That’s perfectly normal. Let's tackle some of the most common ones that come up.

How Long Does It Take to Improve My Score?

This is the big question, and the honest answer is: it depends. The timeline for boosting your credit score is tied to where you're starting from and what steps you're taking.

If you find a simple error on your credit report and get it corrected, you could see a change in as little as 30-45 days. For bigger lifts, like consistently paying your bills on time or paying down high credit card balances, you'll likely see a noticeable improvement in three to six months. Major setbacks, like a bankruptcy, take real patience—often years of steady, positive habits to fully recover from.

Does Checking My Own Credit Score Lower It?

Absolutely not. Checking your own score is what’s called a "soft inquiry," and it has no impact on your credit whatsoever. Feel free to check it as often as you'd like through a credit monitoring service or even your bank's app.

The kind that can cause a small, temporary dip is a "hard inquiry." This only happens when a lender formally pulls your credit report because you've applied for something new, like a mortgage, auto loan, or credit card.

What Is the Difference Between FICO and VantageScore?

You've probably seen both of these names, and they are the two major players in the credit scoring world. Both FICO and VantageScore use the same basic 300-850 scale and get their information from your credit reports, but they analyze that data a bit differently.