What is Credit Monitoring? Protect Your Financial Health

Think of credit monitoring as your personal security guard for your financial reputation. It's a service that constantly keeps an eye on your credit reports, watching for any suspicious activity or changes. This gives you a critical head start to shut down identity theft or fix errors before they spiral into bigger problems.

Your Financial Watchdog Explained

So, how does it actually work? At its heart, a credit monitoring service connects to your credit files at the three major bureaus—Experian, Equifax, and TransUnion. Instead of you having to pull your own reports and comb through them line by line, these services do the heavy lifting for you, 24/7.

Here's a simple analogy: imagine your credit report is like a highly secure building. Every time someone applies for a loan, opens a credit card, or even changes an address in your name, it's like they're trying to open a door. Credit monitoring is the guard at the front desk who calls you the second someone tries a lock, making sure you're aware of every single access attempt.

This early warning is what makes it so valuable. Without it, a fraudster could open a new account in your name, and you might not find out for months. By then, the damage to your credit score and financial standing could be significant.

What Does Credit Monitoring Actually Track?

A good credit monitoring service keeps tabs on the most sensitive parts of your credit file. When it spots a change, it immediately sends you an alert, usually through email or a push notification on your phone.

To give you a better picture, here’s a quick breakdown of the core alerts and why they matter.

Credit Monitoring at a Glance: Key Features and Alerts

As you can see, each alert gives you a chance to react quickly.

The demand for these services is exploding. With data breaches becoming more common, the credit monitoring market is expected to hit 15 billion by 2025** and an astonishing **45 billion by 2033. If you're interested in the market forces behind this growth, in-depth industry reports offer a comprehensive look.

Ultimately, this constant oversight offers genuine peace of mind. It turns credit management from something you worry about reactively into a proactive part of keeping your finances healthy and secure.

How Credit Monitoring Actually Works

Ever wonder what’s happening behind the scenes with a credit monitoring service? It’s not magic, but it’s pretty close. Think of it as hiring a personal security guard who watches your financial files 24/7.

It all starts when you give a service the green light to access your credit information. The provider then taps directly into the data streams of the major credit bureaus. For real peace of mind, you’ll want a service that connects to all three credit bureaus. Why? Because some lenders only report to one or two, and you can’t protect what you can’t see. You can learn more about why monitoring all three credit bureaus is the only way to get a complete picture of your financial identity.

Once that connection is established, the service doesn't just pull your report and call it a day. It actively and continuously scans for changes that could spell trouble.

The Digital Tripwire System

The easiest way to picture how this works is to imagine a digital tripwire. Your credit monitoring provider sets up this invisible wire around your credit files. Any time a new activity happens—like a lender pulling your credit or a new account popping up in your name—it "trips the wire."

The moment that happens, an alert is instantly fired off to you through email, a text message, or a notification on your phone's app. This whole process is built for speed, turning what used to be a slow, manual chore into a near-instant warning system.

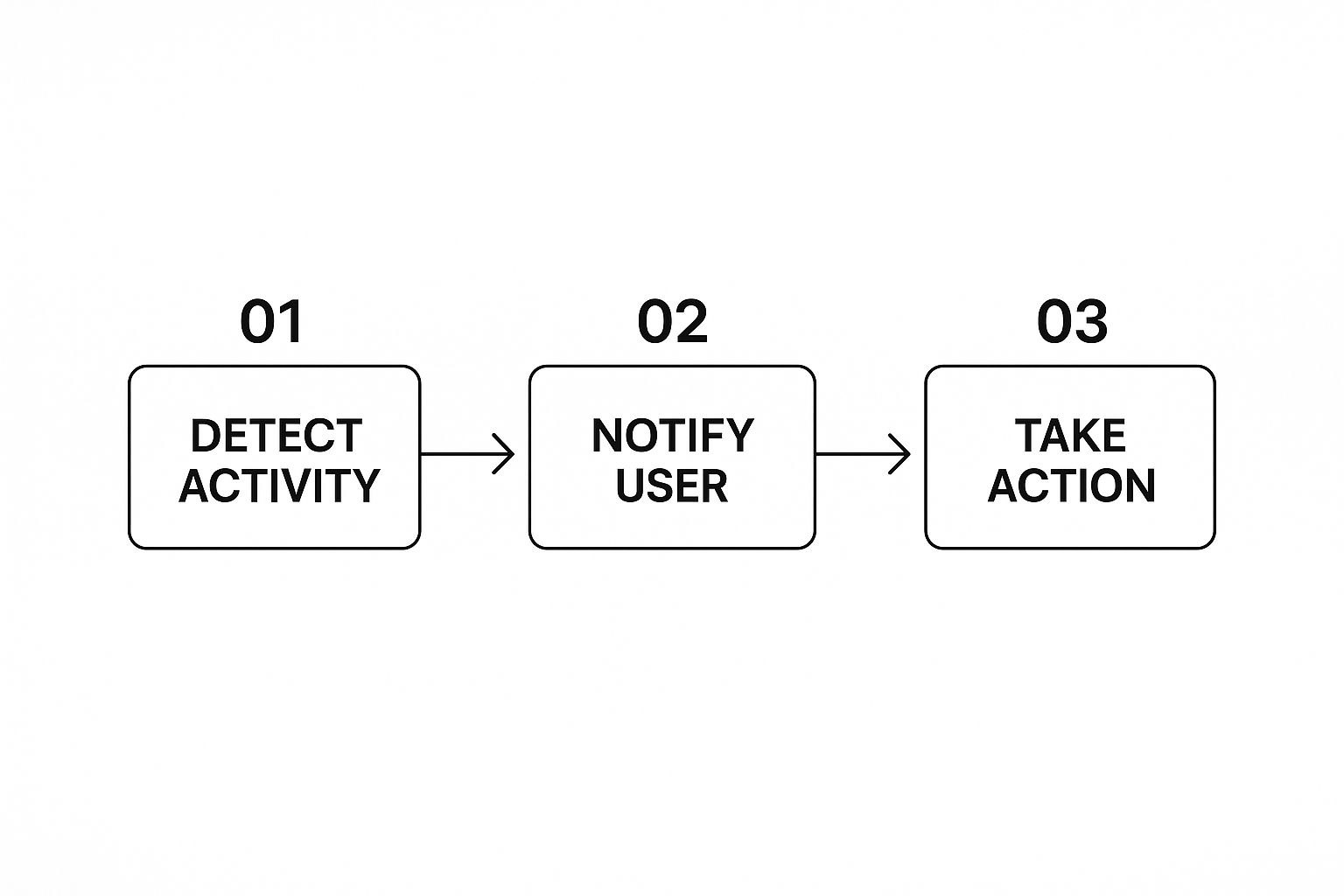

This visual breaks down that simple, powerful workflow.

As you can see, the goal is to get you from detection to action in the shortest time possible. This shrinks the window of opportunity for a thief to do any real damage.

So, what kind of activity is the system looking for? Here are some of the most common triggers that will set off an alert:

This constant, automated watchfulness means you don't have to stress about remembering to pull your own reports. Your service does the heavy lifting for you, pushing the most critical information your way the moment it happens. This gives you the power to quickly confirm if an activity is yours or to shut down fraud before it gets out of hand.

The Real-World Benefits of Keeping an Eye on Your Credit

It’s one thing to know what credit monitoring is, but the real lightbulb moment comes when you understand what it can do for you. The single most powerful benefit is early fraud detection. Getting an instant alert about a new credit card or loan application you didn't authorize is your first and best line of defense against identity thieves.

That speed is everything. It can turn a potential financial catastrophe into a minor inconvenience. Imagine a thief trying to open a store credit card with your information. A quick alert from your monitoring service could let you shut it down before they even walk out of the store. Without that alert, you might not find out for weeks until a surprise bill shows up, giving the fraudster a huge head start to do more damage.

More Than Just Fraud: Spotting Errors and Seeing Your Progress

Credit monitoring is also your best friend for making sure your financial record is accurate. Let's face it, credit reports aren't perfect—mistakes happen. A payment you made on time might get reported as late, or a closed account could still show an outstanding balance. Both of these errors can unfairly pull your credit score down.

Getting regular alerts helps you catch these mistakes right away, so you can file a dispute and get them corrected. This isn't just about cleaning up your report; it's about making sure your hard work and good financial habits are actually reflected in your score. This becomes especially important when you’re building toward a big financial goal.

Here are a few key advantages this gives you:

Ultimately, credit monitoring puts you in control. It gives you the information you need, when you need it, to protect your identity, ensure your financial data is accurate, and move confidently toward your goals. For more insights on building a strong financial future, feel free to explore our official blog.

Credit Monitoring Versus Identity Theft Protection

It’s easy to get "credit monitoring" and "identity theft protection" mixed up. People often use the terms as if they mean the same thing, but they are actually two very different tools for protecting your financial life. Getting the distinction right is key to picking the right kind of security.

Here’s a simple way to think about it: credit monitoring is like a security camera pointed directly at your front door. Identity theft protection, on the other hand, is a complete security system—cameras, motion detectors, window sensors, and a direct line to the authorities, all covering your entire property.

Credit monitoring has a very specific, focused job: it watches your credit reports at the three main bureaus—Experian, Equifax, and TransUnion. That's it. It’s designed to be a reactive alert system, letting you know the moment something specific happens, like a new credit card application appearing in your name or a change of address being filed.

By contrast, identity theft protection is a much broader shield. It casts a far wider net to guard your entire personal identity, not just the activity on your credit files.

What Does Identity Theft Protection Cover?

While strong credit monitoring is almost always part of the package, a true identity theft protection service goes much further. It includes a whole suite of services meant to spot trouble long before it ever has a chance to damage your credit score. These tools are constantly scanning for your personal information in places it absolutely shouldn't be.

This often includes features like:

The demand for these combined services is exploding. The market is projected to be worth $25 billion in 2025 and is expected to grow at 15% annually through 2033, a direct result of our increasingly digital lives. You can dive deeper into this trend in this comprehensive market analysis.

Choosing the Right Level of Protection

So, which service is right for you? Honestly, for most people, a dedicated credit monitoring service is the perfect place to start. It focuses directly on one of the most common and damaging types of fraud—someone opening new accounts in your name—and gives you the early warning you need to shut it down fast.

If your biggest worry is stopping someone from taking out a fraudulent loan or credit card, a specialized service like All3Credit provides the critical alerts you need without unnecessary bells and whistles. It’s a powerful and affordable way to keep a close watch on your reports from all three bureaus. You can explore our straightforward approach to credit monitoring to see if it’s the right fit.

For those who want the most comprehensive defense against every possible angle of identity fraud, a bundled identity theft protection service is probably the better option.

How to Choose the Right Credit Monitoring Service

Picking a credit monitoring service can feel like a chore with so many options out there. But it doesn't have to be complicated. If you know what to look for, you can cut through the noise and find a service that genuinely protects your financial life.

The absolute first thing you need to check is how many credit bureaus it monitors. This is non-negotiable. Some services—especially the free ones—only keep an eye on one bureau. That’s like locking your front door but leaving all the windows wide open. Lenders and creditors don't always report to all three bureaus, so if your service only watches Experian, you're completely in the dark about what's happening at Equifax and TransUnion. For real security, you need three-bureau monitoring. Period.

Evaluating Key Features and Costs

Once you've confirmed three-bureau coverage, it's time to dig into the details. This is where you'll see a big difference between free services and paid subscriptions, and what you get for your money.

Free services, like the ones your bank might offer, are a decent first step. They're better than nothing and can give you a basic heads-up on your score. But they often lack the immediate, detailed alerts you need to shut down fraud before it gets out of hand.

Paid plans are where you find the heavy-duty protection. When you’re comparing them, look for these specific features:

Making the Final Decision

At the end of the day, the right service for you is the one that fits your budget and your need for peace of mind. If you want the most complete picture of your credit, a service like All3Credit that monitors all three bureaus for a simple monthly fee is a smart move. It gives you a single, unified view of your entire credit profile.

So, ask yourself what level of risk you’re willing to accept. Is a free, basic service enough for you right now? Or is the peace of mind that comes from knowing your identity is constantly watched across all three bureaus—backed by a hefty insurance policy—worth a small monthly investment? Your answer will point you directly to the best choice for protecting your financial future.

What to Do When You Get a Credit Alert

So, an alert just landed in your inbox. Before you jump to conclusions, take a breath. That notification is actually a good thing—it means your credit monitoring service is on the job. The trick is to stay calm and figure out what’s going on.

First things first, verify the alert is legitimate. Don't click any links in the email. Instead, go directly to your credit monitoring service’s website or open their app and log in. Once you're in, take a look at the specific change that triggered the alert. More often than not, it’s something perfectly normal that you caused, like paying off a big balance or a lender just updating your account info.

Acting on Suspicious Activity

Okay, what if you look at the alert and have no idea what it's about? Maybe it’s a credit inquiry from a store you've never visited or a new account you definitely didn't open. Now it's time to move, and move quickly.

Here’s a simple game plan to tackle it head-on:

Dealing With Simple Errors

Sometimes, an alert points to a simple mistake, not outright fraud. It could be an account you closed that’s still showing a balance or a payment that was accidentally marked as late. For these kinds of issues, you can file a dispute directly with the credit bureau that has the incorrect information on your report.

By following these steps, you can turn a moment of panic into a series of manageable actions. It's how you stay in the driver's seat and keep your financial health on track.

Frequently Asked Questions About Credit Monitoring

Even after you get the basics down, you're bound to have a few more questions about credit monitoring. That’s perfectly normal. Getting straight answers to these common questions is the best way to feel confident about what these services can—and can't—do for you.

Let's tackle some of the ones I hear most often.

Can I Monitor My Own Credit For Free?

Yes, you absolutely can. In fact, you're legally entitled to a free copy of your credit report from all three bureaus—Equifax, Experian, and TransUnion—once a year at AnnualCreditReport.com. Many banks and credit card companies also throw in free credit score tracking as a perk.

So, what's the catch? These free tools aren't built for speed. You get a snapshot, but not the constant vigilance that paid services offer. The real value of a paid service is getting near-instant alerts when something changes, which could be the difference between stopping fraud in its tracks and discovering it months later.

Does Credit Monitoring Affect My Credit Score?

This is a big one, and thankfully, the answer is a simple no. Checking your own credit through a monitoring service results in what's called a "soft inquiry."