What Is Credit Mix and How Does It Work?

Ever wondered what lenders see when they pull your credit report? It's not just about whether you pay your bills on time. They're also looking at your credit mix, which is really just a fancy term for the variety of credit accounts you have.

Think of it like a financial diet. A healthy diet isn't just one food group, and a healthy credit profile isn't just one type of debt. Having a good mix shows lenders you can responsibly manage different kinds of financial obligations, from credit cards to a car loan. This one factor alone makes up about 10% of your FICO® Score.

Understanding Your Credit Mix

Put yourself in a lender's shoes for a moment. If they look at your report and only see a handful of credit cards, they know you can handle that specific type of debt. But what about a larger loan with a fixed monthly payment that spans several years? That’s a whole different ball game.

A healthy credit mix paints a more complete picture of your financial discipline. It proves you can juggle different payment structures and timelines, which makes you look like a much more reliable—and less risky—borrower when you need to apply for a new loan or card.

The Two Main Types of Credit

All of your accounts fall into one of two main categories. Understanding these is the key to understanding your credit mix.

Here's a quick breakdown:

Having a blend of both installment and revolving accounts tells lenders you have experience with different financial responsibilities.

Ultimately, a diverse and well-managed portfolio makes you a more attractive candidate for a loan. This can open doors to better interest rates and more favorable terms down the road, saving you real money.

The Building Blocks of Your Credit Portfolio

To really get a handle on credit mix, you have to look at what it's made of. Think of it like a financial toolbox—different tools are designed for different jobs, and lenders want to see you know how to use more than just a hammer.

The two main categories you'll find in this toolbox are installment credit and revolving credit.

These two account types tell very different stories to the people and institutions looking at your credit history. Getting good at managing both shows you’re a well-rounded borrower, which makes you a much more predictable—and appealing—candidate for a loan.

Installment Credit: The Long Game

Installment loans are all about consistency and predictability. You borrow a set amount of cash and agree to pay it back in fixed, regular payments over a predetermined timeline. These are typically for big-ticket items that signal a serious, long-term commitment.

A few common examples include:

Every single on-time payment you make on an installment loan helps build a powerful history of reliability.

Revolving Credit: The Balancing Act

Revolving credit is the complete opposite of an installment loan—it’s all about flexibility. Instead of a fixed amount, you get a credit limit and can borrow and pay back money as you see fit. Because your balance can change, your monthly payment isn't fixed, which means you have to actively manage it.

Credit cards are the classic example here. Juggling them successfully shows lenders you can handle fluctuating debt without running up your balances to the max. It's a constant, real-time test of your financial self-control.

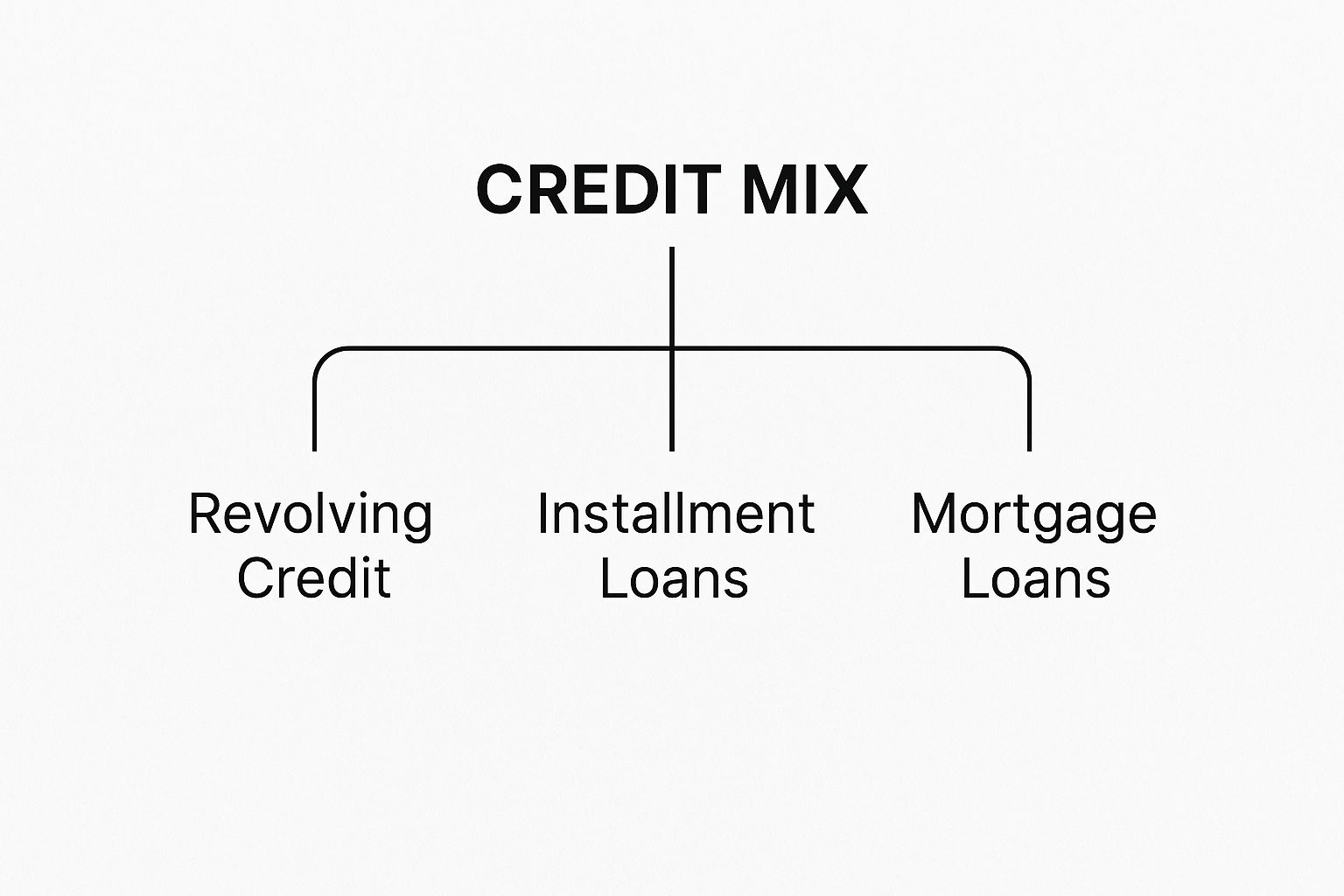

This diagram helps visualize how these different types of loans come together to form your credit mix.

As you can see, both revolving accounts and installment loans are critical pieces of your credit portfolio. According to FICO, your credit mix is responsible for about 10% of your credit score.

While that might not sound like a lot compared to payment history, it’s a crucial piece of the puzzle. It proves you can juggle different kinds of financial responsibilities, which goes a long way in helping lenders trust you. You can learn more about how the three credit bureaus report these accounts to get the full picture.

Why Lenders Want to See a Healthy Credit Mix

From a lender's perspective, every single application carries some risk. The big question they're always trying to answer is, "Will this person pay us back on time?" Your credit mix helps tell that story, giving them a much clearer picture of your reliability with money.

Think about it like hiring someone for a job. A candidate with a varied resume—experience in sales, project management, and customer support—often stands out. It shows they're adaptable and can handle whatever challenges come their way.

It’s the same with your credit. A borrower who has successfully juggled a car loan (installment credit) and a few credit cards (revolving credit) is seen as a more dependable, well-rounded applicant. You’ve proven you can manage different kinds of financial obligations, which gives lenders peace of mind.

Proving Your Financial Versatility

A strong credit mix is tangible proof of your money management skills. It shows you can handle the two main types of debt without getting into trouble.

This is a bigger deal than it might sound because managing a fixed monthly car payment is a completely different ballgame than handling the fluctuating balances of a credit card. In fact, research from FICO shows that people who successfully manage different types of credit are statistically less risky than those who only have experience with one. You can find more details on how lenders view this on CreditCards.com.

At the end of the day, having this diverse financial experience simply makes lenders more comfortable saying "yes." Someone who has only ever used credit cards is an unknown when it comes to a big, long-term loan. But if you’ve already shown you can handle both, you become a much more predictable—and trustworthy—borrower in their eyes.

How Your Credit Mix Affects Your Credit Score

When it comes to your credit score, making payments on time is definitely the main event. But your credit mix? Think of it as a crucial supporting actor—it can make or break the whole performance. For the most common scoring models, like FICO, your credit mix quietly influences about 10% of your total score.

Now, 10% might not sound like a game-changer, but it can be the very thing that nudges your score from "good" into the "excellent" range. That little boost can mean unlocking much better interest rates on a mortgage or car loan, saving you a boatload of money over time. On the flip side, a thin credit mix might be the one thing holding you back from reaching that top-tier credit status.

How Different Models Weigh Your Mix

It’s worth knowing that not all scoring models see credit mix through the same lens. While FICO allocates that 10%, some other models give it even more weight.

Take VantageScore, for example. It bundles your credit mix together with your credit history, and combined, those factors account for about 20% of your score. This just goes to show that it’s not only about having different types of credit, but proving you can handle them responsibly over the long haul. You can discover more about how VantageScore calculates this on Experian's site.

Ever noticed your score take a dip after opening a new account or closing an old one? Your credit mix might be the culprit. Understanding the reasons why your credit score might be dropping is key to figuring out what's happening and how to fix it.

Smart Strategies to Diversify Your Credit Mix

Alright, so we've covered the "why" behind having a good credit mix. Now, let's get into the "how." The last thing you want to do is rush out and apply for a bunch of new loans just for the sake of it. That's a recipe for disaster.

The real goal here is to be strategic. Think of it like building a well-rounded investment portfolio—you don't just buy random stocks. You choose assets that work together to strengthen your overall financial position. The same logic applies to your credit.

Start with Low-Risk Options

If you're just starting out, or if your credit file only has one type of account (like a single credit card), there are some great, low-risk ways to start diversifying. These are tools designed specifically to help you build credit without getting in over your head.

Here are a couple of solid starting points:

Be Strategic with New Debt

I can't stress this enough: opening new accounts just to improve your credit mix can seriously backfire. Every time you apply for credit, it usually triggers a hard inquiry, which can knock a few points off your score temporarily. A flurry of these inquiries can make you look desperate for cash, which is a red flag for lenders.

As the experts at Experian note, a varied mix can help your score, but the potential damage from hard inquiries and taking on new debt often isn't worth it if you're just doing it for show.

As you start adding accounts, it becomes even more important to keep a close watch on your credit reports. Using a service for comprehensive credit monitoring can alert you to changes and help you stay on top of everything.

Common Credit Mix Myths You Should Ignore

When you're trying to build good credit, bad advice is everywhere. The idea of "credit mix" is especially prone to myths that can send you down a rabbit hole of bad financial decisions. Let's set the record straight on a few of the big ones.

The most common myth I hear is that you need to collect every type of loan under the sun to get a perfect score. People think they need a mortgage, a car loan, a personal loan, and a handful of credit cards. That’s not just unrealistic for most people; it's also a terrible financial strategy.

Showing you can responsibly manage both types of credit is what lenders actually care about, not how many different logos are in your wallet.

Quality Over Quantity Always Wins

Here’s another one that trips people up: thinking you should close an unused credit card. It might feel like you're tidying up your finances, but it can backfire. Closing an old account shrinks your total available credit, which can immediately spike your credit utilization ratio—a huge piece of your credit score. Plus, you just shortened the average age of your credit history.

Think about it from a lender's perspective. They want to see a solid track record of you paying your bills on time. While data shows that people with both installment and revolving credit tend to have higher scores, your mix alone is almost never the reason you get denied. You can learn more about how lenders view credit mix from Experian to see how it fits into the bigger picture.

At the end of the day, building a strong credit profile is a long game. Focus on the fundamentals: pay everything on time, every time, and keep your credit card balances low. As you go through life and hit different financial milestones, a healthy credit mix will start to build itself naturally.

Your Credit Mix Questions, Answered

Let's dig into some of the most common questions that pop up when people start thinking about their credit mix. Getting these details right can make a real difference.

So, How Many Accounts Do I Actually Need?

There’s really no magic number here. Lenders care much more about how you manage your credit than how many accounts you have.

The goal is to show you can responsibly handle both types of credit: installment and revolving. A solid history with at least one of each is a fantastic foundation to build on.

Does Opening a New Account Hurt Your Score?

Yes, but it's usually just a temporary dip. Opening a new account triggers two things: a hard inquiry and a decrease in the average age of your accounts. Both can nudge your score down for a little while.

But don't let that scare you off. Over the long haul, the benefit of having a more diverse credit mix—plus another account with a positive payment history—almost always outweighs that small, initial drop.

Ready to see how your credit mix fits into the full picture of your credit health? With All3Credit, you can monitor your scores and reports from all three bureaus—Experian, Equifax, and TransUnion—all in one place. Take control of your financial journey by visiting the All3Credit website.