A Guide to Three Bureau Credit Report Monitoring

Think of your financial identity like a priceless painting guarded by three different security guards. If you only pay attention to one guard, you're leaving two other entry points completely exposed. That’s essentially what happens when you don't monitor your credit with all three major bureaus. True three-bureau credit report monitoring is about keeping a close watch on your files at Experian, Equifax, and TransUnion, because you simply never know which one a lender will look at.

Why Monitoring All Three Credit Bureaus Is a Non-Negotiable

Your credit profile is a story, but it’s told by three separate authors. While the main plot points should be consistent, each author—Experian, Equifax, and TransUnion—might emphasize different details, tell events in a slightly different order, or even get some facts wrong. A lender, landlord, or potential employer might pick just one of those stories to read when making a decision that could change your life.

This creates a massive blind spot if you're only monitoring, say, your Equifax report. What if a thief opens a fraudulent credit card that only shows up on your Experian file? What if a clerical error is dragging down your TransUnion score? These aren't just "what ifs." It’s incredibly common for information to differ between the bureaus because many creditors don't report to all three.

The Real-World Risk of an Incomplete Picture

This isn't a small problem. The three major credit reporting agencies—Equifax, Experian, and TransUnion—manage the financial histories of over 200 million Americans. The scary part? Studies have shown that roughly 20% of consumers have different, and sometimes inaccurate, information across their credit files. Those discrepancies can be the direct cause of a denied loan or a sky-high interest rate.

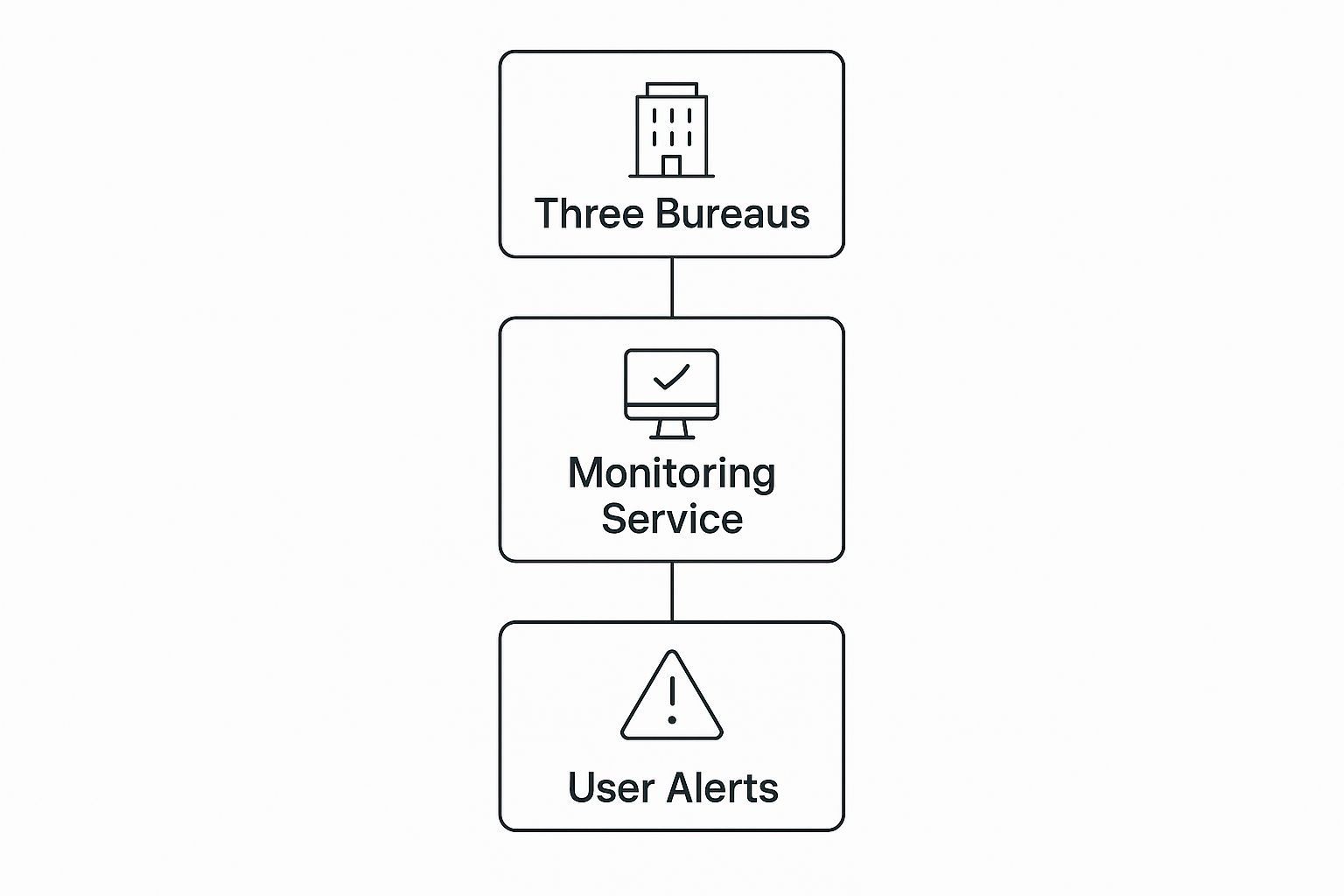

A comprehensive monitoring service acts as your personal command center, pulling in alerts from all three bureaus so nothing slips through the cracks.

As you can see, a full-service platform consolidates information from every source, giving you one clear, actionable view of your credit health.

The Three Pillars of Your Credit Profile

To really understand why this matters, you have to appreciate that each bureau is a distinct pillar supporting your financial reputation. They each have slightly different data sets and areas of focus. To learn more, check out our guide on the specifics of credit monitoring for all three bureaus.

Let's break down what makes each bureau unique and the specific danger of leaving one out of your sight.

At the end of the day, checking only one credit report is like trying to put together a puzzle with two-thirds of the pieces missing. You’ll never see the whole picture. Only three-bureau credit report monitoring gives you the complete visibility you need to protect your identity, catch errors fast, and confidently build your financial future.

How to Read and Understand Your Three Credit Reports

Opening your credit reports for the first time can feel a little intimidating. Each report from Experian, Equifax, and TransUnion tells a detailed story about your financial life, but they use a language filled with data points and industry terms. Honestly, learning to read them is one of the most powerful things you can do for your financial health.

Think of it like getting a full physical. A doctor looks at different systems—cardiovascular, respiratory, neurological—to get a complete picture of your health. In the same way, you need to review the different sections of your credit reports. Understanding what each part means is how you diagnose the state of your credit and catch small issues before they snowball into major problems.

The good news? While the layouts might look a bit different, all three bureaus organize your information into the same basic categories. Once you get the hang of reading one, you'll know how to read them all.

Decoding the Four Core Sections of Your Credit Reports

Every single credit report is built on a foundation of four key sections. Each one gives you a different piece of the puzzle, and when you put them together, you get a clear picture of how lenders see you. Let's break down what you'll find.

1. Personal Information This is the "who you are" section. It’s a collection of identifying details that bureaus use to make sure your report is actually yours.

2. Credit Account History (Tradelines) This is the real meat and potatoes of your report. It’s an itemized list of every credit account you have, both open and closed.

3. Credit Inquiries This section is a logbook of everyone who has pulled your credit report. It's important to know there are two different kinds of inquiries, and they have very different effects.

4. Public Records Here you'll find any financially related information that's been recorded in public, government sources.

Why Do the Three Reports Look Different?

When you lay your Experian, Equifax, and TransUnion reports side-by-side, you'll almost certainly spot some differences. Don't panic—this is perfectly normal. The main reason is simple: not all lenders report to all three bureaus. Your auto loan might show up on your Experian and TransUnion reports, but that credit card from your local credit union might only report to Equifax.

This is exactly why you have to look at all three. An error or a fraudulent account could be lurking on just one report, silently hurting your credit score without you even knowing it. You can learn more by checking out our guide on how to get all three credit reports for free. Getting that complete, 360-degree view is the cornerstone of smart credit management.

Why Bother Monitoring All Three Credit Bureaus?

So, you understand the basics of credit reports. But why is it so crucial to monitor all three? Let's get straight to the point: keeping tabs on all three bureaus is the difference between reacting to a financial fire and preventing one from starting in the first place.

Think of it like this: only watching one credit report is like having a single smoke detector in your entire house. If a fire starts in the kitchen, you’re covered. But what about the basement? Or the attic? You’d be completely in the dark until the problem is too big to ignore. That’s the kind of blind spot you create by not having a complete view of your credit.

Having this total visibility isn't just about seeing a number. It's about spotting fraud the second it happens, catching mistakes that could be costing you money, and making your next big financial move with total confidence.

It’s Your Best Defense Against Identity Theft

Identity theft moves fast. A criminal could open a new line of credit using your information, and that new account might only show up on your TransUnion report for a while. If you’re only checking Experian, that fraudulent account can rack up debt and trash your score for months before you even realize something is wrong.

With three bureau credit report monitoring, you get an alert as soon as a new inquiry or account pops up on any of your files. This gives you the critical head start you need to freeze your credit and shut down the thieves.

You Can Find and Fix Expensive Errors

Mistakes on credit reports happen a lot more often than people realize. It could be something as simple as a misspelled name, a payment marked late when it was on time, or an account that isn’t even yours. Since creditors don’t always report to all three bureaus, an error could be hiding on just one of your reports.

When you consistently check all three, you can catch these inaccuracies and start the dispute process. Getting just one negative item removed—like an incorrect 30-day late payment—can give your credit score a serious, and much-deserved, boost.

Make Smarter Decisions with the Full Picture

Knowing your complete credit profile isn’t just about playing defense—it’s about going on offense. When you see exactly what lenders see, you can make much more strategic financial moves. There's a reason banks and lenders pull data from all three bureaus.

Access to three reports gives lenders a far more accurate picture of a borrower's risk. In fact, their prediction models improve by over 15% when they use data from all three bureaus instead of just one. You can use this to your advantage by making sure every single report is clean and accurate, positioning yourself for the absolute best rates and terms. For a deeper dive into these trends, check out the Equifax global credit analysis.

Ultimately, a three bureau credit report monitoring service like All3Credit gives you the same comprehensive view that lenders have. It puts the power back in your hands, allowing you to not only guard your financial identity but to actively build it, so you're always prepared for your next opportunity.

How to Choose the Right Monitoring Service for You

With a sea of credit monitoring services on the market, picking the right one can feel overwhelming. They all promise to protect your identity and help your credit, but the features and costs can vary wildly. Making the right choice isn't just about grabbing the cheapest option; it’s about finding the level of protection that truly fits your life and your budget.

Think of it like choosing a home security system. For some, a simple doorbell camera might feel like enough. Others might want a fully integrated system with motion sensors and 24/7 professional monitoring. The best choice depends on what you need to protect and your personal tolerance for risk. The same exact logic applies when you're selecting a three-bureau credit report monitoring service.

This section is your roadmap. We'll help you cut through the marketing noise and focus on what actually matters, outlining the essential features you should look for and comparing different service tiers so you can make a decision you feel confident about.

Your Essential Feature Checklist

Not all monitoring services are created equal. To get robust, meaningful protection, you need to make sure your service provides a core set of non-negotiable features. Anything less leaves you with dangerous blind spots.

Comparing Service Tiers: Free vs. Paid

The biggest decision you'll probably face is whether to go with a free service or a paid subscription. And while "free" is always tempting, it's vital to understand what you're giving up. Free services can be a decent entry point, but they often lack the proactive, comprehensive features needed for complete protection.

To help you see the differences at a glance, we've put together a simple table. It breaks down what you can typically expect from different tiers of service.

Comparing Credit Monitoring Service Tiers

As you can see, paid services fill the crucial gaps that free options leave wide open. For a more detailed breakdown, our guide on three-bureau credit monitoring goes even deeper into what you should expect from a quality provider.

A service like All3Credit, for example, offers a great middle ground. For $12.99 a month, you get the comprehensive three-bureau access, timely alerts, and expert support you need—without paying for premium extras you might not use.

Ultimately, making the right choice empowers you to move from passively watching your credit to actively safeguarding your entire financial future.

Getting the Most Out of Your Monitoring Service

Signing up for a three-bureau credit monitoring service is a fantastic move, but it's just the first step. To really unlock its power, you have to actively use the tools you're paying for. Think of it like getting a top-of-the-line home security system; it doesn't do you much good if you never turn it on or check the alerts.

Putting your service to work right away is what transforms you from a passive observer into the person firmly in control of your financial destiny. Let's walk through how to set up your account, what to do on day one, and how to handle alerts so you're always one step ahead.

Your First Moves After Signing Up

Once you've picked your service, the setup process is your top priority. It's usually pretty straightforward, but getting these initial steps right is crucial for making sure your monitoring is accurate and effective from the get-go.

How to Handle Credit Alerts Like an Expert

Getting an alert can make your heart skip a beat, but there’s no need to panic. The whole point of the system is to give you a timely warning so you can act quickly. What you do next depends entirely on the alert.

Let's walk through a common scenario: you get an alert for a hard inquiry from a credit card company you've never heard of. That's a huge red flag for identity theft.

Best Habits for Long-Term Monitoring

Staying on top of your credit isn't a one-time fix; it's an ongoing habit. After you're all set up, a few simple routines will keep you in the driver's seat.

Schedule a Monthly Check-In: While real-time alerts are great for emergencies, it's smart to block off 15-20 minutes each month for a full review of all three reports. This helps you track your progress, keep an eye on your credit utilization, and notice small changes that might not have triggered an official alert.

Watch Your Scores Over Time: Use the score-tracking tools to see how your actions affect your numbers. There's nothing more motivating than watching your scores climb after you've paid down a card or built a solid history of on-time payments. Your monitoring service turns abstract financial data into a clear, simple scorecard of your success.

Practical Steps for Maintaining Excellent Credit Health

Having a three-bureau credit report monitoring service in place is like installing a top-notch security system for your financial life. It’s your first line of defense. Now, it's time to go on offense. Monitoring tells you what's happening; this is how you take that information and actively build a more powerful, resilient credit profile.

Think of it this way: your monitoring alerts are like a detailed scouting report on an opposing sports team. It shows you their strengths, weaknesses, and every move they make. Your job is to use that intel to create a winning game plan. That means disputing errors, managing your balances like a pro, and building a long track record of responsible habits.

The real magic happens when you use the data from monitoring to make smarter financial decisions. It's the key to building a positive history that opens doors to better loans, lower interest rates, and ultimately, more financial freedom.