Your Guide to Three Bureau Credit Monitoring

Imagine you have three main doors to your financial house. It wouldn't make much sense to install a security camera on only one of them, would it? Three-bureau credit monitoring is the same concept—it's like having a dedicated security system watching all three major entry points to your financial life.

This type of service keeps a close eye on your credit files at all three major credit bureaus—Equifax, Experian, and TransUnion—and immediately alerts you to any suspicious activity or changes.

What Is Three-Bureau Credit Monitoring?

Let's break it down with an analogy. Think of your credit history as a story being told by three different authors. Each author—Equifax, Experian, and TransUnion—crafts their own version based on the information they get from lenders, banks, and other creditors. Sometimes their stories are identical, but often, they have slight (and occasionally major) differences.

A three-bureau monitoring service is your personal surveillance team, constantly scanning each author's story for unexpected plot twists. This includes things like new accounts opened in your name, hard inquiries you never made, or sudden changes to your address or personal information.

The Three Pillars of Your Credit Profile

Just checking one bureau is like only reading one-third of your own story; you’re bound to miss critical details happening in the other two versions. This is why a complete, three-bureau view is so important. In fact, the global market for credit monitoring is expected to jump from 15 billion in 2025 to nearly 45 billion by 2033, which shows just how seriously people are taking financial security.

This is the power behind services like those from All3Credit, which bring together data from all three sources to give you total visibility.

To truly understand why this matters, it helps to see what each bureau does and why monitoring them all is essential for your financial well-being.

The Three Pillars of Your Credit Profile

In short, each bureau holds a unique piece of your financial puzzle. Without seeing all the pieces together, you're always working with an incomplete picture.

Why Monitoring All Three Bureaus Is Essential

Relying on single-bureau credit monitoring is like installing a top-of-the-line security camera on your front door but leaving the back door and windows wide open. It creates a false sense of safety. You feel protected, but you’ve left yourself vulnerable where you aren't looking. For genuine financial security, you need to watch every entry point.

The simple truth is that lenders aren't required to send your information to all three major credit bureaus. Many credit card companies, auto lenders, and other creditors may only report your account activity to one or two of them. This practice creates significant differences between your reports at Equifax, Experian, and TransUnion.

What does that mean for you? It means a thief could open a fraudulent account in your name that only shows up on your TransUnion report. If you’re only keeping an eye on your Experian file, you’d have no idea the damage was being done until it spirals out of control. The same applies to costly errors, like an on-time payment that gets mistakenly reported as late.

The Real-World Impact of Report Discrepancies

These inconsistencies aren't just trivial details; they have serious, real-world consequences. A single, overlooked error on one report can slam the brakes on your financial goals right when you're about to achieve them.

Think about applying for a mortgage. Your lender isn't just going to check one report—they will pull your credit history from all three bureaus to get the full story.

These examples show why being prepared is so important. To dive deeper, you can explore the distinct roles of all three credit bureaus in our detailed guide.

Without a service that watches all three of your credit files at once, you’re always a step behind. You’re left reacting to problems instead of stopping them before they start. True peace of mind comes from knowing that every aspect of your financial identity is being monitored.

How These Monitoring Services Actually Work

So, what’s happening behind the curtain with a three bureau credit monitoring service? Think of it as your own personal security guard for your financial identity. Instead of you having to manually request and sift through individual reports from Equifax, Experian, and TransUnion, the service automates the entire process, keeping a constant watch for you.

Once you sign up and provide your details, the service establishes a secure connection to the databases of all three bureaus. From that point on, it’s your digital watchdog, tirelessly scanning your credit files 24/7. This isn't just a monthly glance; it's an always-on surveillance system designed to spot changes the second they appear.

The Power of Instant Alerts and Smart Analysis

The real magic of these services is their speed and intelligence. The moment a lender checks your credit, a new account pops up in your name, or a key piece of personal information is altered, the system flags it. You’ll get an immediate heads-up through an email, a text message, or a notification on your phone's app.

This rapid-fire alert system is what really matters. It shifts you from being a potential victim of fraud to being an empowered defender of your own identity. Seeing an alert for a credit inquiry you don’t recognize gives you the crucial head start to challenge it, possibly stopping a fraudulent account before it causes any real damage.

Today’s top-tier services take this a step further by using artificial intelligence. These smart systems are trained to pick up on subtle, suspicious patterns that you or I might easily overlook. For instance, an AI could flag something like a string of credit applications made in different states over a few hours—a classic sign that an identity thief is at work.

The Tech and Market Growth Behind It All

The technology that powers this constant oversight is pretty impressive. It all runs on sophisticated data aggregation platforms that can securely pull, combine, and analyze huge volumes of information from the credit bureaus. This is what lets you log in and see a single, unified dashboard showing your complete credit picture, making everything much easier to understand.

This powerful tech framework is the backbone of a booming industry. The global credit bureaus market is on track to grow from 109.59 billion in 2024 to an estimated 191.22 billion by 2029. This surge is fueled by a growing demand for better risk management and more precise ways to assess credit. If you're interested, you can learn more about the drivers of this market growth and get more details on current industry trends.

Here is the rewritten section, designed to sound completely human-written and natural.

Why Total Credit Protection Is Worth It

Think of three-bureau credit monitoring as more than just a fraud detection service. It's really a command center for your entire financial life, giving you a powerful edge in managing your money and securing your future.

The most obvious win is how much faster you can react to identity theft. Getting an alert about a sketchy new account can be the difference between a quick five-minute phone call to a lender and a year-long nightmare trying to reclaim your good name. When you know what’s happening right away, you can shut down the problem before it spirals out of control.

It also pulls everything together. Instead of trying to piece together three different reports from Experian, TransUnion, and Equifax—which often have slightly different information—you get a single, clear picture. This unified view helps you spot and fix errors before they can do any real damage to your credit scores.

Making Smarter Financial Moves

When you have a complete, 360-degree view of your credit, you can make much smarter decisions with your money. Are you gearing up to apply for a mortgage, finance a car, or even pass a background check for a new job? Knowing exactly where you stand across all three bureaus means no nasty surprises. It puts you in the driver's seat.

Here’s where it really pays off:

Imagine you spot a hard inquiry on your TransUnion report that you don't recognize. With a good monitoring service, you can flag it and freeze your credit before a thief manages to open a new credit card in your name. Without three-bureau credit monitoring, that inquiry could sit there unnoticed for months.

Ultimately, this kind of oversight gives you true control. You’re no longer just playing defense and reacting to problems. You're proactively managing your credit with confidence, armed with the most complete information possible.

How to Choose the Right Credit Monitoring Service

Picking a service for three bureau credit monitoring can feel a bit overwhelming, but it gets a lot simpler once you know what to look for. The truth is, not all services are created equal. The key is to focus on the features that provide real value, so you can make a choice that fits your life and your budget.

Don't just look at the monthly price. Of course, affordability matters, but the quality of the protection you're getting is what really counts. A great service is more than just an alert system; it's a partner dedicated to your financial security.

Evaluate the Core Features

When you start comparing different options, you need to zero in on the details that will actually make a difference in protecting you. Some services will try to dazzle you with flashy add-ons, but these three core components are what I consider non-negotiable for real protection.

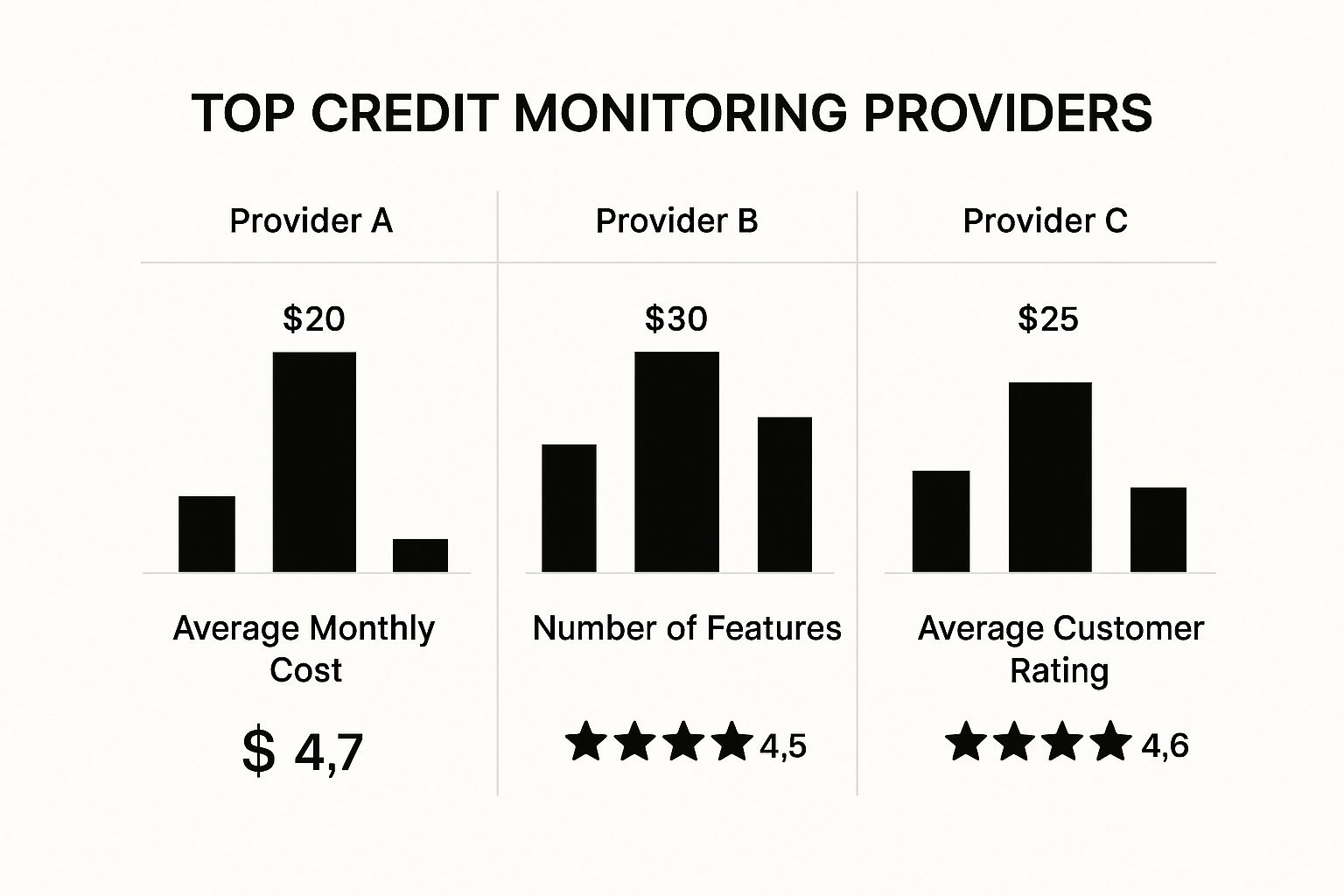

To give you a better idea of how different providers compare, the infographic below breaks down several popular options by cost, features, and what actual users think of them.

As you can see, a higher price doesn't always mean you're getting better features or a better experience. It's all about finding that sweet spot.

Match the Service to Your Needs

After you’ve sized up the core features, take a moment to think about your own situation. Are you just trying to keep an eye on your own credit, or do you need to protect your entire family? Most providers have different plans designed for these very different needs.

Here’s a quick look at the typical service tiers you’ll run into:

The following table can help you think through which features are most important for you and see how they are typically bundled across different plan levels.

Comparing Credit Monitoring Service Features

A guide to help you evaluate and choose the right three bureau credit monitoring service based on common features and protection levels.

As you weigh your options, remember that the right plan is the one that covers your specific vulnerabilities without making you pay for features you'll never use.

The market for these services is massive and getting bigger every day. In the United States, the credit agency market is on track to grow from 18.77 billion in 2025 to 24.96 billion by 2030. This boom is fueled by lenders needing better ways to assess risk and new regulations pushing for more sophisticated scoring models. You can dig into more details by exploring the expanding U.S. credit market on mordorintelligence.com.

Ultimately, making a smart choice comes down to comparing these key factors against what you personally need. Always prioritize strong core features, responsive support, and a plan that truly fits your life.

Common Questions About Credit Monitoring

Even after seeing all the benefits, it's totally normal to have a few questions before you sign up for a three bureau credit monitoring service. Let's walk through some of the most common ones I hear, so you can feel confident you’re making the right move to protect your financial identity.

Think of this as a quick Q&A to clear up any lingering doubts.

Can't I Just Monitor My Credit for Free?

You absolutely can get free credit reports and even some free monitoring services, but they don't offer the same level of protection as a paid, comprehensive service. It's a classic case of getting what you pay for.

Free annual reports are just a once-a-year snapshot in time. They're useful for a yearly check-up, but they won’t help you catch fraud that’s happening right now. As for free monitoring services, they usually only watch one of the three credit bureaus. That's like locking just one of the three doors to your home—it leaves you wide open to anything that shows up on the other two reports.

Will Credit Monitoring Hurt My Credit Score?

This is a great question, and I get it all the time. The answer is a hard no—using a credit monitoring service will not hurt your credit score one bit.

When a monitoring service checks your credit, it’s called a "soft inquiry." These checks are only visible to you and have zero impact on your credit scores. They are completely different from a "hard inquiry," which happens when a lender pulls your credit because you've applied for a new loan or credit card. That's the kind of inquiry that can cause a small, temporary dip in your score.

Credit monitoring is purely a defensive tool. The scoring models are built to tell the difference. For more helpful tips on keeping your credit healthy, you can find a ton of great articles on the All3Credit blog.

Is This the Same as Identity Theft Protection?

They're closely related, but not always the same thing. The best way to think about it is that three bureau credit monitoring is a crucial part of a complete identity theft protection plan. It’s the foundation, focusing specifically on your Equifax, Experian, and TransUnion credit files.

Many top-tier identity theft protection services bundle credit monitoring with other powerful tools, like:

When you’re comparing services, definitely check if these extra layers of protection are included.

How Quickly Will I Be Alerted to Problems?

Speed is the whole point. Fast alerts are arguably the biggest advantage of a paid monitoring service, giving you a crucial head start against crooks.

Most quality providers send out alerts in near real-time. You'll typically get a notification via email, text message, or a push notification from their app within minutes—or a few hours at most—of a key change hitting one of your three credit reports.