How Your Length of Credit History Impacts Your Score

Think of your credit history as your financial track record. It’s a detailed story that tells lenders how long you've been managing credit and how well you've been doing it. Just like a long, steady work history can impress an employer, a long, well-managed credit history shows lenders you’re a reliable borrower.

This isn’t just a minor detail; it’s a cornerstone of your financial health.

Why Your Credit History Length Matters

Let’s use an analogy. Imagine you’re hiring for a critical role. Candidate A has a 15-year career with a proven track record of success. Candidate B is fresh out of college, with very little experience. Who feels like the safer bet?

Lenders look at your credit history in much the same way. A longer history gives them a bigger window into your financial behavior. It provides a rich set of data they can use to predict how you’ll handle future debts.

This isn't something you can build overnight. It’s about demonstrating consistency, proving that you can manage payments responsibly through life’s ups and downs. That kind of long-term proof is incredibly valuable.

Building a Foundation of Financial Trust

When you apply for a big loan—like a mortgage or a car loan—lenders are looking for signs of stability. A long credit history is one of the clearest signals you can send. It shows you’re not a financial flight risk.

They want to see a predictable pattern of responsible behavior, something that gives them confidence you’ll pay back what you borrow, month after month, year after year.

Ultimately, this single factor can make or break your ability to reach major financial goals. It could be the difference between getting approved for your dream home or securing a car loan with a manageable monthly payment.

Impact on Your Credit Score

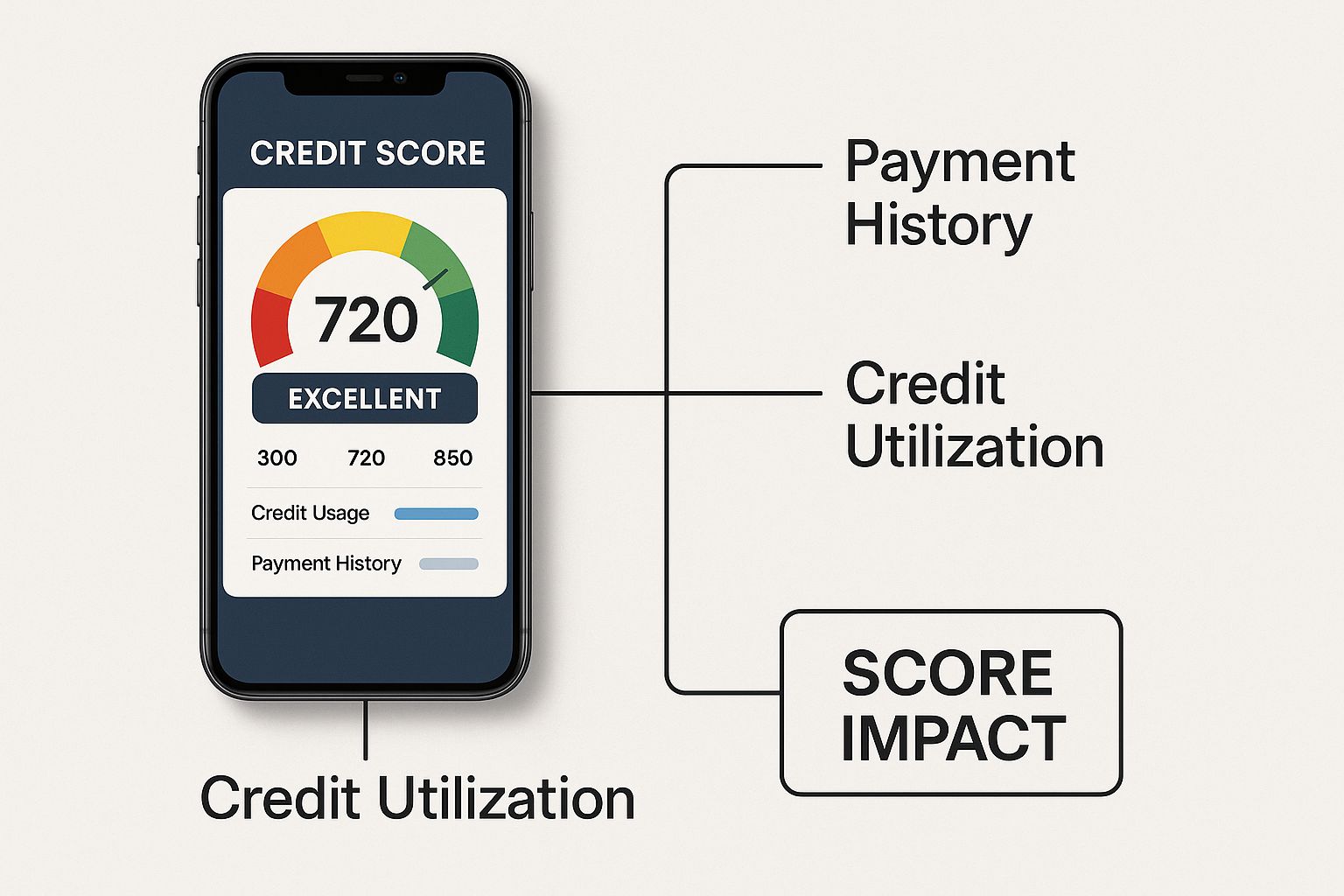

Your credit history's length is a significant piece of the credit score puzzle. Scoring models like FICO don't just look at one number; they consider several age-related metrics.

We've put together this table to break down exactly what they're looking at.

Components of Your Credit History Age

Each of these components helps paint a picture of your experience for lenders and the three major credit bureaus that collect this data.

So, how much does it really matter? The length of your credit history accounts for about 15% of your FICO® Score.

But here's the key: age alone isn't enough. Its true power comes from being paired with a consistent, on-time payment history. This is why it can be tough for young adults to get the best interest rates—their shorter track record simply provides less data to prove their creditworthiness.

When it comes to building a great credit score, time plus good habits is an unbeatable combination.

How Lenders Calculate Your Credit Age

When a lender pulls your credit report, they aren't just looking at a single number to determine your length of credit history. It’s more like a blended recipe. They look at a few different ingredients to get a full picture of your experience managing credit over time.

Think of it like a sports team. You have veteran players who’ve been around for years, rookies who just joined, and the average experience level of the entire roster. Each of these tells a different story about the team's depth and stability. Your credit history works the same way.

The Three Key Metrics

Credit scoring models, like those from FICO and VantageScore, zero in on three specific data points to size up your credit age. Each one offers a unique angle on your financial journey.

This visual really brings home how these pieces fit together to shape your credit score.

As you can see, keeping that average account age high has a direct, positive effect on your score. It’s a marathon, not a sprint.

Let's Bust a Common Credit Myth

A question I hear all the time is, "Should I close my old credit cards?" People often think that as soon as they close an account, its history vanishes from their report. Thankfully, that’s not true.

Here's the catch, though. Once those 10 years are up, the account falls off your report for good. If it was your oldest account, its age is no longer factored into your average, which can cause your score to dip.

This is exactly why the standard advice is to keep your oldest, no-annual-fee credit cards open. You don't have to use them for everything—just a small, recurring purchase now and then is enough to keep the issuer from closing it. Guarding those seasoned accounts is a cornerstone strategy for maintaining a strong length of credit history.

The Real-World Impact of Your Credit History

It’s one thing to understand the math behind your credit age, but it’s another to see how it directly hits your wallet. A long and healthy length of credit history isn't just some abstract number on a report. Think of it as a powerful financial tool that can literally save you thousands of dollars over your lifetime.

When you apply for a loan, lenders are looking at this history as your financial resume. It’s a track record that showcases your reliability over the long haul. A proven history of managing credit well makes you a lower-risk borrower in their eyes, and they reward that stability with better deals, more opportunities, and greater financial flexibility.

Sarah and Nick: A Tale of Two Borrowers

Let's make this tangible. Imagine two people, Sarah and Nick. Both are responsible, have a good payment history, and earn a solid income. The only major difference is their credit history. Sarah has been building credit for 12 years, while Nick is just getting started with a two-year-old history.

They both walk into a dealership to apply for the same $30,000 car loan. Here's how it plays out:

Just because of that one difference—the age of their credit—Nick ends up paying over $3,400 more for the exact same car. This same scenario repeats itself with mortgages, personal loans, and credit cards, highlighting just how valuable patiently building your credit history can be.

The Long-Term Financial Advantages

The perks of a mature credit history don't stop with a single loan. A long track record of responsible borrowing is a powerful signal of financial stability, making you a much more attractive customer to all sorts of companies.

This isn’t just a hunch; the data backs it up. Consumers with longer credit histories tend to demonstrate more financial discipline. This principle holds true in global credit systems too, where countries like Canada and Australia also place a heavy emphasis on history length, helping their citizens access better rates and terms.

Protecting this asset is absolutely critical. For example, closing your oldest credit card can accidentally shrink your average credit age and cause your score to dip. If you’ve noticed a sudden change, our guide explains more about why your credit score might be dropping and what you can do about it. Ultimately, building and protecting your credit history is a long game, but it’s one with very powerful real-world rewards.

Proven Strategies to Build Your Credit History

Trying to build your length of credit history from zero can feel like a classic chicken-and-egg problem. You need a credit history to get approved for credit, but how do you get a history without any credit in the first place?

Thankfully, it’s not as impossible as it sounds. There are a few tried-and-true ways to get your foot in the door and start building that all-important financial track record.

The trick is to start small and be consistent. Whether you’re a student, new to the country, or just starting your financial journey, these methods are designed to be safe and easy to manage.

Become an Authorized User

One of the fastest ways to get on the board is to become an authorized user on someone else's credit card. If you have a parent, spouse, or family member who trusts you, they can add you to their account.

When this happens, the entire history of that account—its age, its payment record, everything—can get added to your own credit report. If they've had the card for years and have always paid on time, you essentially get to "borrow" their good history.

A word of caution, though: this strategy is built on trust. If the main cardholder misses a payment, it can hurt your credit score too. So, make sure you team up with someone who is financially responsible.

Open a Secured Credit Card

A secured credit card is probably the best tool for building a credit history all on your own. It works a little differently than a regular credit card. You make a small, refundable cash deposit upfront, and that deposit usually becomes your credit limit.

For example, a 300** deposit gets you a card with a **300 spending limit.

Because your own money secures the line of credit, lenders see it as a very low-risk way to give you a chance. This makes secured cards much easier to get approved for than traditional ones.

Use a Credit-Builder Loan

A credit-builder loan flips the idea of a normal loan on its head. Instead of getting a lump sum of cash upfront, you make small monthly payments to the lender. They hold onto this money for you in a locked savings account.

Once you’ve made all the payments and the "loan" is paid off, the lender gives you the full amount back.

Each on-time payment you make gets reported to the credit bureaus, building a solid record of reliability. It’s a clever way to prove you can handle payments while also forcing yourself to save a little money.

Comparing Credit Building Strategies

To help you decide which path is right for you, here’s a quick breakdown of how these common credit-building methods stack up against each other. Each has its own pros and cons depending on your situation.

Ultimately, choosing the right strategy is less important than simply starting. Pick one that feels manageable and stick with it.

No matter which path you take, the goal is always the same: create a consistent record that shows lenders you're a reliable borrower. Once you have a few accounts up and running, it's a good idea to keep tabs on your progress. You can learn more about how to get all 3 credit reports to watch your length of credit history grow and see how your hard work is paying off.

Of all the factors that go into your credit score, the length of your credit history is the one you can’t rush. It’s a true marathon, built up slowly and patiently over years of consistent, responsible behavior.

After putting in all that work, the last thing you want is for one simple misstep to knock you back. Protecting the age of your credit is just as critical as building it in the first place.

Many common financial moves, which might seem totally harmless on the surface, can actually do some real damage to your credit age. Knowing what these pitfalls are is the key to protecting the history you’ve worked so hard to establish.

Closing Your Oldest Credit Card

This one is probably the most frequent—and most damaging—mistake people make. It's easy to see why. You look at that old, forgotten credit card with no annual fee that's just sitting in a drawer and think, "I should close this to simplify my finances."

Hold on. That card is likely the anchor of your entire credit history.

While closing it won't make it vanish from your report overnight, its history will eventually drop off after about 10 years. When that happens, the average age of all your accounts can take a nosedive, and your score will likely follow.

Opening Too Many New Accounts in a Short Time

Every new account you open nudges the average age of your credit history downward. Opening just one new card isn't a big deal, but applying for several cards or loans in a short period of time creates a real problem.

This rapid-fire opening of new accounts doesn't just pile up hard inquiries; it significantly drags down your average account age. From a lender's perspective, this can look like a red flag for financial distress, hitting your score from two different angles.

Letting Old Accounts Go Dormant

Even if you don't intentionally close an old card, your bank might do it for you. If an account goes unused for too long, the credit card company may shut it down due to inactivity.

The result is the same as if you'd closed it yourself—you lose that account's age and its associated credit limit from your overall profile.

The fix is simple: make a small purchase on each of your older cards once or twice a year. That little bit of activity is enough to signal to the issuer that you're still using the account, keeping it open and protecting the foundation of your credit history.

The focus on credit age isn't new; credit scoring models have always seen it as a key indicator of risk. This goes back to the mid-20th century when FICO made it a core component of its formula, giving it a weight of about 15% of the total score. You can dive deeper into the evolution of credit outlooks from Fitch Ratings.

Common Questions About Credit History

Let's be honest, the rules around credit history can feel a bit mysterious. It's easy to get tangled up in myths and half-truths. Below, we'll clear the air and tackle some of the most frequent questions people have about the age of their credit.

Does Closing a Credit Card Make It Disappear from My Report?

No, and this is probably one of the biggest misconceptions out there. When you close a credit card in good standing, it doesn't just vanish. It can actually stick around on your credit report for up to 10 years. For that entire decade, its long history of on-time payments continues to help your score.

There are a couple of things to watch out for, though. The moment you close the card, you lose its credit limit, which can make your overall credit utilization ratio jump up. More importantly, after those 10 years are up, the account will finally fall off your report, and its age disappears from your credit calculation. If that was your oldest account, you could see a real dip in your average age of accounts.

This is exactly why you'll hear experts say you should keep your oldest credit cards open, especially if they don't have an annual fee. Just use them for a small purchase every so often to keep them active.

How Long Does It Take to Build a Good Credit History?

There isn't a single magic number, but lenders generally start to see a credit history as "mature" or "established" once the average age of your accounts hits about seven years or more. It shows a long, stable track record of managing debt.

But don't get too hung up on that number. Building credit is a marathon, not a sprint. You can absolutely earn an excellent score with a much younger history—say, two or three years—as long as every other part of your report is spotless.