How to Remove Hard Inquiries From Your Credit Report

Before we get into the nuts and bolts of removing hard inquiries, let's be crystal clear about one thing: you can only get rid of inquiries that are there by mistake or as a result of fraud. If you genuinely applied for that credit card or loan, that inquiry is legitimate and will stay on your report for two years. Our focus here is on identifying the ones that shouldn't be there and challenging them effectively.

What Hard Inquiries Really Mean for Your Credit Health

So, what’s the big deal with hard inquiries anyway? Think of your credit report as your financial track record. When you formally ask for credit—a mortgage, a car loan, a new credit card—the lender pulls that record to see how you've handled debt in the past. That official pull is logged as a hard inquiry.

It’s basically a footprint showing other lenders you’ve been shopping for credit. A couple of inquiries here and there is no big deal. But a bunch of them in a short period? That can look like a red flag, making it seem like you're desperate for cash or about to take on a mountain of new debt. This is precisely why they can knock a few points off your credit score.

Hard Versus Soft Inquiries

Now, not every peek at your credit report is a hard pull. There's another kind called a soft inquiry, and these have absolutely no effect on your score. These happen all the time—when you check your own credit score, when a company pre-qualifies you for an offer without you applying, or even when a potential employer runs a background check.

The core difference boils down to permission and purpose.

Getting this distinction straight is the first step. You can completely ignore soft inquiries; they’re harmless. Your mission is to find any unauthorized or inaccurate hard inquiries that might be holding your score back.

To make it even clearer, here's a quick breakdown of how they stack up against each other.

Hard vs Soft Inquiries A Quick Comparison

This table breaks down the key differences between hard and soft credit inquiries, helping you quickly identify what impacts your score.

Understanding this table is key. You only need to scrutinize the "Hard Inquiry" column on your report for potential disputes.

The Real Impact on Your FICO Score

So, how much does one little hard inquiry actually hurt? Honestly, it's usually less than people fear. While a hard inquiry sticks around on your report for 24 months, it typically only affects your FICO score for the first year.

According to Experian, a single hard inquiry will often drop a score by fewer than five points. Over time, that impact fades. The real trouble starts when you have multiple inquiries in a short window. That’s what signals risk. Learn more about the factors that influence credit score changes in our detailed article about why your credit score might be dropping.

For instance, applying for five different retail cards in a single month can make you look financially unstable. Lenders see that and might think twice.

But there's a smart exception to this rule. Scoring models are designed to recognize when you're "rate shopping" for a big-ticket item like a mortgage or an auto loan. They understand you're trying to find the best deal. Because of this, multiple inquiries for the same type of loan are usually bundled together and treated as a single event, as long as they happen within a short timeframe (typically 14 to 45 days). This lets you be a savvy shopper without tanking your credit score.

Spotting Inquiries You Can Actually Remove

Here’s the thing about removing hard inquiries: you can’t just wipe the slate clean. If you legitimately applied for credit, that inquiry is probably staying put. The real goal is to get surgically precise, identifying and challenging the inquiries that have no business being on your report in the first place.

This whole process kicks off with a detailed review of your credit reports. And I mean all three—from Experian, Equifax, and TransUnion. They don’t always share information perfectly, so you need to look at each one to get the full picture. Your mission is to find the hard inquiries that fall into a few specific, disputable categories.

The Low-Hanging Fruit: Clear-Cut Grounds for a Dispute

As you comb through your reports, you’re essentially playing detective, looking for red flags. Most of the inquiries you can successfully remove come from a handful of common slip-ups where a company pulled your credit without proper authorization or just plain made a mistake.

These are the most obvious ones to look for:

If an inquiry fits one of these descriptions, you've got a solid foundation for a dispute.

Trickier Scenarios That Are Still Worth a Fight

Beyond the easy-to-spot errors, some situations are a bit more gray but can still be grounds for a dispute. These require you to think back and connect the dots.

For example, did you call an insurance agent for a simple rate quote, only to find they ran a hard credit check without your explicit permission? Or maybe a rental application service was only supposed to run a background check but pulled your full credit report instead. Under the Fair Credit Reporting Act (FCRA), every hard inquiry needs a "permissible purpose"—and you giving permission is a big part of that.

Another common one is a soft pull that gets miscoded as a hard inquiry. It's a simple clerical error, but it's your score that takes the hit. If you were just browsing pre-qualified offers online and a hard pull showed up, that’s a mistake worth challenging.

Successfully cleaning up these kinds of inquiries can give your credit score a real boost, which in turn means better odds of approval for loans and lower interest rates. This is especially vital if you've been a victim of identity theft, which can leave your report littered with fraudulent inquiries. You can learn more about how inquiry removal services can benefit individuals and businesses on robinwaite.com.

Build Your Case Before You Make a Move

Once you've flagged a few questionable inquiries, hold on. Don't just fire off a dispute letter without a clear plan. For every single inquiry you want to challenge, pause and ask yourself a few questions.

Answering these questions helps you separate a legitimate inquiry you just forgot about from one that is truly unauthorized. This clarity is everything. A well-reasoned, specific dispute is taken far more seriously by the credit bureaus than a vague complaint. You're not just trying to "clean up" your report; you're correcting a specific error, and that targeted approach is what gets results.

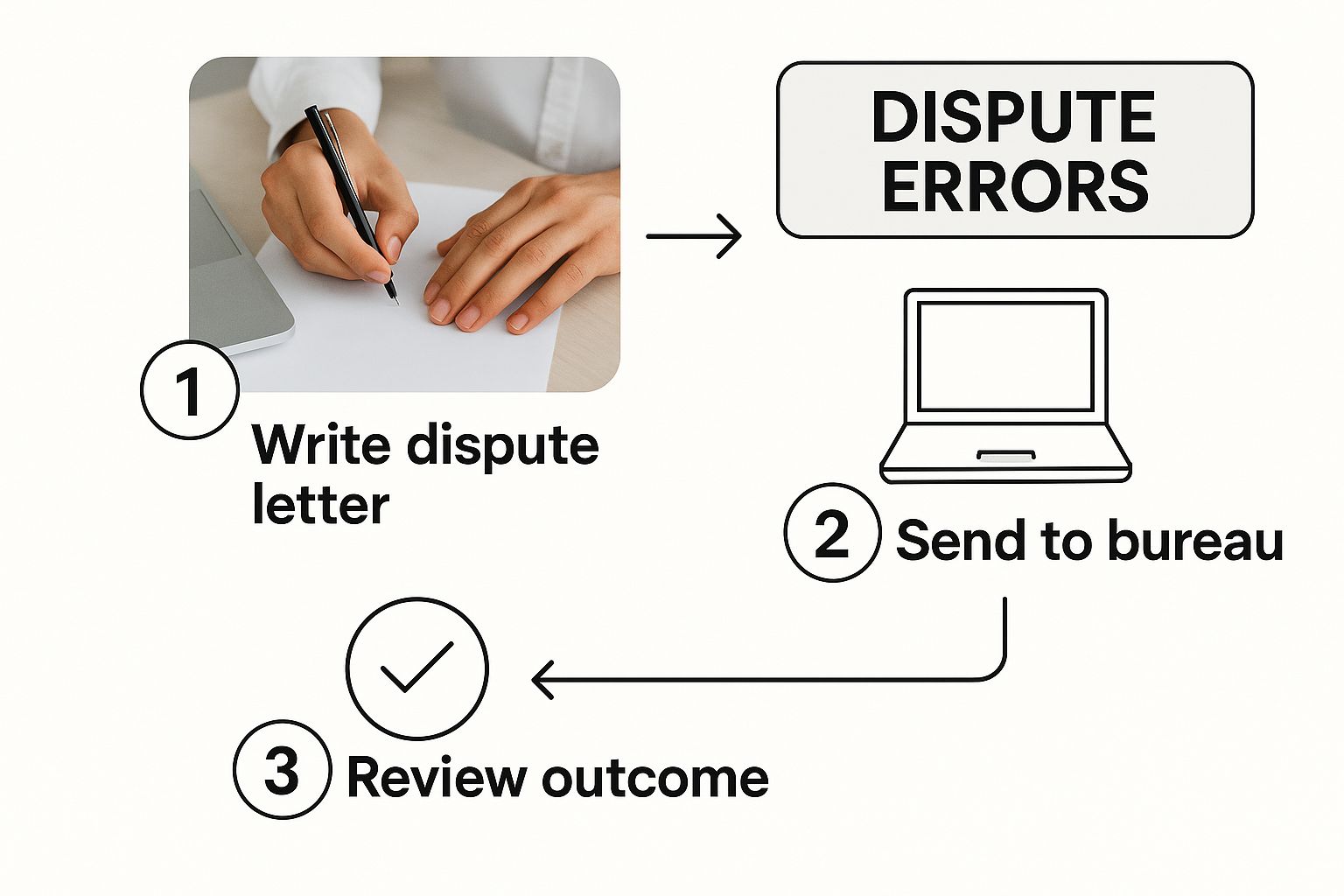

Your Game Plan for Disputing Hard Inquiries

Alright, you’ve combed through your credit reports and flagged the hard inquiries that just don't belong. Now it's time to switch from detective mode to action mode. This isn't about just sending a complaint and crossing your fingers; it's about building a solid, persuasive case that the credit bureaus are legally required to investigate.

First thing's first: you need the most up-to-date copies of your credit reports. Things can change quickly, so always work with the freshest information available. If you're not sure how to get them, our guide on getting all three credit reports for free breaks it down for you.

With your current reports in hand, let's start building your case.

Gathering Your Supporting Evidence

A dispute without proof is just an opinion. To get the bureaus to take you seriously, you need to back up your claim with clear documentation. Don't worry, this doesn't mean you need a mountain of paperwork, but what you send needs to be specific and directly related to the inquiry you're challenging.

For each sketchy inquiry, try to pull together the following:

Your goal is to make it as easy as possible for the investigator to see the problem and agree with you. A clean, organized, and well-supported claim is a lot tougher for them to simply dismiss.

As you can see, a successful dispute really begins with this careful preparation, long before you ever mail that letter or click "submit."

Crafting a Powerful Dispute Letter

You can absolutely dispute errors online, and it’s often faster. However, I’ve seen time and again that sending a physical letter via certified mail gives you a serious advantage. Why? It creates an undeniable paper trail.

That little green certified mail receipt is your proof of when the credit bureau received your dispute. From that moment, the clock starts on their legally mandated 30-day investigation period.

When writing your letter, keep it professional and straight to the point. This isn't the place for long, emotional stories. Just stick to the facts.

A solid dispute letter must include:

Here's a look at how you can phrase the core of your letter.

Feel free to adapt this to your own situation. The real keys are clarity and professionalism.

Online vs. Certified Mail: Which Is Better?

Choosing between an online dispute and certified mail is a strategic decision. Both have their pros and cons, and the right choice depends on your situation.

While the convenience of online disputes is tempting, I lean toward certified mail for anything serious. That receipt is your golden ticket if a bureau ignores you or denies your claim without a proper investigation. It provides irrefutable proof that they received your request, forcing accountability. For that reason alone, it's the method most consumer rights advocates recommend.

Navigating the Follow-Up: What Happens After You Dispute?

So you've sent your dispute letter. Now what? This is where a lot of people drop the ball, but staying on top of the follow-up is what separates a successful removal from a frustrating dead end. You’ve done the hard part; now it’s about making sure the credit bureaus do theirs.

Once your dispute lands on their desk, a timer starts. Thanks to the Fair Credit Reporting Act (FCRA), the credit bureaus have a legal obligation to investigate your claim and get back to you with the results. Generally, they have 30 days to do so. This isn't a friendly guideline—it's the law.

The 30-Day Waiting Game

During this month-long window, the bureau isn't just sitting on your letter. They're required to reach out to the company that put the inquiry on your report in the first place (often called the "furnisher"). They'll ask that company to prove the inquiry was legit and that you authorized it.

The outcome is pretty straightforward. The lender either provides proof that you gave them permission, or they don't respond. If they can't cough up the evidence or just ignore the request, the bureau is legally required to delete the inquiry. It’s that simple.

This is exactly why a well-crafted, documented dispute letter is so effective. It triggers a formal process that forces everyone to play by the rules.

Victory! Your Dispute Was Successful

Getting that letter in the mail saying the inquiry has been deleted feels great. But don't pop the champagne just yet. You have one final, crucial step.

Trust, but verify. Give it a week or two for the systems to update, then pull your credit reports again from all three bureaus—Experian, Equifax, and TransUnion. You need to see with your own eyes that the inquiry is gone. Sometimes an update only goes through at one bureau, or a clerical error prevents it from being processed correctly.

Once you’ve confirmed it's gone for good, you're all set. If you use a credit monitoring service like All3Credit, you should see the change reflected there soon, too.

What to Do if Your Dispute is Denied

It’s definitely a setback to get a letter saying your dispute was denied because the creditor "verified" the inquiry. But this isn't necessarily the end of the line.

First, look at the reason they provided. Then, map out your next move. You’ve got a few solid options:

Filing a complaint with the Consumer Financial Protection Bureau (CFPB) is an incredibly powerful tool. The CFPB is a federal watchdog that will officially forward your complaint to the credit bureau and demand a formal response. This often forces a much more serious review of your case.

What if You Just Hear Crickets?

The 30-day investigation window closes, and your mailbox is empty. Now what? This is precisely why you sent that first letter via certified mail. Your little green receipt is your golden ticket—it's undeniable proof of when they received your dispute.

If a credit bureau blows past its legal deadline, it is in violation of the FCRA. It's time to send a follow-up letter, often called a "letter of non-response." In it, reference your original dispute, include a copy of the certified mail receipt, and point out that they have failed to meet their 30-day legal obligation.

This one simple, organized step has a way of getting your dispute moved to the very top of the pile. It sends a clear message: you know your rights, you're keeping track, and you aren't going away.

How to Protect Your Credit from Unwanted Inquiries