How to Raise Credit Score Quickly: Top Tips & Strategies

When you're in a pinch and need to raise your credit score fast, there's no time to waste on slow-moving strategies. You need to know which levers to pull for the biggest impact, right now. The good news is, a couple of key actions can deliver noticeable results in as little as 30 to 60 days.

It all boils down to two things: lowering your credit utilization and making sure every single payment is on time. This isn't about a complete financial makeover. It's about surgical strikes on the factors that matter most.

The Quickest Wins for Your Score

Let's get practical. Two of the most effective moves you can make involve how you manage your credit card balances. First, aggressively pay down the balances on your cards, especially any high-interest ones. This move pulls double duty by saving you money on interest and slashing your overall debt.

Here’s a pro tip that many people miss: make a payment before your statement closing date. Most people wait for their bill, but the balance on your statement closing date is typically what gets reported to the credit bureaus. By paying down the balance early, you ensure a lower number gets reported, which can give your score an almost immediate lift.

Why Credit Utilization is Your Golden Ticket

The single most powerful factor you can influence quickly is your credit utilization ratio. This is simply the amount of credit you're using compared to your total available credit. To a lender, a high utilization ratio looks risky, as if you're overextended. Keeping that number low is one of the clearest signals you can send that you're a responsible borrower.

We saw this play out on a massive scale during the COVID-19 pandemic. As people paid down their credit card balances, average credit scores actually went up. You can dig into the data yourself by checking out the analysis of credit score developments on FederalReserve.gov. It’s a perfect real-world example of this principle in action.

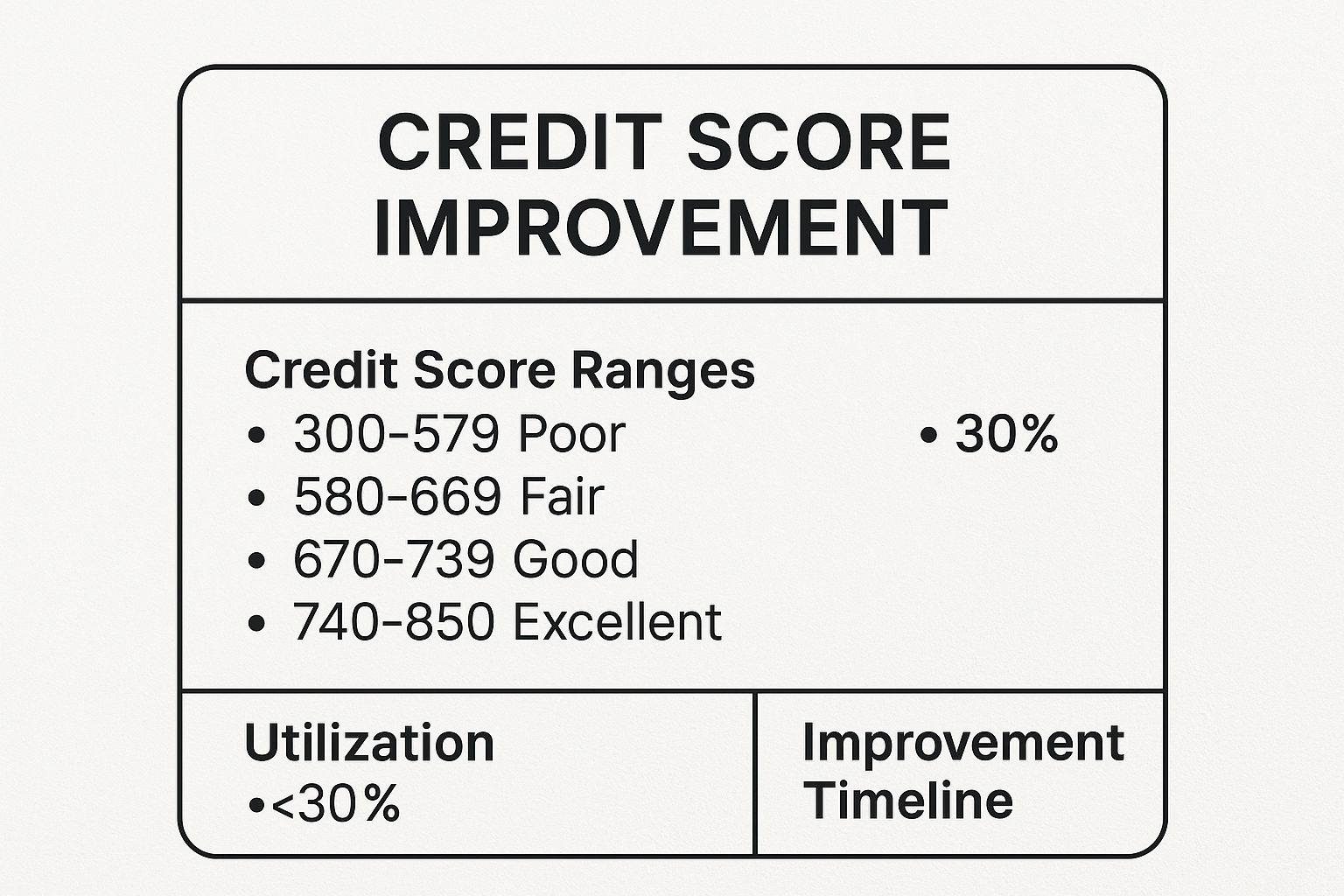

This infographic lays out the key benchmarks and a realistic timeline for improving your score.

As you can see, getting into that "Good" or "Excellent" range is absolutely within reach in just a few months, provided you make keeping your utilization under 30% your top priority.

For a clearer picture, here’s a breakdown of the most effective tactics you can deploy right away.

Quickest Actions for Credit Score Improvement

These actions are your fastest path to a better score. By focusing your energy here, you're not just hoping for a change—you're actively making it happen.

Master Credit Utilization for Immediate Gains

If you're looking for the fastest way to give your credit score a real jolt, look no further than your credit utilization ratio. While your payment history is the bedrock of good credit, it takes time to build. Utilization, on the other hand, can be changed almost overnight.

This single factor has a massive impact on your score, and the best part is that any improvements you make can show up on your credit report in as little as 30 days. It’s the single most powerful lever you can pull for a quick score boost.

You’ve probably heard the standard advice: keep your credit card balances below 30% of your total credit limit. That’s not bad advice, but it's just the beginning. To see a real difference, you have to get a bit more strategic.

Here’s the secret most people miss: credit card companies typically only report your balance to the credit bureaus once a month. This usually happens on your statement closing date. So, even if you’re a rockstar who pays your bill in full every single month, a high balance on that one specific reporting day can tank your score. It’s not about what you spend, it’s about what balance they see.

Go Beyond Basic Payments

The trick is to be proactive. Don't just wait for your bill to arrive. By making a payment before your statement date closes, you can dramatically lower the balance that gets reported. It's a simple move that can have an immediate, positive effect on your score.

Let’s put this into perspective with a common scenario:

But what if you made a 3,500** payment a week before the statement closing date? Now, the reported balance is just **500. Your utilization plummets to a stellar 5%. That one small action can trigger a significant score increase in a single month.

Explore the AZEO Method

Want to take it to the next level? For those aiming for the highest possible score, there's a technique the pros use called All Zero Except One (AZEO).

It's exactly what it sounds like: you pay off the balances on all your credit cards down to $0, except for one. On that one card, you let a tiny balance report—think 1-3% of its limit. This shows lenders you're actively and responsibly using your credit, but you aren’t dependent on it. It’s a subtle but powerful signal that can squeeze out those extra points.

This isn't just theory. The Federal Reserve saw this play out on a national scale. Their analysis found that one of the main reasons credit scores shot up during the pandemic relief periods was a sharp drop in overall credit utilization. It's proof that paying down balances quickly produces results. You can see the data yourself in the Federal Reserve’s detailed report.

To make these strategies work, you need to know when your lenders report. Keeping an eye on everything yourself can be a hassle, which is why finding the cheapest credit monitoring service is a smart move. It allows you to track your balances and score updates across all three bureaus in near real-time, so you know exactly when to make your move.

Fix Your Payment History and Resolve Delinquencies

Your payment history isn't just a part of your credit score; it's the biggest piece of the puzzle. Just one late payment can tank your score and linger on your report for up to seven years. So, if you're serious about boosting your credit score quickly, making every single payment on time from here on out—and cleaning up any past stumbles—is absolutely critical.

The easiest way to safeguard your score is to set up automatic payments for at least the minimum amount due on every account. Think of it as your financial safety net. It ensures you never miss a due date, even when life gets hectic. I also recommend setting up payment alerts on your phone's calendar or through your bank's app for an extra layer of security.

Dealing With Past-Due Accounts

If you have an account that's currently behind, that needs to be your number one priority. A delinquent account is like an anchor, actively dragging your score down every month it goes unpaid. Getting that account current is the only way to stop the damage.

I once worked with a client whose credit card was 60 days past due. Their score was in a nosedive, and they felt completely stuck. The first thing we did was have them pay the overdue amount to bring the account current. Within the next two months, after the lender updated their report from "past due" to "paid as agreed," their score jumped by over 40 points. It was a massive, almost immediate impact from a single action.

Using Goodwill Letters for One-Time Mistakes

What about that one late payment from a year ago on an otherwise spotless record? You might be able to get it wiped clean with a goodwill letter. This is simply a polite, well-written letter to your creditor asking them to remove a negative mark as a courtesy.

Goodwill letters have the best chance of success when:

In your letter, you'll want to briefly explain what happened, take responsibility, and highlight your loyalty as a customer. There are no guarantees, of course, but many creditors are willing to do this for good customers. Spotting these small issues is often the first clue that you should learn more about why your credit score might be dropping.

The power of on-time payments is a global principle. For instance, in the UK, a recent dip in credit card delinquency rates to a two-and-a-half-year low led to a nationwide improvement in credit health. This proves that consistent, on-time payments have a direct and positive effect, largely because being 90 or more days past due is one of the most damaging things for a credit score. You can find more global credit trend data at Equifax.com.

Strategically Grow Your Available Credit

Beyond just paying down your balances, there’s another angle of attack for a quick score boost: increasing your total available credit. This move directly lowers your credit utilization ratio, which is a major factor in your score. Think of it this way—if you increase your total credit limit while your balance stays the same, your utilization percentage has no choice but to drop.

It’s a smart, proactive strategy that can show results in as little as one billing cycle. Lenders love to see that you have access to a lot of credit but don't feel the need to use it. It's a classic sign of responsible credit management. There are two great ways to make this happen.

Ask for a Credit Limit Increase

Your current credit card companies are often the best place to start. If you've been a good customer—paying on time and keeping your account in good standing—you're in a prime position to ask for a higher credit limit.

Most banks make this incredibly easy. You can often submit a request right from their mobile app or website, and it only takes a couple of minutes. The best part is that many of these requests are handled with a “soft pull” on your credit, which has zero impact on your score. Just be sure to ask the issuer beforehand if it will be a soft or hard inquiry.

Become an Authorized User

This is one of my favorite "shortcuts" for building credit fast, especially for those with a thin credit file. If you have a family member or a trusted friend with a long history of excellent credit, ask them to add you as an authorized user on one of their cards.

By doing this, you essentially get to "piggyback" on their good habits. The account's age, its high limit, and its perfect payment history can all appear on your credit report. It’s a triple-threat that can boost your average account age, increase your total available credit, and lower your overall utilization all at once. The impact can be huge, often showing up in as little as 30-60 days.

A word of caution is necessary here, though. This strategy is only as good as the account you're added to. Don't just jump on any card. Make sure the primary account holder's card checks all these boxes:

Choosing the wrong account can seriously backfire and pull your score down. But if you partner with someone you trust who has a stellar credit record, becoming an authorized user is one of the quickest ways to build a stronger credit profile.

Find and Dispute Errors on Your Credit Report

You'd be surprised how often a simple mistake on your credit report is the very thing holding your score back. These errors are more common than you think, and even something small—like a payment incorrectly marked as late—can cause real damage. Hunting down these inaccuracies and getting them fixed is one of the most direct ways to give your credit score a quick boost.

Your first move is to pull your credit reports from all three major bureaus: Experian, Equifax, and TransUnion. The good news is you can get these for free every single week. The only place you should go for this is the official, government-authorized site, AnnualCreditReport.com. We have a guide that breaks down exactly how to get all three credit reports for free to make it even simpler.

Here’s a look at the homepage, so you can be sure you've landed in the right spot.

This site is the secure, centralized hub for accessing your files from all three bureaus at once.

What to Look For

Once you have your reports, it's time to put on your detective hat. Don't just give them a quick scan. You need to go through each one, line by line, and question everything.

Keep an eye out for these common slip-ups:

How to Handle a Dispute

If you spot an error, you have the legal right to challenge it. Each bureau—Experian, Equifax, and TransUnion—has an online dispute portal on its website. When you file your dispute, be crystal clear. Identify the specific account, explain exactly why it's wrong, and state what the correct information should be.

Next, round up any proof you have. This could be a bank statement that shows you paid on time, a letter from the creditor confirming the account is closed, or court documents. The more evidence you can provide, the stronger your case.

By law, the credit bureaus typically have 30 to 45 days to investigate your claim with the lender. If the lender can't verify the information, it has to be removed.

The payoff for this diligence is huge. One TransUnion study found that 15% of consumers who actively monitored their credit saw their scores climb by an average of 28 points in a single year. This shows that staying on top of your reports and correcting mistakes isn't just a chore—it’s a powerful strategy for improving your credit.

Your Top Credit Score Questions, Answered

When you're working hard to boost your credit score, it's easy to get bogged down by conflicting advice. Let's cut through the noise and tackle some of the most pressing questions I hear all the time. Getting straight answers is the only way to build a solid plan.

How Long Until I Actually See a Difference?

This is the big one, isn't it? The good news is, it’s often faster than you’d expect. You can genuinely start to see positive movement in your credit score within 30 to 60 days.

The quickest wins come from tackling your credit utilization. For example, if you pay down a hefty credit card balance, that action gets reported pretty fast. Lenders usually send your account updates to the credit bureaus once per billing cycle. So, a big payment you make today will likely show up as a new, lower balance on your credit report right after your next statement closes, which is typically within a month.

Should I Close My Old Credit Cards?

I see this mistake all the time, and it can really set you back. In nearly every situation, closing old credit cards will actually hurt your score.

Think about it this way: closing an account delivers a double whammy. First, you instantly lose that line of credit, which shrinks your total available credit and can spike your credit utilization ratio. Second, if it’s an account you've had for a long time, you shorten the average age of your credit history—another crucial factor in your score.

This simple strategy lets the account's history and credit limit continue to give your score a healthy foundation.

Is It Really Worth Paying Off an Old Collection?

Absolutely. Paying off an account that's gone to collections is almost always the right call for your financial future. The collection itself will stay on your report for up to seven years, but its sting fades considerably over time.