How to Monitor Credit Score: Tips to Protect Your Financial Health

If you want to take control of your finances, the first place to start is your credit score. This isn't just about occasionally pulling your report; it's about actively keeping an eye on it. That means regularly checking your reports from all three major bureaus—Experian, Equifax, and TransUnion—and using a service that sends you real-time alerts when something changes. Staying on top of your credit is truly your best defense against nasty surprises like errors or identity theft.

Why Monitoring Your Credit Score Is a Must

Your credit score is so much more than a three-digit number. It’s what lenders look at to decide if you’re a safe bet. This single number influences the interest rates you're offered for everything from mortgages and car loans to new credit cards. A better score means lower rates, which can save you a fortune over the life of a loan. Flying blind here is like driving without a dashboard—you have no idea if you're speeding toward a financial cliff.

Let’s put it into a real-world context. Say you're applying for a mortgage. A tiny error on your credit report—one you didn't even know was there—could drop your score just enough to bump you into a higher interest bracket. On a 30-year loan, that small difference could easily cost you tens of thousands of extra dollars. This is exactly why proactive monitoring is so critical; it helps you spot these costly problems before they can mess up your plans.

Your First Line of Defense

Think of regular credit monitoring as your personal security guard against identity theft. It happens more than you think—criminals can use stolen personal details to open accounts in your name, wrecking your credit in the process. With a service like All3Credit, you get instant alerts for suspicious activity, like a hard inquiry you didn't authorize or a new credit card you never applied for.

Ensure Accuracy and Correct Errors

It's a frustrating but true fact: credit report errors are incredibly common. I’ve seen everything from simple typos in personal information to entire accounts that belong to someone else entirely. With the average U.S. credit score hovering around 715 in 2023, even one mistake can cause a significant dip, sometimes by dozens of points.

By keeping a close watch on your reports, you can spot these mistakes and formally dispute them with the credit bureaus. Cleaning up inaccuracies is one of the most straightforward ways to maintain a healthy score. To get a better handle on the basics, you can learn more about what is credit monitoring. Ultimately, you want to ensure that the profile lenders see is an accurate, true reflection of your credit history.

Choosing the Right Credit Monitoring Tool for You

When you first start looking into credit monitoring, you’ll quickly notice there are two main paths: free tools and paid services. The best one for you really boils down to what you're trying to accomplish with your credit.

Think of free services as a good first step. They'll usually give you a basic score from one of the credit bureaus, which is certainly better than flying blind. You get a snapshot of your credit health. The catch? It’s just that—a snapshot. You're often getting a limited view, and they typically lack the powerful features needed for serious credit building or robust identity theft protection.

If you need the full story, a paid service is almost always the way to go. This is where you unlock the comprehensive, detailed data that free tools just don't provide.

Free vs. Paid Services: What's the Real Difference?

The gap between free and paid services becomes crystal clear once you start comparing features. A comprehensive service like All3Credit is designed to give you a complete, 360-degree view of your financial identity. This level of detail is critical if you're actively working to improve your score or are serious about protecting yourself from fraud.

Making the right choice is about weighing what you get for what you pay. To help visualize this, let's break down what you can typically expect from each.

Free vs. Paid Credit Monitoring Services

At the end of the day, if you’re just casually checking your score, a free tool might be all you need. But if you’re getting ready to apply for a major loan, are in the middle of repairing your credit, or simply want true peace of mind against identity theft, investing in a paid service pays for itself.

Cost doesn’t have to be a roadblock, either. You can check out our guide on the cheapest credit monitoring service to see just how affordable real protection can be.

Alright, you've decided to take control of your financial health with credit monitoring. Smart move. Let's walk through how to get everything set up with a service like All3Credit so you can start benefiting from it right away.

Getting started is pretty painless. The whole point is to get you past the setup phase and into the real work of monitoring your credit. To do that, the service needs to connect to your credit files at the three major bureaus: Experian, Equifax, and TransUnion. This means you'll have to go through a quick identity verification. It’s a standard security step—and a necessary one—to make sure you're the only one with access to your financial information. Just have your Social Security number and current address ready, and it'll be a breeze.

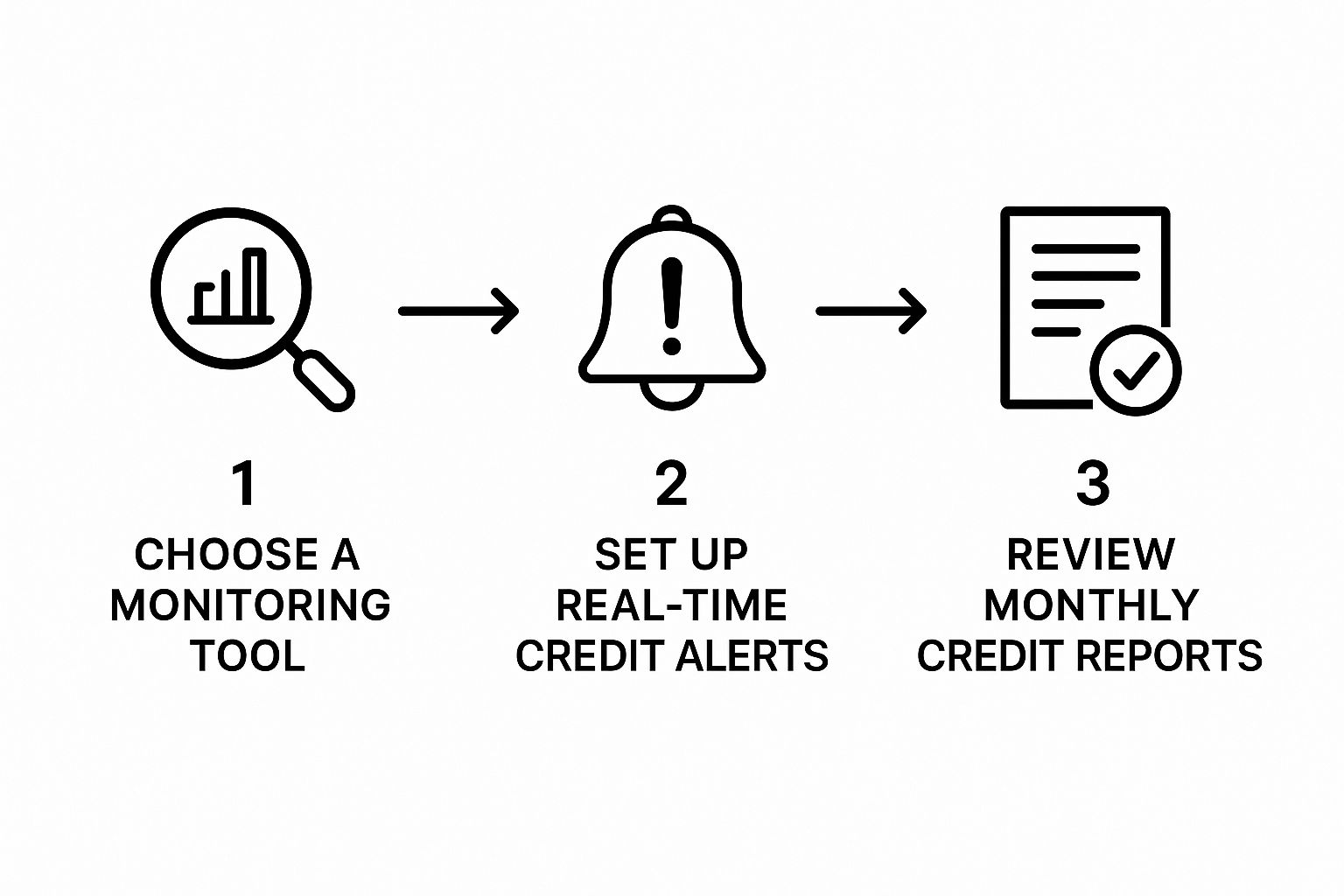

The basic workflow for effectively monitoring your credit is simple, but powerful. This image gives you a great visual breakdown.

As you can see, it all comes down to choosing your service, turning on the alerts, and then getting into a rhythm of checking in regularly.

Personalizing Your Dashboard And Alerts

Once you're verified and logged in, you’ll land on your dashboard. This is your new credit headquarters. Take a few minutes to get familiar with it. You'll see your scores from all three bureaus laid out clearly, which is incredibly important since lenders don't all pull from the same source.

Now for the most important part: customizing your alerts. Don't just accept the default settings. This is where you can really make the service work for you. Think about what activity you want to know about immediately.

I always advise people to set up instant text or email alerts for things like:

How to Read Your Credit Reports and Alerts

Getting that ping—an alert that something on your credit file has changed—is just the first step. The real skill is knowing what to make of it and what to do next. This is where you move from just having a service to actively managing your credit. Think of your credit report as your financial biography; alerts are the footnotes telling you a new detail has been added.

To really get a handle on this, you need to understand the five main ingredients that make up your credit score. Every single alert, and every line on your report, ties directly back to one of these areas. Lenders live and die by these factors, so they're essential knowledge for anyone looking to build better credit.

These are the pillars of your score:

Making Sense of Your Credit Monitoring Alerts

When an alert from a service like All3Credit lands in your inbox, take a breath. Most of the time, it’s nothing to worry about. For instance, getting an alert that a new balance has been reported is typically just your credit card company doing its monthly update. That's perfectly normal.

The alerts you need to jump on are the ones that seem out of place. A hard inquiry you don’t recognize is a huge red flag. This means a lender has pulled your complete credit file because someone applied for credit in your name. If that someone wasn't you, it's a potential sign of identity theft.

Another alert that requires immediate action is a change to your personal information, like a new address you've never lived at. This is a classic move by fraudsters. When you see an alert like this, your very next move should be to pull your full reports. To get a complete view, you should learn how to get all 3 credit reports since one bureau might have information the others don't. Once you have the reports in hand, you can pinpoint the fraudulent information and start the dispute process directly with the credit bureau.

How to Actually Improve Your Credit Score

Watching your credit score go up and down without doing anything about it is like staring at your car's speedometer hoping it will magically go faster. The real magic happens when you take what you learn from your credit report and put it into action.

Let's get practical. Forget the vague advice you’ve heard before. Here are the strategies that actually move the needle.

Tackle Your Credit Utilization

If there’s one thing that can give your score a quick and powerful boost, it’s managing your credit utilization ratio. This is just a fancy term for how much of your available credit you're currently using.

Lenders start to get anxious when they see maxed-out cards. A good rule to live by is to keep your total utilization below 30%. So, if you have a combined limit of 10,000 across all your credit cards, you’ll want to keep your total balance under 3,000. Want an even bigger impact? Aim for under 10%.

Make Late Payments a Thing of the Past

Nothing tanks a credit score faster than a late payment. Your payment history is the heavyweight champion of credit score factors, making up about 35% of your score. A single late payment can haunt your report for up to seven years.

The simplest fix? Autopay. Set it up for at least the minimum payment on every single one of your accounts.

You can also look into services that report your on-time rent and utility payments to the credit bureaus. This is a fantastic way to build a positive payment history, especially if you’re just starting out or your credit file is a little thin.

Play the Long Game with Your Accounts

Two other big factors are the age of your credit accounts and how often you apply for new credit.

First, lenders love seeing a long, stable credit history. It shows them you're experienced and reliable. This is why it’s usually a smart move to keep your oldest credit cards open, even if you rarely use them. Just buy a coffee or a pack of gum every few months to keep the account active. Closing that old account can shrink your average credit age, and your score might take a hit.

Second, be strategic about new credit applications. Every time you apply for a credit card or loan, it triggers a hard inquiry on your report, which can cause a small, temporary dip in your score. Instead of applying for several cards hoping one sticks, do your homework first. Only apply for cards you have a strong chance of getting. This shows lenders you're a responsible borrower, not someone in a desperate scramble for credit.

Your Top Credit Monitoring Questions, Answered

Even after you get started with credit monitoring, a few questions are bound to pop up. I see them all the time. Getting straight answers is key to feeling in control of your financial future, so let’s tackle some of the most common ones I hear from people.

How Often Should I Check My Credit?

For a general financial check-up, looking at your full credit reports from all three bureaus once or twice a year is a great habit. It helps you catch any slow-burning issues or inaccuracies before they become real problems.

But let's be realistic. If you're gearing up for a big purchase like a car or house, actively trying to boost your score, or have a nagging worry about identity theft, you need to be checking much more often. That's where a service like All3Credit really shines, giving you instant alerts whenever something important changes.

Does Checking My Own Credit Score Hurt It?

This is probably the biggest myth in the credit world, and I'm happy to bust it. The answer is a hard no.

When you check your own credit, it’s what’s known as a "soft inquiry." It has zero effect on your score. This is true whether you're using a paid monitoring service, a free app, or getting your annual free report directly from the bureaus.

A "hard inquiry" is different. That only happens when a lender pulls your report because you've formally applied for credit, like a mortgage or a new credit card. That can cause a small, temporary dip in your score. But you’re always in the driver’s seat for those.

What Should I Do If I Find an Error on My Report?

Finding an error on your credit report is frustrating, but don't panic. There's a well-defined process to fix it. You have to dispute the mistake directly with the credit bureau that's reporting it—whether that’s Equifax, Experian, or TransUnion. Most bureaus let you file a dispute online, which is usually the fastest way.

To get the ball rolling, you’ll need to provide:

The credit bureau is legally required to investigate your claim, typically within 30 days. If they confirm the mistake, they must correct or delete it. Seeing that incorrect information vanish from your report is often followed by a welcome jump in your credit score.

Ready to stop guessing about your credit? With All3Credit, you get real-time alerts and all three of your credit scores on a single, easy-to-use dashboard. It's time to start monitoring your financial health with real confidence. Learn more and get started with All3Credit.