How to Improve Credit Score Fast in 2024: Easy Tips & Strategies

If you're looking for the fastest way to give your credit score a serious lift, the secret isn't complicated. From my experience, the quickest wins always come from two places: aggressively paying down your credit card balances and making absolutely sure every single payment is on time.

Why? Because these actions directly influence the two heaviest hitters in your credit score calculation. Best of all, you can often see a positive change in as little as 30-45 days.

Your Fast Track to a Better Credit Score

Think of this as a credit score sprint, not a marathon. When you need to see results fast—maybe you’re about to apply for a mortgage or a car loan—you have to focus on the moves that pack the biggest punch. We're zeroing in on what lenders and scoring models like FICO and VantageScore care about most.

Your game plan needs to be simple and direct. Forget about the slow-and-steady strategies for a moment. This is all about making immediate, positive changes that get reported to the credit bureaus and reflected in your score as quickly as possible.

Target the Most Powerful Factors First

When it comes to your credit score, not all factors are created equal. The two you can influence the fastest are your payment history and your credit utilization.

Payment history is straightforward: you either pay your bills on time, or you don't. A single late payment can wreak havoc on your score and stay on your report for seven years, so making on-time payments is non-negotiable.

Your credit utilization ratio, on the other hand, is where you can make some real magic happen in a short amount of time. This is simply the percentage of your available credit that you're currently using.

I’ve seen clients gain 20, 30, or even 50 points in a month just by slashing their utilization. It’s that impactful. Global consumer credit trends consistently show this is a critical metric for lenders. You can dig deeper into the data by exploring the full Equifax report on global consumer credit trends.

Create Your Immediate Action Plan

To get started, you need to know your starting point. That means pulling your credit reports from all three major bureaus—Experian, Equifax, and TransUnion. You can't fix what you can't see.

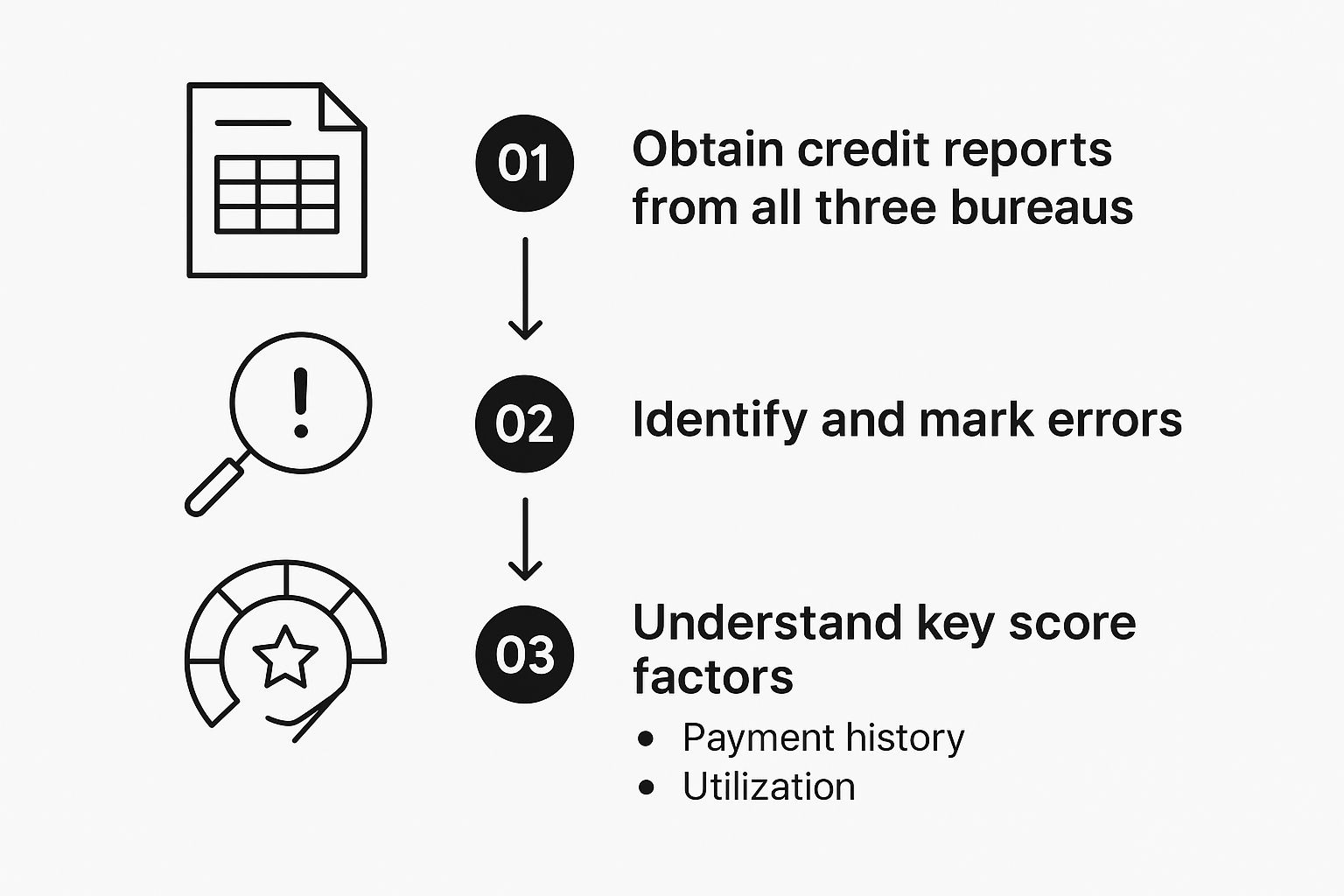

This visual gives a great overview of the initial steps to take for a quick credit review.

This workflow nails the fundamentals: get your reports, hunt for errors, and get a feel for what’s holding your score down. Once you have that baseline, you can build a targeted plan.

Here's a quick summary of the most effective strategies you can implement right away.

| High-Impact Actions for Fast Credit Score Improvement | | :--- | :--- | :--- | | Action | Impact Level | Typical Timeframe for Score Change | | Pay down high-interest credit card balances | High | 30-60 days | | Dispute inaccuracies on your credit report | High | 30-90 days | | Become an authorized user on a seasoned account | Medium-High | 30-60 days | | Make bi-weekly payments instead of monthly | Medium | 30-60 days | | Request a credit limit increase (if you won't use it) | Medium | 30-60 days |

These are the strategies that move the needle the fastest. Pick one or two from the top of the list and you'll be well on your way.

From there, it’s all about execution.

Master Your Credit Utilization Ratio for a Quick Boost

If you're looking for the fastest way to give your credit score a serious lift, there’s one area you need to focus on above all others: your credit utilization ratio (CUR). I've seen it time and again—nothing else offers this kind of immediate impact. This single metric makes up a whopping 30% of your FICO score, and it all comes down to how much of your available revolving credit you're actually using.

What makes it so powerful? Unlike your payment history or the age of your accounts, which take months or even years to improve, you can dramatically change your CUR in under 30 days. Lenders see a low utilization rate and think, "This person has access to credit but isn't dependent on it." A high rate, on the other hand, can signal financial strain, even if you never miss a payment.

It's More Than Just One Number

Here's something a lot of people miss: your utilization is calculated two ways. Lenders look at your overall ratio across all cards, but they also scrutinize the utilization on each individual card. Maxing out a single card can be a red flag, even if your other cards have zero balances.

Let's walk through a quick example. Say you have two cards:

Your overall utilization looks fantastic at just 10% (1,000 used / 10,000 total limit). But a lender's algorithm might get hung up on that 50% on Card A, flagging it as a potential risk. The real goal is to keep both your individual and overall ratios as low as possible.

Tactics for Lowering Your Utilization—Fast

Dropping that ratio isn't just about paying down debt; it's about being strategic. Here are a couple of my favorite tactics that deliver quick results.

Pay Before Your Statement Closes

This is a game-changer. Most people don't realize that card issuers typically report your balance to the credit bureaus only once a month—right after your statement closing date. This means that even if you pay your bill in full, whatever your balance was on that one day is what gets reported for the entire month.

To work around this, simply make a payment before your statement date.

Let’s say you charged 900 on a card with a 1,000 limit. If you wait for the bill, the bureaus see 90% utilization. But if you pay off 700 a few days *before* the statement closes, your issuer reports a balance of just 200. Just like that, your reported utilization for that card plummets from a scary 90% to a much healthier 20%.

Ask for a Credit Limit Increase

Here's another powerful move that doesn't require you to change your spending at all. If you've had your card for a while, have a solid payment history, and maybe your income has gone up, just call your card issuer and ask for a higher credit limit.

Think about the math. A 500 balance on a 2,000 limit is 25% utilization. If they bump your limit to 4,000, that same 500 balance instantly becomes just 12.5% utilization. Your score will thank you. The key, of course, is to have the discipline not to use that extra credit you just unlocked.

Before you make the call, it's a good idea to see your credit from the same perspective as the lender. Take a moment to get all 3 credit reports so you know exactly what they're looking at. Going in with clean reports across the board gives you the best possible chance of getting approved for that increase.

Make Your Payment History Flawless and Hunt Down Errors

While managing your credit utilization is a fantastic way to get a quick score boost, the real foundation of a healthy credit score is your payment history. This isn't just one piece of the puzzle; it's the biggest one, making up a massive 35% of your FICO score. If you're serious about raising your score and keeping it high, building a perfect payment record isn't optional.

Think about it from a lender's perspective: a long history of on-time payments shows you're reliable. On the flip side, just one payment reported 30 days late can seriously damage your score and stay on your report for up to seven years. And the longer a bill goes unpaid, the worse the impact gets.

Use Automation to Your Advantage

Let's be honest, life gets hectic. The most common reason for a missed payment isn't a lack of funds; it's simply forgetting. The best way to combat this is to take human error out of the equation.

Set up automatic payments for at least the minimum amount due on every single one of your accounts. This acts as a crucial safety net, ensuring you never miss a beat. You can—and absolutely should—go in and pay more than the minimum manually before the due date, but autopay guarantees you’re never marked late.

I also recommend setting up calendar reminders or using your banking app's alerts. A simple notification a few days before a bill is due gives you plenty of time to shuffle funds around or deal with any last-minute surprises.

What to Do About Late Payments and Past-Due Accounts

So, what happens if a payment is already late? That first 30-day window is critical. Most creditors won't report a late payment to the bureaus until it's officially 30 days past its due date. If you realize you've missed a payment, act fast.

Pay it immediately and then pick up the phone and call your creditor. If you have a good track record with them, you can often request a "goodwill" or courtesy waiver to prevent them from reporting the slip-up in the first place.

If an account is already showing as delinquent, the most powerful move you can make is to bring it current. Getting that account back to a "paid as agreed" status stops the ongoing damage and starts the healing process. Recent FICO data shows that people who bring delinquent accounts current can see score improvements surprisingly quickly, sometimes in just a month or two. You can dig into FICO's latest findings to see how these trends affect the average U.S. FICO score.

Become a Detective: Scour Your Credit Reports for Errors

Mistakes on credit reports are far more common than you might think. An incorrect late payment, a loan you paid off that still shows a balance, or an account that isn't even yours can all unfairly pull your score down. This is why you have to regularly check your credit reports from all three major bureaus: Equifax, Experian, and TransUnion.

You're legally entitled to a free report from each bureau every year. Get them and go through every single line. You're looking for anything that seems off, like:

This chart from FICO shows just how sensitive the national average score is to these kinds of inaccuracies and delinquencies.

The data makes it crystal clear: delinquencies drag down the national average, which really underscores why having a clean and accurate credit report is so vital.

The Dispute Process Is Your Path to a Higher Score

If you spot an error, don't just get frustrated—get proactive. You have a legal right to dispute it with the credit bureau that's reporting it. The process is pretty straightforward.

You'll need to submit a dispute, either online or through a letter, clearly stating what the error is and why it's wrong. Be sure to include any proof you have, like bank statements or payment receipts.

By law, the credit bureaus have about 30 days to investigate your claim with the original creditor. If the negative information can't be verified, they have to remove it. Getting an inaccuracy deleted can lead to a fast and sometimes substantial jump in your credit score. If you've ever been stumped by a sudden drop, errors are often the silent culprit. For a deeper dive, check out our guide on why your credit score might be dropping.

Strategically Build Your Credit Profile

While keeping your balances low and paying bills on time are the quickest ways to a better score, the real long-term goal is building a strong, resilient credit profile. If your credit file is a bit thin—meaning you only have a few accounts—or you’re working to overcome some past financial stumbles, you need a proactive game plan.

This isn’t just about dodging negative marks. It's about actively adding positive information to your credit reports to show lenders you're a reliable borrower. The good news is you can do this without taking on risky, high-interest debt. With the right approach, you can build a solid credit history faster than you might think.

Use Credit-Builder Tools to Your Advantage

When you have limited or damaged credit, getting approved for a standard unsecured credit card can feel impossible. It’s a classic catch-22: you need credit to build a credit history, but you can't get approved for credit without a history. This is exactly where specialized credit-building products come into play.

Two of the most effective tools I’ve seen are secured credit cards and credit-builder loans. They’re designed specifically for this situation and, crucially, report your payment activity to all three credit bureaus. That consistent, positive reporting is what builds a score over time.

Both of these are fantastic, low-risk methods for establishing a track record of on-time payments—the single most important factor that makes up 35% of your FICO score.

Become an Authorized User for a Potential Quick Win

One of the most popular tactics for a fast credit score boost is becoming an authorized user on someone else's credit card. Sometimes called "piggybacking," this strategy can deliver a pretty significant jump to your score in a short amount of time when it works correctly.

Here’s the simple version: A trusted person, like a parent or spouse with excellent credit, adds you to one of their long-standing credit card accounts. You don't even have to touch or use the physical card. The magic is that the entire history of that account—its age, high credit limit, and perfect payment record—can be copied over to your credit reports.

This move is especially powerful for young adults just starting or anyone with a "thin" credit file. It instantly injects account age and a positive payment history where there was little or nothing before. But, and this is a big but, it's not without its risks.

Weighing the Pros and Cons of Piggybacking

While being an authorized user sounds like a simple fix, it requires a huge amount of trust. You’re hitching your financial wagon to someone else's, for better or for worse.

The biggest danger is obvious: any mistake the primary cardholder makes becomes your mistake, too. If they’re late on a payment or max out the card right before a big trip, that negative information will show up on your credit report and could tank your score.

Before you even consider this, have a frank conversation. Make sure the account has a flawless history and a consistently low balance. For the person adding you, it’s smart to set clear ground rules—or just keep the physical card in their own wallet. It’s a powerful tool, but one that needs total transparency to work without causing a disaster.

Tracking Your Progress and Understanding the Numbers

Trying to boost your credit score without tracking it is like driving with your eyes closed. You might be moving, but you have no idea if you're headed in the right direction. To make real, fast improvements, you need to see what's working and what isn't.

This isn't just about watching a number tick upward; it's about understanding the why behind it. When you see your score jump after paying down a credit card, that's powerful motivation. It confirms your efforts are paying off and helps you build lasting financial habits instead of relying on guesswork.

Choosing Your Credit Monitoring Tools

Your first move should be to get a clear, consistent view of your credit reports and scores. Sure, you can get free annual reports, but when you're actively working on your credit, once a year just doesn't cut it. You need more frequent updates.

This is where a good credit monitoring service becomes your best friend. A platform like All3Credit is designed for this, pulling your reports and scores from all three major bureaus—Experian, Equifax, and TransUnion—into one easy-to-read dashboard. This is a game-changer because lenders don't all look at the same report. One might pull from Experian, another from TransUnion, so you need to see what each of them sees.

For a deeper dive into why monitoring all three bureaus is so critical, our guide on credit monitoring across all three bureaus is a must-read. It breaks down exactly how these services empower you.

FICO vs. VantageScore: What You Need to Know

Once you start looking, you'll notice you don't have just one credit score—you have several. The two most common models you’ll see are FICO and VantageScore. Both scores range from 300 to 850 and aim to predict how likely you are to repay debt, but they calculate that risk a bit differently.