How to Get Inquiries Off My Credit Report: Expert Tips

You can't just wipe every inquiry off your credit report. Let's get that straight from the start.

If you applied for a loan or credit card, that hard inquiry is legitimate and it's there to stay. The good news is that they naturally fall off your report after two years. The only inquiries you can—and should—fight to remove are the ones that are unauthorized or flat-out fraudulent. That’s where you can take action.

What Credit Inquiries Mean for Your Score

Before diving into the dispute process, it's essential to know which inquiries are worth worrying about. Not all inquiries are created equal, and understanding the difference will save you a ton of time and unnecessary stress.

You'll come across two main types on your credit report: soft inquiries and hard inquiries.

A soft inquiry, sometimes called a "soft pull," is pretty harmless. It happens when you check your own credit, or when companies screen you for those "pre-approved" offers you get in the mail. Think of them as a background glance—they have zero impact on your score.

A hard inquiry, or "hard pull," is the one that matters. This happens when a lender pulls your credit report because you've officially applied for new credit. We’re talking mortgages, car loans, or a new credit card. This is the kind of inquiry that can ding your score, usually just for a little while.

Hard vs Soft Inquiries: What You Need to Know

To figure out which inquiries on your report deserve your attention, it helps to see a direct comparison. This table breaks down the essentials at a glance.

Seeing the differences laid out like this makes it clear why focusing on hard inquiries is key. Soft pulls are just part of the background noise of your financial life and aren't visible to potential lenders.

The Real Impact of Hard Inquiries

While it’s smart to keep an eye on hard inquiries, don't let them become your main obsession. In the grand scheme of things, they're a relatively small piece of the puzzle.

Inquiries only make up about 10% of your FICO score calculation. Their influence is minor compared to heavy hitters like your payment history and how much of your available credit you're using.

Hard inquiries stay on your report for two years, but they typically only affect your score for the first few months. A few legitimate inquiries from responsible credit shopping is perfectly normal—lenders actually expect to see this. What really raises a red flag is a flurry of applications in a short time, which can signal financial trouble.

Finding Inquiries You Can Actually Remove

Before you start drafting dispute letters, you need to know which battles are actually winnable. Here’s a hard truth: you can't remove every hard inquiry. Trying to get rid of legitimate inquiries is a fast track to frustration, so the real game is playing detective with your own credit history.

Your first step is getting your hands on all three of your credit reports—one from Equifax, one from Experian, and one from TransUnion. Don't just check one! A shady inquiry might only pop up on a single report, so you need the complete picture. We've got a guide on how to get all three credit reports for free if you need a hand.

Spotting Potential Targets for Removal

With your reports in front of you, it’s time to hunt for red flags. We're not talking about that car loan you applied for last year; we’re looking for genuine mistakes and things that just don't add up.

Keep a sharp eye out for these tell-tale signs:

A hard inquiry can ding your score and will stick around on your report for two years. The most common and successful removal strategy is to dispute pulls that are fraudulent or flat-out inaccurate. Just remember, a legitimate inquiry is almost impossible to remove because it accurately reflects that you were shopping for credit.

Why Legitimate Inquiries Are Off-Limits

I get it. It’s tempting to want a completely clean slate. But if you gave a company permission to check your credit, that inquiry is there to stay. The whole point of the system is to give future lenders a clear picture of your recent credit-seeking activity.

Trying to dispute valid inquiries is a dead end. The credit bureaus will just call up the creditor, confirm you gave them the green light, and dismiss your dispute. Save yourself the headache. Focus your energy on the real errors and unauthorized inquiries—that's where you can actually make a difference.

How to Dispute Unauthorized Credit Inquiries

So, you've spotted a hard inquiry on your report that you know you didn't authorize. Now what? It’s time to take action. The whole dispute process might sound like a major headache, but it’s actually a right you're guaranteed under the Fair Credit Reporting Act (FCRA).

Think of it less as a fight and more as a formal request for a correction. You're simply telling the credit bureaus—Equifax, Experian, and TransUnion—to double-check information they're legally required to report accurately. If they can't prove you gave a company permission to pull your credit, that inquiry has to go.

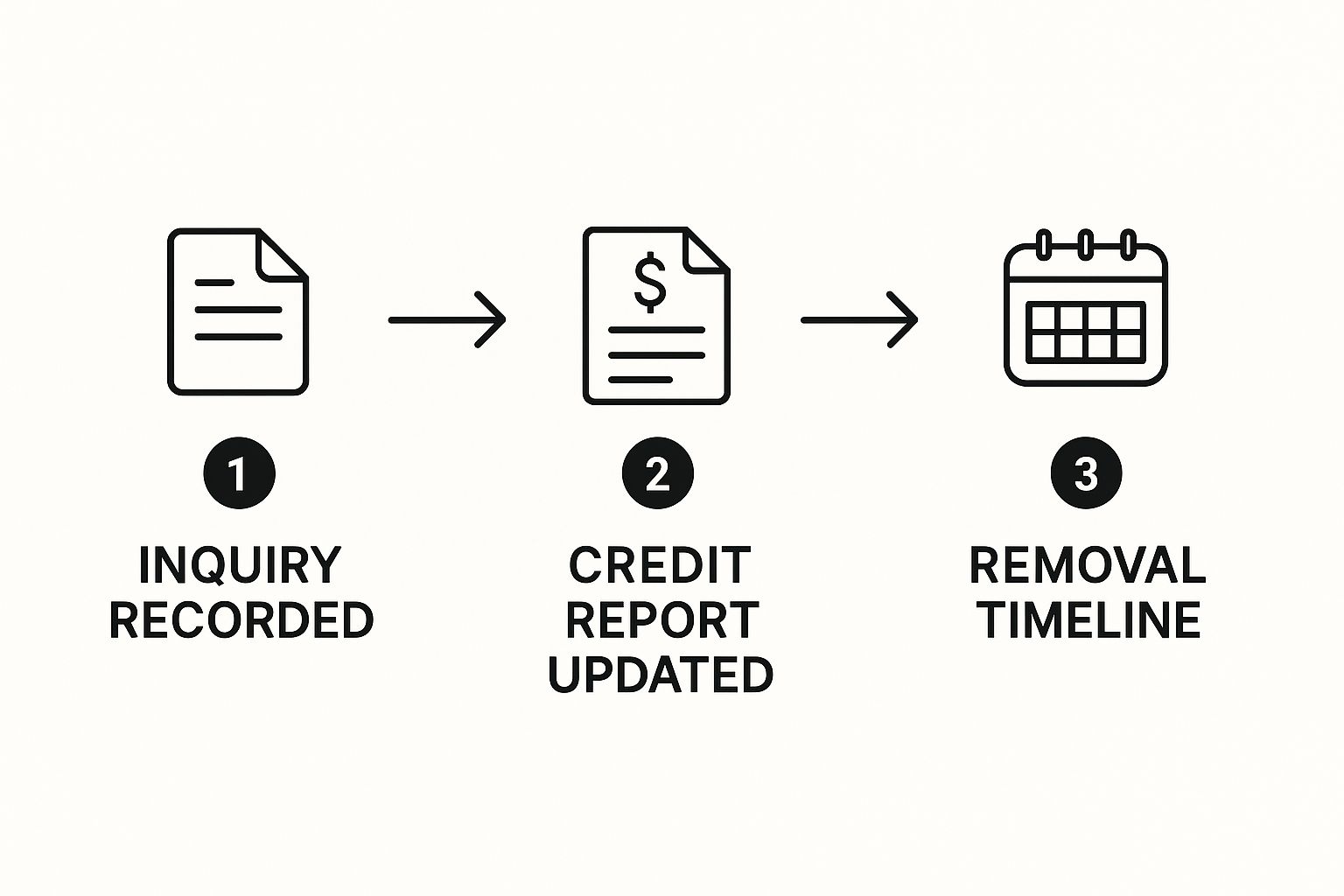

This chart breaks down how an inquiry lands on your report and the general timeline for getting it removed once you've successfully disputed it.

The most important thing to notice is the timeline. Once you officially file a dispute, a clock starts ticking, and the credit bureaus have a legal deadline to investigate and get back to you.

Gather Your Evidence First

Before you even think about writing a letter, get your paperwork in order. A solid dispute is built on clear, organized evidence, not just your word against theirs. Your job is to make it incredibly easy for the investigator at the credit bureau to see the mistake and side with you.

First, print a fresh copy of your credit report and literally circle the inquiry you're challenging. Make a few notes for yourself explaining why it’s an error. Did you never even talk to this company? Is it a case of mistaken identity? Jot it down so you don't forget the details.

Next, pull together any supporting documents. Now, you obviously won't have a document proving you didn't do something. Instead, include a copy of your driver's license and a recent utility bill. This proves your identity and current address, which helps prevent the bureaus from tossing out your dispute as "frivolous."

Write a Clear, No-Nonsense Dispute Letter

While you can dispute things online, I’ve always found that sending a physical letter via certified mail with a return receipt is the most powerful approach. It creates a paper trail that's impossible to deny—you'll have proof of exactly when you sent it and when they received it.

Keep your letter professional and straight to the point. This isn't the time for emotional, long-winded stories. Just stick to the facts.

Your letter needs to include a few key things:

Here is a straightforward template you can adapt. Just fill in the bracketed information with your own details.

Sample Dispute Letter [Your Name] [Your Address] [Your City, State, Zip Code] [Your Phone Number]

[Date]

Dispute Department [Credit Bureau Name: Equifax, Experian, or TransUnion] [Credit Bureau Address]

Re: Request to Remove Unauthorized Inquiry

To Whom It May Concern:

I am writing to dispute an unauthorized hard inquiry on my credit report. After reviewing my file, I have identified an inquiry that I did not authorize and am requesting its immediate removal.

The inquiry in question is: Creditor Name: [Name of the Company] Date of Inquiry: [Date on Your Report]

I have no relationship with this creditor and never provided my consent for them to access my credit file. Please investigate this matter and remove this inaccurate item promptly.

Enclosed, you will find a copy of my credit report with the inquiry highlighted, along with a copy of my driver's license and a recent utility bill to verify my identity.

Thank you for your prompt attention to this matter.

Sincerely, [Your Signature] [Your Printed Name]

To make this step easier, you'll need the correct contact information for each bureau. Sending your letter to the right department is critical for getting a timely response.

Credit Bureau Dispute Contact Information

Having this table handy saves you from having to hunt down the right addresses when you're ready to mail your letters.

Once your letter is in the mail, the clock starts. The FCRA legally requires the credit bureaus to investigate your claim and send you a written response, usually within 30 days. Now, you just need to be patient. But keep an eye on the calendar, and be ready to follow up if you don’t hear anything back in that timeframe.

What About Legitimate Inquiries? Try a Goodwill Letter

Challenging unauthorized inquiries is a straightforward, legally-backed process. But what about the inquiries you actually did approve? Maybe you were shopping for the best mortgage rate, and that one extra hard pull is now the only thing standing between you and a top-tier credit score.

In these cases, a formal dispute won't work. This is where a different tool comes into play: the goodwill letter.

This isn't a dispute at all. It's a polite, well-reasoned request sent directly to the creditor who pulled your credit—not the bureaus. You're asking for a courtesy removal, a favor. Success isn't guaranteed by any means, but when the situation is right, it can be surprisingly effective. Think of it as a human-to-human appeal.

When a Goodwill Letter Actually Makes Sense

Let's be clear: a goodwill letter isn't a magic wand for every hard inquiry on your report. Lenders are under no legal obligation to remove accurate information.

That said, they are far more likely to listen when your history with them speaks volumes.

Your chances for a "yes" go way up if you have a compelling case built on:

This is all about relationship management. You're leveraging the positive history you've built with a company and asking them to do you a solid in return.

How to Craft a Persuasive Goodwill Request

The tone of your letter is absolutely critical. It needs to be respectful, concise, and persuasive. You aren't making demands or citing laws; you're asking for a favor based on your good standing.

Make sure your letter hits these key points:

How to Minimize Future Hard Inquiries

Getting an unauthorized inquiry removed is a great feeling, but playing defense isn't the best long-term strategy. The real key to protecting your credit score is to prevent unnecessary hard inquiries from showing up in the first place. This means shifting your mindset from damage control to smart, proactive credit management.

This isn't about swearing off credit. It's about being more deliberate when you do decide to apply. A lot of people don't realize just how much credit-seeking activity has been climbing. For instance, among hospitality workers globally, unsecured credit inquiries shot up from 14% in 2021 to a staggering 43% by 2024, according to Equifax.com. That trend makes it crystal clear: managing your applications carefully is more important than ever.

Shop for Big Loans the Smart Way

One of the most effective ways to keep inquiries from hurting your score is to "rate shop" intelligently. The good news is that credit scoring models are built to recognize that you're going to compare offers for major loans, like a mortgage, auto loan, or student loan.

Because of this, you get a special grace period. Multiple inquiries for the same type of loan are usually bundled together and treated as a single inquiry, as long as they happen within a short window of time. This window is typically between 14 and 45 days, depending on which scoring model is being used.

So, you can apply with five different mortgage lenders over a week or two, and it will only have the impact of one hard pull on your score. This gives you the freedom to hunt down the absolute best interest rate without worrying about each application dinging your credit.