How to Get All 3 Credit Reports Easily & Quickly

To really understand your financial standing, you need the full story. That means getting your credit reports from all three major bureaus: Experian, Equifax, and TransUnion. The best and most direct way to get all three for free is through the federally authorized website, AnnualCreditReport.com. It's the official, secure source—no hidden fees, no credit card required.

Why One Report Is Not Enough

Ever seen three photos of the same person taken by different photographers? Each one tells a slightly different story, right? The same goes for your credit reports. Think of the bureaus as those photographers. While they’re all focused on your financial history, each one captures a unique angle.

That’s because creditors and lenders don’t always report your account activity to all three bureaus. A car loan might show up on your Experian and Equifax reports, but your new credit card might only be on your TransUnion report.

If you only pull one report, you're getting an incomplete picture. You could easily miss things like:

Having all three reports lets you lay them out side-by-side. It's the only way to see the complete, detailed narrative of your credit history.

The Power of a Complete Financial Picture

The biggest reason to get all 3 credit reports is to check for accuracy across the board. Errors are more common than you might think. Some studies have found that roughly 25% of credit reports have mistakes that could tank your credit score and jeopardize loan applications. Getting your reports from Experian, Equifax, and TransUnion all at once is your best defense.

To help you get a sense of why each bureau's data matters, here's a quick look at their individual focus areas.

The Three Major Credit Bureaus at a Glance

Each credit bureau gathers and organizes your financial data, but they can have slightly different information. Understanding these nuances helps you see why checking all three is non-negotiable for a clear financial picture.

Comparing all three ensures no stone is left unturned. What one bureau misses, another might catch.

Thankfully, the government made this process simple and free. The Fair and Accurate Credit Transactions Act (FACTA) led to the creation of AnnualCreditReport.com, the only website mandated by federal law to give you your reports for free every year. You can learn more about consumer credit trends and the importance of accurate reporting from Equifax's recent analysis.

Here’s a look at the official homepage for the federally authorized service.

This screenshot shows just how straightforward the official site is. It's designed as a public service, not a commercial product trying to sell you something. The clear "Request your free credit reports" button takes you right into the secure process, making it easy for anyone to get all 3 credit reports without any hassle.

Your Guide to Accessing Your Free Reports

Knowing you should check all three of your credit reports is one thing, but actually getting your hands on them can feel like a mission. The only place authorized by federal law to provide them for free is AnnualCreditReport.com. It’s a pretty direct website, but let’s be honest—the identity verification process can sometimes feel like a pop quiz on your entire financial life.

Let’s walk through what you’ll need so you can get in, get your reports, and get out without any headaches.

Getting Your Information Ready

First things first, you'll have to provide some basic personal information. This is just standard procedure to prove you are who you say you are.

To save yourself some hassle, it’s a good idea to gather everything you need before you start. You don't want to be scrambling to find an old bill or a document mid-process.

Here's a quick checklist of what to have on hand:

This info allows the site to find your specific files at Experian, Equifax, and TransUnion. Once you’ve entered that, the real fun begins: the security questions.

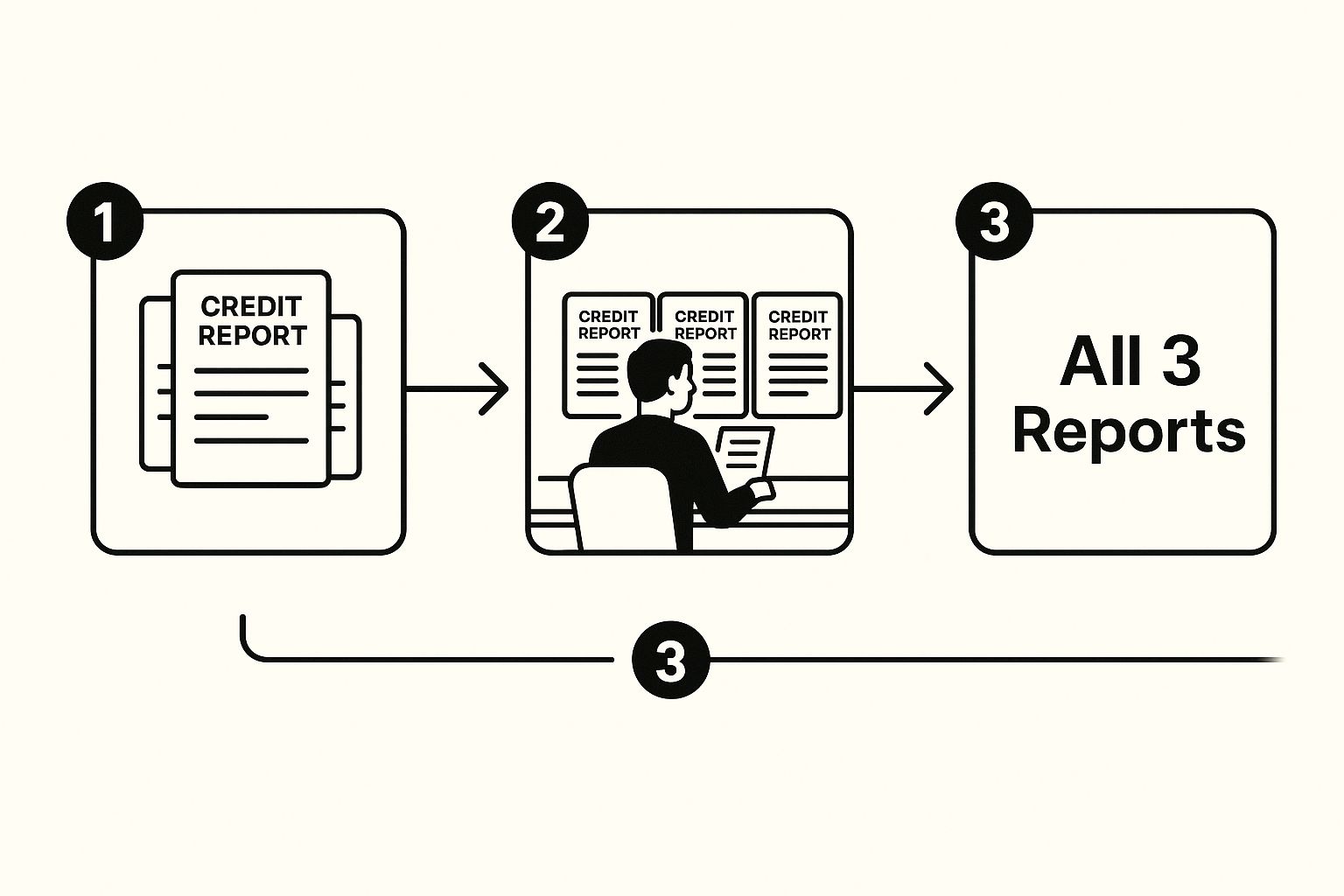

This simple graphic breaks down the flow, from gathering your info to comparing your reports side-by-side.

As you can see, the goal is to get all three reports together so you can spot any differences and get a complete picture of your credit.

Nailing the Security Questions and Grabbing Your Reports

Once you’ve successfully answered the security questions for each credit bureau, you'll unlock access to your reports. You’ll see an option to pull your report from just one, two, or all three bureaus. My advice? Always, always select all three.

As soon as you can view a report, download it as a PDF. Make this your immediate next step. If you happen to close the browser window, you might lose access and have to start the entire verification process from scratch. It’s a pain you can easily avoid. Just save the PDFs somewhere secure on your computer.

It's worth noting that this centralized, single-portal system is pretty unique to the U.S. In other countries, the process can be quite different. Australia and Canada have their own distinct bureau networks, while Europe’s credit reporting is much more fragmented. This just goes to show how direct and streamlined the American process is, despite the tricky security questions.

Getting all three reports is a fantastic first step. But doing this manually every year to track changes can become a real chore. Instead of going through this whole song and dance every time you need an update, there’s a much simpler way to stay on top of things.

You can consolidate all your credit data on All3Credit to get a single, unified view of your reports and scores in real-time. This moves you from a once-a-year snapshot to having a constant, clear view of your financial standing.

Making Sense of Your Credit Reports

Alright, you’ve got your hands on the raw data from all three bureaus. Now comes the part where you put on your detective hat. At first, these reports can feel a bit overwhelming—like they’re written in a different language full of codes, dates, and account numbers.

But here’s the secret: they all follow a pretty standard formula. Once you know what to look for, these intimidating documents become incredibly powerful tools for managing your financial health. Think of each report as a chapter in your financial biography.

The Four Main Sections of Your Report

Let's break down what you're actually looking at. Even though the design might look a little different from Experian, Equifax, or TransUnion, the fundamental information is always grouped into these four key areas.

What to Look For: Red Flags and Small Differences

The real magic happens when you lay all three reports side-by-side. It's actually quite common to find small differences. For instance, a lender might report your payment to Equifax a week before they report it to TransUnion. That’s usually no big deal.

What you're hunting for are the major discrepancies. An account that shows a late payment on one report but is perfectly current on another. Or maybe that old car loan you paid off years ago is still showing as an open account on your Experian report. These aren't just minor typos; they can drag your credit score down.

Getting this information is becoming more important than ever. The global credit bureau market is expected to jump from 109.59 billion in 2024 to 123.89 billion in 2025—that's a 13% increase in a single year. This isn't just corporate growth; it reflects a massive consumer movement toward demanding more control over personal financial data.

If you want to dig deeper into why these differences happen, our guide on the differences between all three credit bureaus is a great resource. By carefully checking each section and comparing the reports, you can catch problems early and make sure your financial story is being told accurately.

Found an Error? Here’s How to Get It Fixed

Spotting a mistake on your credit report can be alarming, but look at it this way: you've just found something that might be holding your score back, and now you can do something about it. The Fair Credit Reporting Act (FCRA) is on your side, giving you the legal right to an accurate credit history. Thankfully, the process for correcting errors is pretty direct.

The first thing you need to do is build your case. Simply saying "this is wrong" isn't enough; you need to show why it's wrong. Solid proof is your best friend for getting a quick resolution. This could be anything from a cancelled check proving a debt was paid off to a letter from a creditor confirming an account was closed on good terms. Even bank statements showing you never missed a payment can be powerful evidence.

Submitting Your Dispute

Once your documentation is in order, it's time to reach out to the credit bureau showing the error. This is a critical point: you have to dispute the mistake with every single bureau that has it listed. If that same incorrect late payment shows up on your Experian and Equifax reports, you'll need to open two separate disputes.

You've got a couple of ways to handle this:

What to Expect During the Investigation

After you've filed, the clock starts. The bureau and the creditor will review the information you sent. Once they've finished their investigation, you'll get a letter in the mail (or an email) with the results.

It usually ends in one of three ways:

What if the decision doesn't go your way, but you're still convinced you're right? You're not at a dead end. You have the right to add a 100-word statement to your credit file. This lets you explain your side of the situation, and anyone who pulls your credit in the future will see it.

Moving Beyond the Annual Check-Up with Credit Monitoring

Pulling your reports once a year is a great start, a solid financial habit. But let's be honest, it's like taking a single snapshot of a train that's always in motion. Your credit profile isn't static; it changes constantly.

A new account, an unexpected hard inquiry, or a simple late payment can pop up anytime. If you're only checking annually, you could be in the dark for months, leaving you exposed. This is where credit monitoring completely changes the game.

Instead of playing catch-up with old information, monitoring services give you a live view. It takes what feels like an annual chore and turns it into a simple, background process. Think of it as a 24/7 security guard for your financial life, ready to tap you on the shoulder the moment something looks off.

The Power of Real-Time Alerts

The biggest advantage of credit monitoring? Immediate notifications. These services keep a constant watch on your files at Experian, Equifax, and TransUnion.

You'll get an alert for any meaningful activity, like:

This speed is your absolute best defense against identity theft. The Federal Trade Commission received over 1 million reports of identity theft in 2023, and credit card fraud was at the top of the list. That unexpected alert about a new store card application you never made is your cue to act fast, freeze your credit, and shut down the fraud before it gets worse.

A Smarter Strategy for Your Financial Health

Switching from a yearly review to always-on monitoring is a serious upgrade to your financial toolkit. It cuts through the hassle of juggling three different reports by bringing all the important updates to one place. No more manually requesting and cross-referencing reports just to figure out what's new.

This hands-on approach also shows you, almost immediately, how your actions affect your credit. Did you just pay off a big credit card balance? You'll see that positive bump to your score much sooner. Thinking about getting a mortgage? Monitoring helps you make sure your reports are pristine right when it counts the most.

It's all about staying in control. To dive deeper into building these kinds of smart financial habits, check out the helpful articles on the All3Credit blog. At the end of the day, knowing how to get all 3 credit reports is the first step; keeping a constant watch over them is how you truly protect your financial future.

Frequently Asked Questions About Credit Reports

Once you've managed to get all three of your credit reports in hand, you’ll probably find yourself with a few more questions. That's completely normal. Getting clear on these common points is a big step toward confidently managing your financial life and protecting yourself from surprises.

Is It Bad to Check My Credit Reports Often?

Absolutely not. In fact, it’s one of the smartest financial habits you can build. When you pull your own reports, it's considered a "soft inquiry" and has zero effect on your credit scores.

The only time an inquiry can ding your score is when a lender checks it as part of a new application for a loan or credit card. That’s called a "hard inquiry," and even then, the impact is usually small and temporary. So go ahead and check your reports—it’s your data, after all.

Do I Get a Credit Score With My Free Annual Report?

This is a common point of confusion. The free reports you get from AnnualCreditReport.com won't include your credit scores. What you get is the raw data—your detailed history of accounts, payments, and public records. The actual three-digit score lenders see is a separate product.

The good news is that many banks, credit unions, and credit card companies now provide free credit scores to their customers, often updated every month.