How to Build Credit History: Easy Tips for Beginners

So you want to build a credit history from scratch. The first move is getting your hands on a credit product—something like a secured credit card or a credit-builder loan—and then, most importantly, using it wisely. Every on-time payment you make and every time you keep your balance low, you're sending positive signals to the three big credit bureaus: Experian, Equifax, and TransUnion. This is how you start building a solid financial reputation.

Your First Steps in Building Credit History

Jumping into the world of credit can feel like a frustrating catch-22. You need credit to get a credit history, but you need a credit history to get credit. It’s a loop that trips up so many people, but trust me, it's a cycle you can absolutely break. If you're starting from square one, you're in good company. This is a far more common hurdle than most people realize.

It’s a real barrier for millions. In the U.S. alone, more than 45 million people are either "credit invisible" or have such a thin file that they struggle to get approved for anything. But here's the encouraging part: data shows that about 20% of these folks manage to become credit active within two years. This shows there's a clear path forward. And this isn't just a challenge in the States; it's a global issue, from Canada to South Africa. If you're interested, you can learn more about this global credit access challenge and the data behind it.

Think of your credit history as your financial resume. It’s the story of how you've handled debt, and lenders, landlords, and sometimes even employers read it to see if you're a reliable bet for the future. It’s not just a three-digit number; it’s the narrative your habits create.

Getting to Know Your Credit Score

Before you can improve your score, you have to know what goes into it. Your score is built from five key ingredients in your credit report. Once you understand these, you'll know exactly where to focus your energy.

Here's a quick breakdown of what matters most to your score.

The Core Components of Your Credit Score

Looking at this, it's clear that two things have an outsized impact: paying your bills on time and not maxing out your credit. If you can get those two things right, you’re already well on your way to a great score.

Why You Need to Monitor Your Credit From Day One

You can't fix what you can't see. The second you open your first account, the clock starts on your credit history. That's why keeping a close eye on it right from the beginning is so critical.

Using a tool like All3Credit is a game-changer here. It gives you a live look at your reports from all three bureaus, so you can actually see your good habits paying off in near real-time.

Here’s a real-world scenario I’ve seen happen: someone diligently pays their new secured card bill for three straight months, only to find out the bank never reported any of it. Without monitoring, they would have had no idea their hard work was for nothing. Real-time alerts can ping you when new information hits your report, giving you peace of mind that your efforts are building the strong credit history you deserve.

Picking the Right Tools for the Job

Alright, you've got the basics down. Now it's time to choose the financial products that will actually do the work of building your credit history. Think of them as your personal messengers, reporting your good financial habits to the credit bureaus.

This isn't a one-size-fits-all deal. The right tool for you really depends on your current situation, how comfortable you are with credit, and what you're trying to achieve.

The good news? There's a whole market designed to help you out. In fact, the U.S. credit-building market is huge, with about $845 million in outstanding balances spread across nearly 2.8 million people. A huge chunk of these products—around 60%—are secured credit cards, with credit-builder loans following behind. This just goes to show how many people, especially those aged 25 to 39, are actively using these tools to build a solid financial foundation. You can dig deeper into the data on credit-building products and who uses them.

Secured Credit Cards: The Beginner’s Best Friend

For most people starting from square one, a secured credit card is the perfect entry point. It functions just like a normal credit card, with one important twist: you put down a refundable security deposit.

That deposit usually sets your credit limit. So, if you deposit 200**, you get a **200 credit limit. This simple step removes the risk for the bank, which is why they're so much easier to get approved for than a standard, unsecured card. You just use it for small, everyday purchases, pay your bill on time, and the card issuer reports all that good behavior to the credit bureaus.

Let’s say you’re a college student with a part-time job. A secured card is ideal. You could use it for your Netflix subscription or a tank of gas—small, predictable bills you know you can pay off every month. After about 6 to 12 months of solid, on-time payments, many banks will even upgrade you to a regular unsecured card and give you your deposit back.

Credit-Builder Loans: A Smart Way to Save

A credit-builder loan kind of flips the whole loan process on its head. Instead of getting a lump sum of cash upfront, the lender puts the loan amount into a locked savings account that you can't touch. You then make small, fixed monthly payments over a set period, usually between 6 and 24 months.

Every single one of those payments gets reported, building a rock-solid payment history on your credit file. Once you’ve paid off the entire loan, the bank unlocks the account, and the money is yours.

This is a fantastic tool if you want to prove you can handle consistent payments while also forcing yourself to save. Imagine you're trying to save up for a down payment on a car. A credit-builder loan makes you put that money away each month, and at the end of it all, you have a nice pile of cash and a stronger credit history to help you get a better auto loan.

Becoming an Authorized User: Getting a Helping Hand

If you have a parent, spouse, or other family member with a long and spotless credit history, becoming an authorized user on their account can be a major shortcut. When they add you, their card's entire history—its age, credit limit, and perfect payment record—can get copied right onto your credit report.

This can give your score a quick and powerful boost, especially by beefing up the average age of your accounts. But be careful. This path requires a huge amount of trust. If the main cardholder ever misses a payment or maxes out the card, that negative mark will show up on your report, too. It can tank your score before you even get started.

Here’s a quick breakdown to help you decide:

Honestly, the best strategy might be a mix of these. Starting with your own secured card to learn the ropes of managing credit, while also being an authorized user on a parent's old, well-managed account, can build an incredibly strong foundation for your financial future.

Mastering Habits for Excellent Credit Management

Getting that first credit card is just the start. The real work—and the real reward—comes from how you manage it every single day. This is where you build the kind of automatic, smart habits that forge a truly excellent credit profile. It's less about knowing what to do and more about making it second nature.

First things first: the most powerful habit you can possibly build is making every single payment on time. I can't stress this enough. Your payment history is the heavyweight champion of your credit score, making up a massive 35% of your FICO® Score. A single late payment can haunt your credit report for up to seven years. Consistency isn't just important; it's everything.

Automate Your Payments to Sidestep Mistakes

Life gets busy. We forget things. The easiest way to build a perfect payment history is to remove human error from the picture entirely.

Go to your credit card issuer’s website right now and set up automatic payments for at least the minimum amount due. Think of it as your financial safety net. It ensures you never miss a due date by accident. Just make sure there's always enough cash in your linked bank account to cover the debit. It’s a simple, one-time setup that pays off for years.

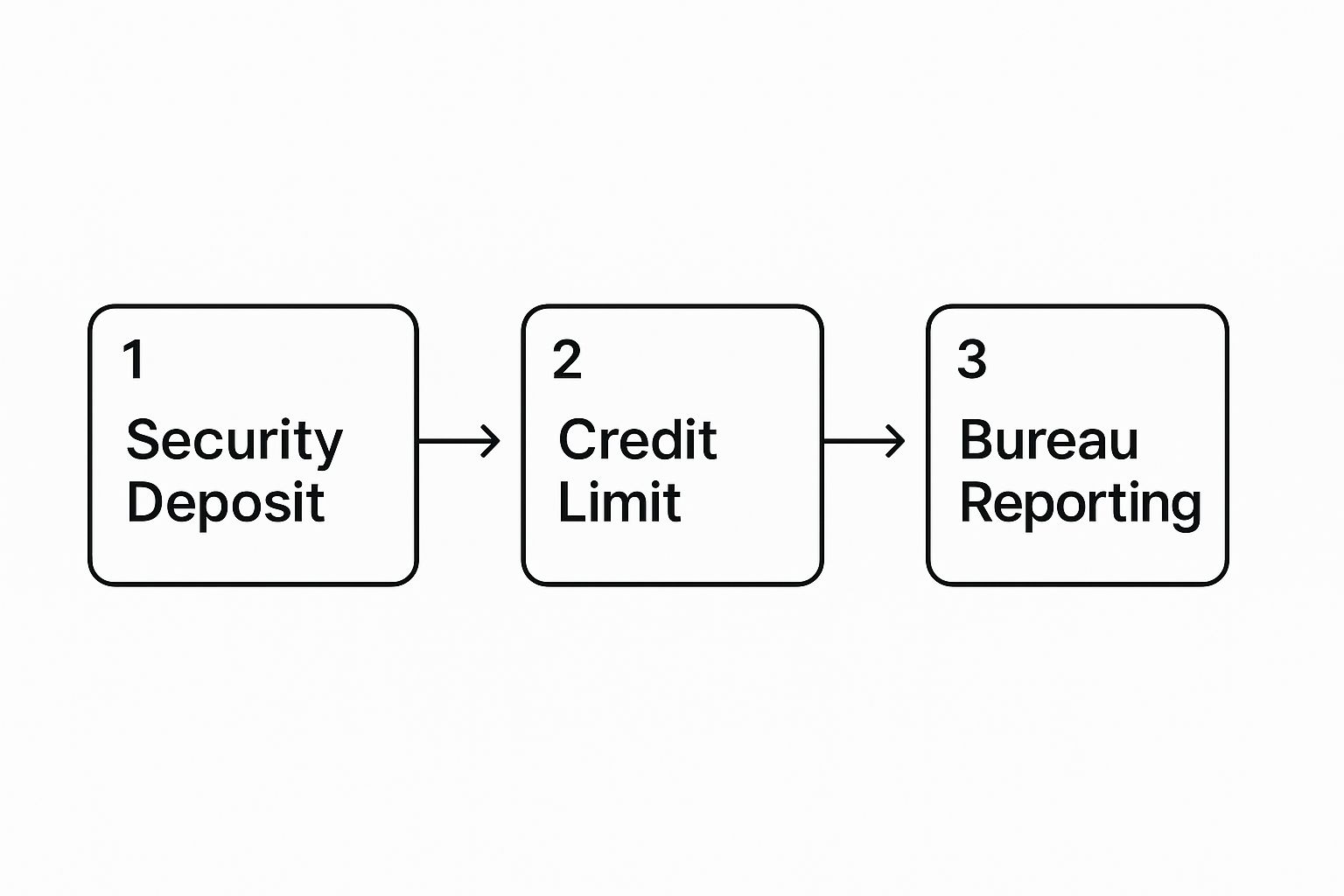

The image below gives a great visual of how a secured card works. It’s a common starting point where your security deposit becomes your credit limit, and every payment you make gets reported to the credit bureaus, building that crucial history.

As you can see, your own funds kickstart the process, giving you the chance to prove you can handle credit responsibly.

Keep a Close Eye on Your Credit Utilization

Right behind on-time payments is your credit utilization ratio (CUR). This fancy term is just the percentage of your available credit that you're currently using, but it's a big deal, accounting for 30% of your score.

If you have a high utilization ratio, lenders get nervous. It looks like you're stretched thin and might be a higher risk. The general rule of thumb is to keep your utilization below 30%, but from my experience, lower is always better. If your credit limit is 1,000**, you should really try to keep your reported balance under **300.

Getting into the habit of monitoring this ratio is a game-changer. Using a service like All3Credit is perfect for this—it gives you a real-time snapshot of your balances, so you can see if you're creeping into that higher-risk zone. If you notice a sudden jump and aren't sure why, check out our guide on common reasons why your credit score might be dropping.

To make these concepts crystal clear, here’s a quick-glance table to help you stay on track.

Your Credit-Building Action Plan

This simple table outlines the do's and don'ts for building a solid credit foundation. Keep these actions in mind as you manage your accounts.

By consistently choosing the "Positive Action" column, you're not just avoiding mistakes—you're actively building a financial reputation that will open doors for you down the road.

Treat Your Credit Card Like a Debit Card

Here’s a fantastic mental trick to build credit without ever falling into debt: use your credit card only for small, planned purchases you could have easily paid for with cash.

Think of things like your morning coffee, your weekly gas fill-up, or a streaming subscription. Charge these predictable items to your card, and—this is the critical part—pay off the balance in full long before the due date. This simple strategy hits three key goals at once:

This disciplined mindset transforms your credit card from a source of temptation into a powerful tool for building a stellar financial reputation.

How to Expand and Diversify Your Credit Profile

After you’ve put in the work for six to twelve months and built a solid foundation of responsible habits, your credit history is officially off the ground. Now comes the fun part: strategic growth. A healthy credit file isn’t just about having a single account with a perfect payment history. It’s about showing lenders you can juggle different kinds of debt successfully.

Think of this phase as building out your financial resume. The goal is to add a new type of account that proves you’re a versatile borrower. Lenders look for a healthy credit mix, which actually makes up about 10% of your FICO® Score. It may not be the biggest piece of the pie, but it’s often the secret ingredient that turns a good score into an excellent one.

Graduating to Unsecured and Rewards Cards

One of the first major milestones you'll hit is moving from a secured card to a traditional, unsecured credit card. Once you've proven you're reliable for several months, your bank might automatically upgrade your account and send your security deposit back. If they don't, don't hesitate to pick up the phone and ask for an upgrade yourself. You can also apply for a brand-new unsecured card.

This is the perfect time to snag a card that gives you something back, like cash back or travel points. For example, if groceries are a big part of your budget, finding a card that offers 3% cash back on those purchases literally puts money back in your pocket for something you were going to buy anyway. Just stick to the golden rule: only open new credit you know you can pay off in full every single month.

Adding an Installment Loan to the Mix

So far, you’ve been dealing with revolving credit (credit cards), where your balance and payments can change. The next step is to add an installment loan to the mix to really diversify your profile. These loans are straightforward: you borrow a fixed amount and pay it back with fixed payments over a set period.

Common examples of installment loans include:

A car loan, for instance, sends a powerful signal to lenders that you can manage a significant, long-term financial commitment. The key here is timing. Only apply for an auto loan when you actually need a vehicle and have a solid budget that accounts for the monthly payment, insurance, and upkeep.

As you start adding new accounts, keeping track of everything becomes absolutely essential. Using a service like All3Credit to monitor all three of your reports is a game-changer during this growth phase. It lets you see exactly how new accounts are being reported and helps you ensure your entire credit picture remains accurate. To get a better handle on what's in your reports, check out our guide on how to get all three of your credit reports for free.

By thoughtfully adding a mix of revolving and installment accounts over time, you’re building a strong, diversified credit profile. You're showing lenders that you aren't just reliable—you're a highly capable, low-risk borrower.

Common Mistakes That Can Wreck Your Credit-Building Efforts

https://www.youtube.com/embed/4Tjcg-xqQdA

Building a solid credit history is more of a marathon than a sprint. While you’re busy making all the right moves, a few surprisingly common slip-ups can quietly undo all your hard work. Knowing what these pitfalls are ahead of time is your best line of defense.

Think of it as proactive prevention. Understanding what not to do is just as critical as knowing the right steps to take. These errors often seem minor on the surface, but their negative impact on your credit can be swift and significant.

Applying for Too Much Credit at Once

When you first start building credit, it’s easy to get a little overeager. You might be tempted to apply for several credit cards or loans at the same time, thinking it will fast-track your progress. Unfortunately, this is one of the classic blunders that can backfire, hard.

Here’s why: every time you submit a formal application, the lender pulls your credit report, triggering a hard inquiry. A single inquiry might only ding your score by a few points, but a flurry of them in a short time sends a major red flag to lenders. It can make you look financially desperate.

This flurry of activity hits the "New Credit" part of your score, which accounts for a meaningful 10% of your FICO® Score. Too many inquiries signal risk, which can ironically lead to more denials.

Closing Your Oldest Credit Account

So you've finally graduated to a slick new credit card with great rewards. Your first instinct might be to close that old, no-frills secured card you started with. Don't do it! This is one of the biggest mistakes you can make.

The length of your credit history is a major scoring factor, making up 15% of your FICO® Score. The age of your oldest account is the cornerstone of this calculation. When you close it, you effectively erase a huge chunk of your positive history, which can dramatically shorten your average credit age and drag your score down.

Even if you don't use the card much, keeping it open is a smart move. My advice? Put a small, recurring subscription on it—like Netflix or Spotify—and set up autopay. This keeps the account active and working in your favor without any real effort.

Ignoring Your Credit Reports

One of the most dangerous things you can do is simply assume your credit reports are accurate. The truth is, errors are far more common than people realize. They can range from a simple misreported late payment to a fraudulent account opened in your name, and they can absolutely tank your score without you ever knowing why.

You have to be your own best advocate, and that’s where active monitoring becomes essential.

Keeping a close watch on your data is non-negotiable. To get a better sense of what you're looking for, it’s worth understanding what information is included in a report from all three credit bureaus looks like. Staying proactive ensures your hard work isn’t derailed by an avoidable error, keeping you firmly on the path to excellent credit.

Your Top Credit-Building Questions, Answered