Data Breach Credit Monitoring Guide

When a company sends you that dreaded letter—the one saying your personal information was part of a data breach—it means your data is officially out in the wild. This is where data breach credit monitoring stops being a "nice-to-have" and becomes your first line of defense against identity theft.

What Happens to Your Credit After a Data Breach

Getting a data breach notice is a gut-punch. It's unsettling to know that sensitive details about your life are no longer private. The best way to think about it is this: your personal information—your Social Security number, birth date, address—is the master key to your entire financial life. After a breach, a copy of that key is now in the hands of criminals.

And they don't sit on it for long. Cybercriminals often sell this information on the dark web or use it themselves to commit identity fraud. We're not just talking about someone getting into your email; we're talking about someone trying to become you, at least on paper.

The Path from Stolen Data to Credit Damage

The road from a data leak to real financial pain can be alarmingly quick. Scammers take your details and start applying for new lines of credit in your name. Suddenly, you have fraudulent accounts you know nothing about, and the first you hear of it might be a call from a collections agency.

The most common schemes include:

Every one of these fraudulent acts leaves a black mark on your credit reports. If you don't catch it right away, your credit score can tank, making it incredibly difficult to get a car loan, a mortgage, or even approval for a new apartment.

Why Proactive Monitoring Is Essential

This is exactly why data breach credit monitoring isn't just a smart idea—it's an emergency response. Simply waiting around to see if something bad happens is a massive gamble with your financial future.

Think of credit monitoring as a security system for your identity. It alerts you the second something suspicious happens, like a credit inquiry you didn't authorize. That early warning gives you the chance to shut down the fraud before it spirals out of control. In a world where data breaches are practically inevitable, it's one of the most critical tools you can have.

How Credit Monitoring Works as Your Financial Guard Dog

Think of credit monitoring as a tireless, 24/7 guard dog for your financial life. It never sleeps, never gets distracted, and is trained to spot even the faintest whiff of trouble. Its entire job is to watch over your most sensitive information and bark loudly the moment something seems off, giving you the precious time you need to react before real damage is done.

This "guard dog" is actually a service that constantly scans your credit files at the three major credit bureaus: Experian, Equifax, and TransUnion. Instead of you having to remember to pull and review each report yourself, the service does the heavy lifting for you. When it spots a change, it sends you an alert right away.

What Triggers a Credit Monitoring Alert

These alerts are your first line of defense. They’re prompted by specific events that could be the first sign of someone trying to use your identity. Getting that instant notification lets you quickly confirm if you made the change or if a criminal is at work.

Common triggers for these alerts include:

This early warning system is absolutely critical. The average time it takes a company to even identify a data breach is a staggering 194 days, with another 98 days needed to contain it. That gives thieves a massive head start.

Expanding the Protective Perimeter

Today's credit monitoring services often go well beyond just watching the three bureaus. Many of the best services build a multi-layered shield by actively scanning other vulnerable places where your stolen data might pop up. You can learn more about what is credit monitoring in our detailed guide.

This expanded protection often includes dark web scanning, which scours illegal online marketplaces for your Social Security number, credit card details, and other credentials. It might also include SSN monitoring to see if your number is being used in contexts totally unrelated to your credit, giving you a much wider safety net for your entire identity.

Choosing The Right Credit Monitoring Service

When you find out your personal information was part of a data breach, picking a credit monitoring service can feel like one more overwhelming task on your plate. With so many companies promising protection, it's tough to know which one is right for you. But this decision is one of the most important you'll make in securing your financial identity.

Think of it this way: if your house was broken into, you wouldn't just lock the front door afterward. You'd check all the windows, the back door, and maybe even install a full security system. It's the same idea with your credit—you need comprehensive protection, not a partial fix that leaves you exposed.

Non-Negotiable Features For Post-Breach Protection

After a breach, certain features aren't just nice to have; they're absolutely essential. These are the core tools that form a real defense against criminals trying to cash in on your stolen data.

Make sure any service you consider checks these boxes:

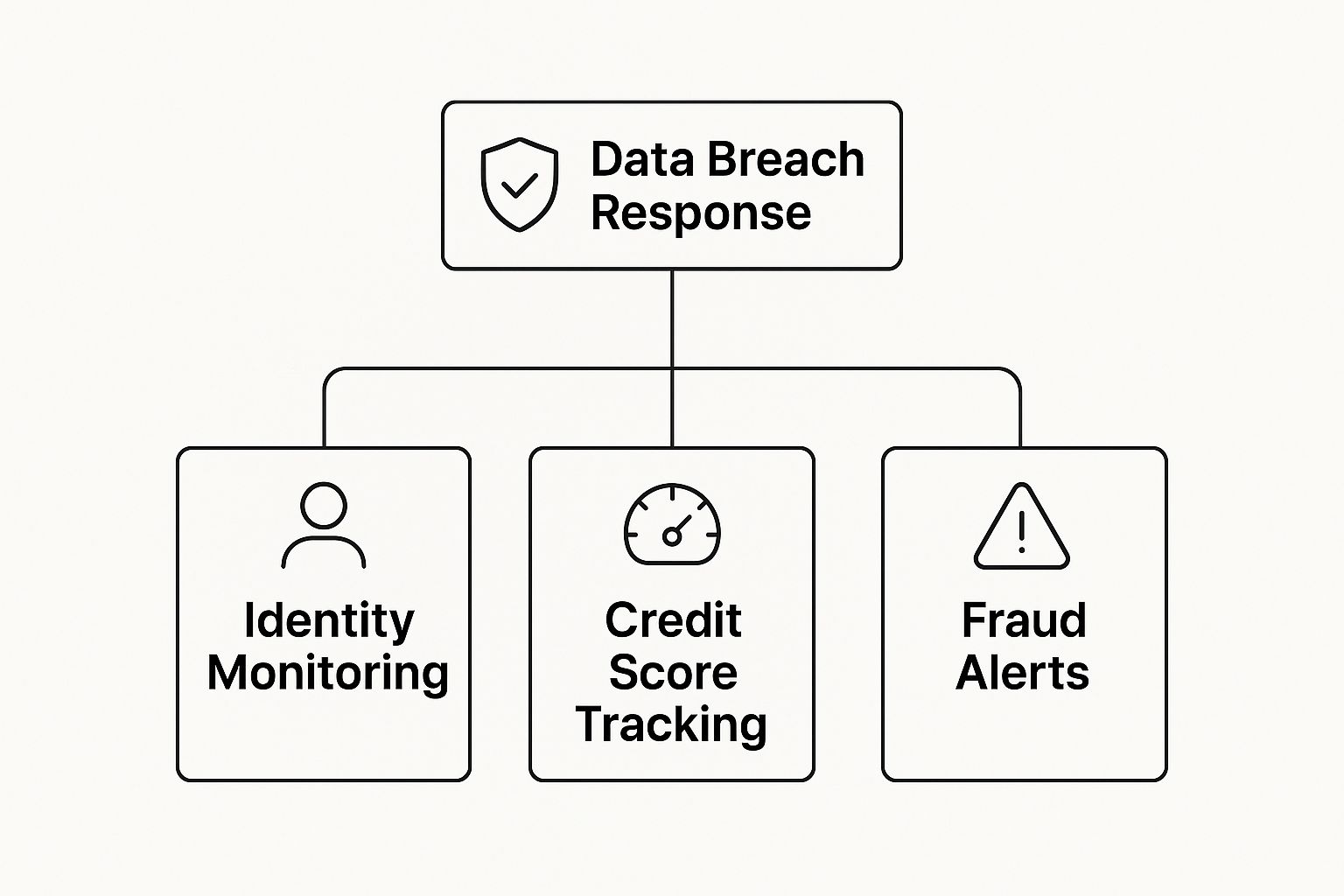

This image highlights how credit and identity monitoring fit into a complete defensive strategy.

As you can see, both are critical pillars holding up your financial security.

Comparing The Different Tiers of Service

Most companies offer a few different plans, usually a free or basic option and a more comprehensive one. While "free" is always tempting, those plans are rarely enough after your data has been actively compromised. If you need help finding a powerful service that won't break the bank, our guide to the cheapest credit monitoring service options can point you in the right direction.

To see why the more robust plans are worth it, let's break down what you typically get at different levels.

Essential Features of Effective Credit Monitoring Services

This table lays out the crucial differences you'll find when evaluating plans. Pay close attention to these distinctions, as they can make or break your ability to respond to a threat quickly.

Ultimately, a basic plan just can't provide the level of vigilance you need after a breach. Opting for a comprehensive service with three-bureau monitoring and real-time alerts gives you the best shot at catching fraud before it spirals out of control. It's the only way to get true peace of mind.

Real-World Data Breaches and Their Aftermath

Statistics and hypotheticals can only tell you so much. The true cost of a data breach really hits home when you see what happens to real people.

Let’s look at two people, Alex and Ben. Both had their information stolen in the exact same corporate hack. But what happened next for each of them couldn't have been more different, all because of one simple choice: to act fast or to wait.

Alex was already signed up for a solid data breach credit monitoring service. Just a few weeks after the breach was announced, his phone buzzed. It was an instant alert—someone was trying to open a store credit card in his name, a thousand miles from where he lived.

Because he got the notification immediately, Alex was able to flag it as fraud with one tap. He called the credit card company, the application was instantly denied, and the problem was solved. Threat neutralized.

A Tale of Two Responses

Ben took a different approach. He figured he'd wait and see, assuming he would eventually notice if anything strange popped up on his accounts. For a few months, everything seemed fine. But in the shadows, a thief was using his stolen Social Security number to quietly build a fake identity.

The first domino fell when Ben was rejected for a car loan he urgently needed. Stunned, he pulled his credit reports. What he found was a nightmare: multiple maxed-out credit cards and a collections account he'd never heard of. His once-healthy credit score was in ruins.

Ben’s road to recovery was a long, draining fight. He had to file police reports, send dispute letters to multiple credit card companies, and spend countless hours on the phone proving he was the victim. While Alex spent five minutes dealing with a single alert, Ben spent the next year trying to piece his financial life back together. Understanding how data gets reported to all three credit bureaus is a crucial first step when you're in that deep. https://www.all3credit.com/blog/all-three-credit-bureaus

Breaches Are a Fact of Life

These aren't just made-up stories; they play out for thousands of people every single day. Look at the Allianz Life data breach, where a clever social engineering attack exposed the personal information of about 1.4 million customers. The company immediately offered credit monitoring to those affected, knowing the risk of identity theft was now incredibly high. If you want to see just how common this is, you can explore the latest data breach reports.

When you look at it this way, data breach credit monitoring stops being just another service and becomes what it truly is: a shield. It gives you the awareness to stop a disaster in its tracks, protecting your money and, just as importantly, your peace of mind.

Getting Your Credit Monitoring Up and Running

Picking a service is the first hurdle, but now it's time to actually flip the switch. Getting your data breach credit monitoring activated is the first real step you can take to reclaim control after your information has been exposed. It’s a simple process, but it’s a crucial one.

The initial setup is really just about proving you’re you. You’ll give them your basic details, and then they'll ask a few of those tricky multiple-choice questions about your financial history—things like past addresses or old car loans. It’s information only the real you would know.

Once you're verified, you can connect your accounts and decide how you want to receive alerts. Set them up to come via text or email so you know the second a potential threat pops up. You want the system to be a helpful guard dog, not an annoying, yappy one.

What to Do When an Alert Hits Your Inbox

After you’re all set up, the alerts will start to roll in. The most important thing to remember is not to panic every time your phone buzzes. The vast majority of these notifications will be for things you actually did, like applying for a new credit card or a lender doing a routine check.

The trick is learning to read these alerts and quickly figure out what they mean. A good service gives you enough information to recognize what's going on. When you get a notification, just run through a quick mental checklist:

If you answer "no" to any of these, it's time to spring into action. Your monitoring dashboard should have a big, obvious button that says something like "This wasn't me" or "Dispute this." Click it immediately and follow the steps to flag the activity as potential fraud.

Layer Your Defenses for the Best Protection

Your data breach credit monitoring service is your front-line alarm system, but for real peace of mind, you should back it up with a few other security measures. It’s like adding a deadbolt and a security chain to a door that’s already locked. The more layers you have, the harder you make it for criminals.

Consider adding these two powerful tools to your arsenal:

When you combine active monitoring with a credit freeze and fraud alerts, you've built a seriously tough defense. This strategy lets you see exactly what’s happening with your credit while making it nearly impossible for anyone else to mess with it.

What Happens If You Ignore a Data Breach Warning? (It's Not Pretty)

Getting a data breach notification in the mail is unsettling, but just tossing it aside is one of the worst things you can do. It's like your smoke alarm going off and deciding to just ignore it. The consequences can be absolutely devastating, hitting your wallet and your peace of mind hard.

The most obvious danger is a direct hit to your finances. With your stolen information, thieves can go on a shopping spree in your name, opening new credit cards, taking out loans, or even draining your bank accounts. Suddenly, you're on the hook for debts you never signed up for, and the fight to clear your name can involve a mountain of paperwork, endless phone calls, and even legal fees.

More Than Just Money: The Emotional Toll

But the damage doesn't stop at your bank account. The emotional fallout from identity theft is huge. Victims often talk about the intense stress and anxiety that comes with it—a feeling of being violated that can stick around for years. It's a helpless feeling, trying to piece your financial life back together after a faceless criminal tore it apart.

This isn't some small-time problem. The numbers are staggering. Global cybercrime damages are on track to hit $10.5 trillion a year. To put that in perspective, if cybercrime were a country, it would have the third-largest economy in the world.

And it’s happening right here at home. In the U.S. alone, 6.47 million cybercrime incidents were reported in 2024, with identity theft and credit card fraud leading the charge. You can see the full scope of the threat in these cybercrime statistics.

This isn’t a far-off threat; it’s a direct risk to your financial well-being. The smartest move you can make is to stop seeing credit monitoring as just another bill. It’s essential insurance for your financial life.

Your Credit Monitoring Questions, Answered

When you get a notice that your data has been breached, it’s natural to have a lot of questions. Let's walk through some of the most common ones so you can feel more in control of the situation.

How Quickly Do I Need to Act After a Breach?

The short answer is: immediately. Identity thieves move fast, often selling or using stolen information within hours of a breach. You need to be just as quick.

The moment you sign up for credit monitoring, you put a watchdog on your accounts. This allows you to catch suspicious activity right away and stop criminals before they can cause real harm.