Your Guide to a Credit Report Tradeline

Ever wondered what your credit report is actually made of? It all comes down to something called a tradeline.

Think of your credit report as the complete biography of your financial life. If that's the case, then each tradeline is a single chapter in that story. Every account you have—from a credit card to a student loan or a mortgage—gets its own unique chapter, or tradeline.

The Building Blocks of Your Credit Report

If you want to get serious about managing your credit, you have to start with the fundamentals. A credit report tradeline is the most basic component, acting as a detailed log of your history with a single lender.

Each tradeline offers a snapshot of one account. When you put them all together, they create the comprehensive picture that banks, mortgage lenders, and credit card companies use to decide if you're a reliable borrower.

What’s Inside a Tradeline?

So, what information does a tradeline actually hold? It’s like a report card for that one specific account, giving lenders the full story, not just the highlights.

Here’s a breakdown of the key details you'll find:

When it comes down to it, taking control of your credit health starts right here, with these individual accounts. Once you learn how to read and understand each tradeline, you can spot what you're doing right, fix what's going wrong, and start building a stronger financial future.

How To Read a Credit Report Tradeline

At first glance, a single tradeline on your credit report can look like a jumble of codes and numbers. But once you know what you're looking at, it starts to tell a clear story about your history with that specific creditor.

Think of it like reading the back of a baseball card. Instead of tracking batting averages and home runs, your tradeline tracks your financial performance. Every part of it gives lenders a snapshot of how you handle your obligations.

Let's break down the key pieces of information you'll find on every account listed on your report.

Decoding the Core Components

When you look at a tradeline, the first thing you'll see are the basics: the creditor’s name (like "Capital One" or "Wells Fargo Auto") and your account number, which is usually partially hidden for your security. This simply identifies who is reporting the information.

Right after that, you get to the meat of it—the details that have a real impact on your credit score.

Key Components of a Credit Report Tradeline

Understanding each piece of a tradeline is the first step to taking control of your credit story. This table breaks down what each term means and, more importantly, why it matters to lenders and your score.

Each of these data points comes together to paint a detailed picture for anyone who pulls your credit.

Understanding Your Payment History Grid

The most critical part of any tradeline is the payment history. This is often shown as a grid or a string of codes that tracks your payment status month-by-month for the last several years.

If you see green checkmarks or codes like "OK" or "C," that’s great news—it means you paid on time.

On the other hand, negative codes like "30," "60," or "90" are red flags. These mean you were 30, 60, or 90 days late on a payment, and these marks can drag your credit score down significantly.

Knowing how to read this grid is your first line of defense. An error here—like an on-time payment accidentally reported as late—is a serious problem you need to dispute right away. You can learn more about how to check for these issues in our guide on how to get all three credit reports free and start monitoring your own tradelines.

When you can confidently read each tradeline, you're no longer in the dark. You can see exactly what lenders see, which allows you to spot your strengths, identify areas for improvement, and turn a confusing document into a powerful tool for building a stronger financial future.

How Tradelines Impact Your Credit Score

Think of your credit score as the final grade on a report card. If that's the case, then each credit report tradeline is an individual assignment. Just like in school, a great performance on one assignment can lift your average, while a single missed or late one can drag the whole thing down.

Every piece of information inside a tradeline is a key ingredient in the recipe that makes up your credit score. Your payment history, for example, is the single biggest factor, accounting for a massive 35% of your FICO® Score. This number comes directly from the payment status logged on every single one of your tradelines. That’s why even one late payment on a credit card can cause a surprisingly big dip in your score.

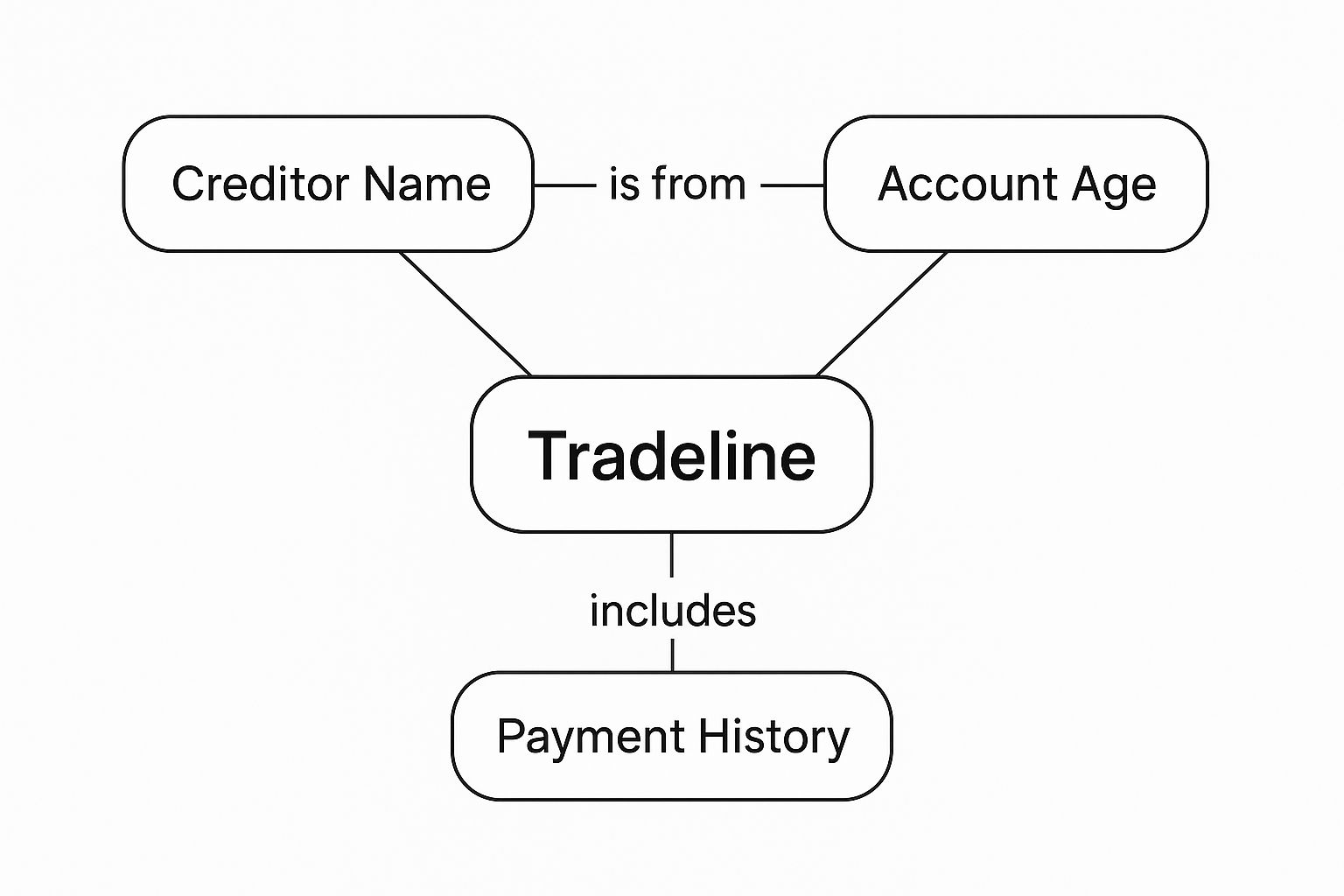

This infographic helps visualize how the basic elements of a tradeline come together to build your credit profile.

As you can see, details like who the creditor is, how old the account is, and your payment history are the fundamental building blocks of your credit identity. These aren't just static records; they're active data points that paint a picture of your financial reliability.

The Power of Positive and Negative Information

Good information on your report, like a long history of paying your bills on time, acts like a strong tailwind, steadily pushing your score higher. The older a positive tradeline gets, the more powerful it becomes, especially if it has a perfect track record. This is exactly why experts often advise keeping your old, well-managed accounts open.

On the flip side, negative information is like an anchor holding you back. A tradeline showing late payments, a sky-high balance, or an account in default can cause swift and serious damage. If you’ve ever found yourself wondering why your credit score is dropping, a line-by-line review of your tradelines is the place to start.

How Lenders Read Between the Lines

Lenders today are digging deeper than just the surface-level numbers. They’re using sophisticated tools to analyze the trends within your tradeline data, giving them a much clearer picture of your habits as a borrower.

They can see your payment history, track your balances month-over-month, and understand how you use credit over time. This detailed information helps them tell the difference between "transactors" (people who pay off their balance in full every month) and "revolvers" (people who carry debt and make minimum payments). This allows for a far more accurate assessment of risk.

What does this mean for you? It means two people with the exact same credit score could be seen very differently by a lender. One person’s tradelines might tell a story of consistent, responsible borrowing. The other’s might reveal a pattern of running up high balances and just scraping by. In the end, it’s the cumulative story of all your tradelines that truly defines your creditworthiness.

Common Tradeline Types on Your Report

Not every credit report tradeline tells the same story. Think of them as different characters in your financial biography—each one plays a unique role and affects your credit score in its own way. Getting a handle on these differences is the key to managing your credit profile well.

You'll generally come across three main categories on your report: revolving, installment, and open accounts. Each one reflects a different kind of financial agreement and is weighed differently by credit scoring models.

Revolving Accounts

Revolving accounts are credit lines you can borrow from, pay back, and then borrow from again. The classic example is a credit card. Your credit limit is fixed, but your balance goes up and down as you make purchases and payments.

This is the only kind of tradeline where your credit utilization ratio is a huge deal. This ratio—the percentage of available credit you're using—is a major factor in your score. Keeping it low, ideally under 30%, is one of the smartest things you can do for your credit health.

Installment Accounts

Installment accounts are straightforward loans with a set number of payments over a specific period. Once you pay it off, the account is closed for good.

For installment loans, scoring models are looking for a consistent history of on-time payments, not a utilization ratio.

Open and Negative Accounts

You might also see open accounts, though they're less common these days. Think charge cards, where you're expected to pay the full balance every month, and there isn't a preset spending limit.

Finally, there are the ones you don't want: negative tradelines. These are debts that have gone south. The most common is a collection account, which shows up when your original creditor gives up and sells your unpaid debt to a collection agency. These tradelines can do serious damage to your credit score.

Actionable Steps to Manage Your Tradelines

https://www.youtube.com/embed/ombDW1ezNJw

Alright, understanding what a tradeline is gets you in the game. But to actually win, you need to take action.

Think of managing each credit report tradeline like steering a ship. Small, consistent adjustments to the wheel are what guide you to a much better destination. This is your playbook for turning knowledge into a stronger credit history.

The great news? You don't need some complex, secret strategy. It really boils down to simple, consistent habits that build an excellent credit profile over time. Let's walk through the most effective things you can do, starting right now.

Master Your Payment Habits

Nothing—and I mean nothing—matters more to your credit score than your payment history. It's the undisputed heavyweight champ, making up a massive 35% of your FICO® Score. A single late payment can knock you back and erase months of progress.

So, the most powerful thing you can do is simple: pay every bill on time, every single month.

The easiest way to make this foolproof is to set up automatic payments for at least the minimum amount due on all your accounts. This acts as a safety net, guaranteeing you'll never miss a due date just because life got busy. You can always log in and pay more before the due date, but that auto-payment ensures your perfect record stays intact.

Keep Your Balances Low

Right after on-time payments, the next biggest deal is your credit utilization ratio. In plain English, that’s just how much of your available credit you're currently using. Lenders get nervous when they see high balances, especially on revolving accounts like credit cards.

A good rule of thumb is to keep your balance on each card below 30% of its credit limit. So, if you have a card with a 1,000 limit, you should aim to keep the balance under 300. This sends a clear signal to lenders that you're in control and not overly reliant on debt.

Regularly Review and Dispute Errors

Mistakes happen. Your credit report isn't immune. Inaccurate information, like a payment marked late when it was on time or an account that doesn't even belong to you, can unfairly drag down your score. This is precisely why you need to check your tradelines regularly.

Here’s a straightforward process for finding and fixing those errors:

By actively managing your payments, keeping balances in check, and ensuring your report is accurate, you stop being a passenger and become the pilot of your financial future. Every positive step you take builds a better story, one tradeline at a time.

Understanding Credit Reporting on a Global Scale

While we've been diving into the nitty-gritty of a credit report tradeline, it's worth taking a step back to see the bigger picture. The idea of tracking how people borrow and repay money isn't just an American thing; it's a global standard.

Think of it this way: the basic principles are universal. Having a system that records financial history helps economies grow and opens up opportunities for more people. It's what allows someone to get a loan for a new business or a mortgage for a family home, whether they're in Ohio or Uganda. Understanding this global context helps you appreciate why managing your own financial reputation is so important.

The Global Push for Credit Bureaus

This worldwide system didn't just pop up overnight. It's the result of a deliberate, global effort to build reliable credit reporting systems, especially in developing countries.

A great example is the Global Credit Reporting Program, which the International Finance Corporation (IFC) kicked off back in 2001. This single initiative has helped more than 90 countries either create or massively improve their credit bureaus. We've seen incredible progress in places like Kenya and Uganda, where these systems have brought millions of new borrowers into the formal financial world. If you're curious, you can dig into the details of these global credit reporting initiatives.

Getting a handle on how the three main credit bureaus operate here at home is the perfect way to see this model in action. It's a local reflection of a much larger, global trend.

A Few Common Questions About Tradelines

When you start digging into the details of your credit report, a few questions always seem to pop up. Let's tackle some of the most common ones people ask about their tradelines.