Mastering the Credit Report Dispute Process

An unnoticed error on your credit report is more than a simple typo. Think of it as a potential roadblock, standing between you and your biggest financial goals. Learning the credit report dispute process isn't just about tidying up paperwork—it's a fundamental personal finance skill that protects your future from some seriously expensive headaches.

Why Your Credit Report Accuracy Is So Important

Your credit report is basically your financial resume. Lenders, insurers, and sometimes even employers pull this report to get a sense of your reliability. A single mistake can paint a completely distorted picture, leading to financial setbacks that are as frustrating as they are costly.

Imagine this: you find your dream home, but you're denied the mortgage because a late payment belonging to someone with a similar name was mistakenly tacked onto your file. Or maybe you're paying hundreds more each year for car insurance because a loan you paid off years ago is still showing up as delinquent.

These aren't just far-fetched stories. I’ve seen these scenarios play out time and time again, and they show just how tangible the impact of credit reporting errors can be.

The High Stakes of Bad Data

The information on your report directly impacts the interest rates you'll be offered. An error that drags down your credit score could be the difference between a great rate on a car loan and a high-interest one that costs you thousands more over the life of the loan. It's like paying a silent tax for a clerical error you didn't even make.

And this problem is a lot more common than most people realize. A 2021 Consumer Reports study found that 21% of consumers discovered at least one confirmed error on their reports after they went through the dispute process. What’s even more alarming is that 5% of those people had errors serious enough to drop them into a worse credit risk tier, which directly impacts their ability to get a loan or a fair interest rate.

Common Errors to Look For

Being vigilant is your single best defense. If you get into the habit of checking your reports regularly, you can spot these issues before they spiral into bigger problems.

Here are the most frequent mistakes I see:

Finding an error can feel unsettling, but the law is on your side—you have a right to a fair and accurate report. Identifying the mistake is the first real step toward taking back control. If you're curious about how each credit bureau handles your data, our guide on all three credit bureaus is a great resource to have before you dive into the next steps.

How to Find and Document Credit Report Errors

A successful credit report dispute hinges on solid, undeniable proof. You can't just tell the bureaus they're wrong; you have to show them. This whole process starts with a meticulous review of your reports from all three major bureaus—Experian, Equifax, and TransUnion.

First things first, you need to get your hands on those reports. You are legally entitled to free copies from each bureau. If you’re not sure where to start, our guide on how to get all three credit reports for free breaks down the exact steps, so you can begin without spending a dime.

Once you have the reports, don't just glance over them. This is a full-blown audit of your financial history. Treat it that way.

Scrutinizing Every Section

I always tell people to think of their credit reports in four main chunks. An error hiding in any one of these sections can drag down your score, so you have to give each one a thorough inspection.

Gathering Your Evidence

Finding the mistake is just the first step. Proving it is how you win the dispute. The credit bureaus operate on documentation, not just your word. You need to back up your claim with clear, compelling evidence.

The proof you need depends entirely on the error you're fighting. For instance, if a creditor claims you paid late but you know you were on time, your best weapon is a bank statement or a canceled check showing the payment date. If an account is still showing as open after you closed it, dig up that confirmation letter from the creditor.

To make things easier, here's a quick-reference table I've put together to help you match common errors with the right documentation.

Common Credit Report Errors and Required Documentation

Keep everything organized! I can't stress this enough. Make copies of all your documents—never send your originals. By building a well-documented file for each specific error, you present a professional and convincing case that makes it much easier for the bureau to investigate and correct the mistake.

Sending Your Dispute for Maximum Impact

You've gathered your evidence and organized your case—now it's time to formally submit your dispute. This is where all that prep work really counts. You have a few ways to do this, and the method you choose can genuinely affect the outcome.

The main options are online, by phone, or old-school mail. The online portals for the credit bureaus are definitely fast, but they can have hidden gotchas. For example, submitting online might box you into a pre-set form, making it hard to explain the nuances of your situation or even to dispute certain types of errors, like a misspelled name.

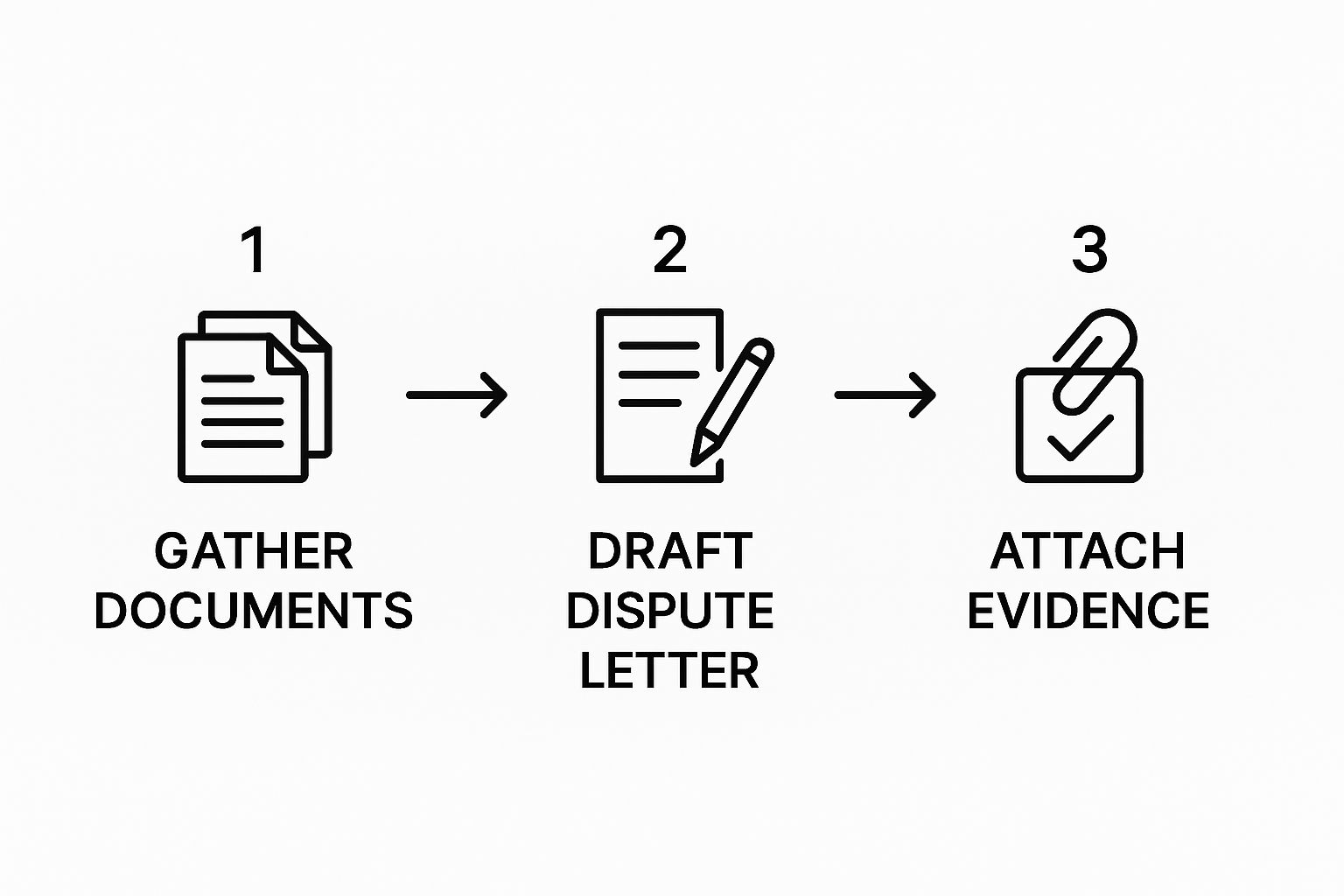

This image lays out the basic game plan for putting together a solid dispute package.

As you can see, a successful submission starts with strong documentation and a clear, concise letter. You package them together to make your case impossible to ignore.

Picking the Right Submission Method

What about calling them? While it can feel helpful to talk to a person, phone disputes leave you with no paper trail, and that's a huge disadvantage.

This is why I almost always recommend sending your dispute via certified mail with a return receipt requested. It’s the gold standard. This method creates a rock-solid, legally recognized record proving exactly when the credit bureau received your dispute. That's what starts their mandatory 30-day investigation window.

That small cost for postage buys you incredible peace of mind and leverage. It turns your request into a formal, documented action that demands a serious, on-the-record response.

How to Write a Dispute Letter That Works

Your dispute letter is the heart of your submission. It needs to be clear, factual, and direct. This isn't the place for long, emotional stories about how the error has inconvenienced you. Just stick to the facts.

Your letter should always include these key elements:

Remember, if the error is on more than one report, you'll need to send a separate, tailored letter to each credit bureau.

The Pro Move: Dispute with the Furnisher, Too

Here’s a strategy that many people miss, but it can make all the difference. In addition to disputing with the credit bureaus, you should also send a dispute directly to the company that supplied the information in the first place—the data furnisher. This is the creditor, lender, or collection agency that made the mistake.

Sending them a similar dispute letter (again, via certified mail!) legally obligates them to do their own internal investigation. If they find you're right, they have to notify all three credit bureaus to fix your file. It's a two-front attack that dramatically boosts your chances of getting a quick and accurate resolution.

This is especially critical when you consider the sheer volume of disputes bureaus are dealing with. The CFPB received over 700,000 credit reporting complaints between January 2020 and September 2021 alone. To help people navigate this process, agencies like the CFPB and FTC offer excellent resources, including sample dispute letters. You can learn more about these consumer protections and resources on their website. By disputing with both the bureau and the furnisher, you force your issue to the top of the pile.

What to Expect After You File a Dispute

https://www.youtube.com/embed/cwPxJGLujrs

Alright, you’ve gathered your documents, written your letter, and sent off your dispute. Now what? This part is mostly a waiting game, but understanding the timeline can make it a lot less stressful.

The good news is the process isn't indefinite. Thanks to the Fair Credit Reporting Act (FCRA), the credit bureau has a legal deadline to investigate your claim—usually within 30 days of getting it.

How the Investigation Unfolds

That 30-day clock starts ticking once the bureau has your dispute in hand. But they aren't just looking at the letter you sent. Their next step is to forward all of your information to the company that originally supplied the data, known as the data furnisher. This could be a credit card company, a mortgage lender, or a collection agency.

That furnisher then has to do its own internal investigation to check its records and confirm whether the information it sent was accurate.

In some cases, this investigation period can stretch to 45 days. This usually happens if you send in more documents after your initial dispute has already been filed. The extra time gives them a chance to review the new evidence you’ve provided.

Keeping Tabs on Your Dispute

Instead of anxiously checking the mail every day, you can monitor your dispute’s progress online. All three bureaus have portals that let you see the status of your claim. It’s a huge relief compared to calling and waiting on hold.

You'll see the status change from "Open" to "Updated" and, finally, to "Dispute results ready." Once the investigation is complete, the bureau is required to mail you the results in writing within five business days. Hang onto this letter—it's your official proof of the outcome.

The Three Possible Outcomes

When the dust settles, the investigation will lead to one of three results. Knowing what each one means will help you figure out your next move.

Even after a successful removal, it pays to stay on top of things. The system isn't foolproof. A 2015 FTC follow-up study found that about 1% of consumers had a negative item reappear on their report after it was deleted. Interestingly, the same study revealed that 31% of people who disputed an error ultimately agreed the information was correct after the investigation. You can discover more about the FTC's findings on credit report accuracy.

Whatever the outcome, take the time to carefully review the updated credit report the bureau sends you. Make sure any corrections were made properly. If your dispute was denied, understanding why is the first step in planning what to do next.

What To Do When Your Dispute Gets Rejected

It’s a frustrating moment: you get a notification that the credit bureau rejected your dispute. After all your hard work, they’ve sided with the creditor and labeled the information “accurate.” It can feel like you’ve hit a brick wall.

Don’t give up. This isn't the end of the credit report dispute process. An initial rejection just means the company that supplied the data (the furnisher) told the bureau that their records match what's on your report. That doesn't automatically make it right—it just means your first attempt didn't have enough muscle to prove your case. You still have some powerful moves to make.

Try Again With Stronger Evidence

If you’ve managed to dig up new, compelling proof that you didn't have the first time around, you can absolutely file another dispute. The key here is new evidence. Just resending the same documents will almost certainly get your dispute flagged as "frivolous" and dismissed without a second thought. You have to build a stronger case.

For instance, let’s say you were disputing a late payment. In your first attempt, you sent a bank statement. This time, you found the actual canceled check image from your bank's portal, which clearly shows the date the creditor cashed it. That’s a much more powerful piece of evidence that could be exactly what you need to get the decision overturned.

Add a Statement of Dispute to Your File

What if you don't have any new documents but you're still 100% certain the item is wrong? The Fair Credit Reporting Act (FCRA) gives you a fantastic tool: the right to add a 100-word statement of dispute to your credit file.

It’s your opportunity to leave a permanent note. For example, you could write something like, "This account was paid on time. I am disputing this late payment because the creditor's internal system delayed processing my payment for two weeks, and I have provided them with documentation of the original transaction date."

Escalate to a Higher Authority

When the credit bureaus just won't budge, it's time to take your complaint to the next level. Your best bet is filing a formal complaint with the Consumer Financial Protection Bureau (CFPB). This isn't just another form—it gets results.

The CFPB will forward your complaint directly to the company in question, and that company is legally required to respond. The process creates a formal record and puts real pressure on both the creditor and the bureau to give your case the serious look it deserves.

If the error is causing you major financial headaches—like a sudden, sharp drop in your credit score—and you’ve exhausted all other options, it might be time to talk to an attorney specializing in the FCRA. They can advise you on your legal rights and whether you can seek damages for violations. Watching your score is a good way to gauge the impact of these errors, and our guide explaining why your credit score might be dropping can help you understand what's happening.

Got Questions? Let's Talk About the Dispute Process

Even with the clearest instructions, you're bound to have questions pop up as you dive into the credit dispute process. That's perfectly normal. Getting solid answers to these common sticking points can make all the difference, giving you the confidence to see it through. Let's clear up some of the most frequent things people wonder about.

How Long Does This Actually Take?

This is usually the first question on everyone's mind. You've done the work, mailed your letters, and now you're just... waiting. The good news is you won't be left in the dark forever.