Finding the Cheapest Credit Monitoring Service That Works

When you're on the hunt for the cheapest credit monitoring service, it's easy to get fixated on the lowest monthly price. But here's a little secret from years of experience: the real goal isn't just the lowest price, but the best overall value. The smartest options strike a perfect balance, combining a low fee with the heavy-hitting features you actually need, like three-bureau monitoring and identity theft insurance. This turns it from just another bill into a smart investment in your financial security.

What Truly Affordable Credit Monitoring Means

Let's be honest, figuring out what "cheapest" really means in credit monitoring can be tricky. A service with a tempting rock-bottom price might look like a huge win, but it almost always comes with trade-offs that can leave your financial life dangerously exposed.

True affordability isn't about the absolute lowest number on a price tag. It's about finding that sweet spot where the cost is reasonable and the protection is solid.

Think of it like buying a helmet for your bike. You could probably find one for a few bucks at a garage sale, but would you really trust it to protect you in a crash? A certified helmet that costs a bit more is the truly affordable choice because it prevents a trip to the ER and a mountain of medical bills. The exact same logic applies here.

The Value Proposition of Smart Monitoring

Paying a small monthly fee for a high-value service is one of the smartest investments you can make to prevent a potential financial nightmare. A "cheap" plan that only watches one credit bureau is like locking your front door but leaving the back door and all the windows wide open. You're completely blind to two-thirds of the places where trouble can start.

Fraudsters are pros at finding these blind spots. The real cost isn’t that small monthly fee; it's the thousands of dollars and hundreds of agonizing hours you could spend cleaning up the mess from identity theft that a good service would have caught right away.

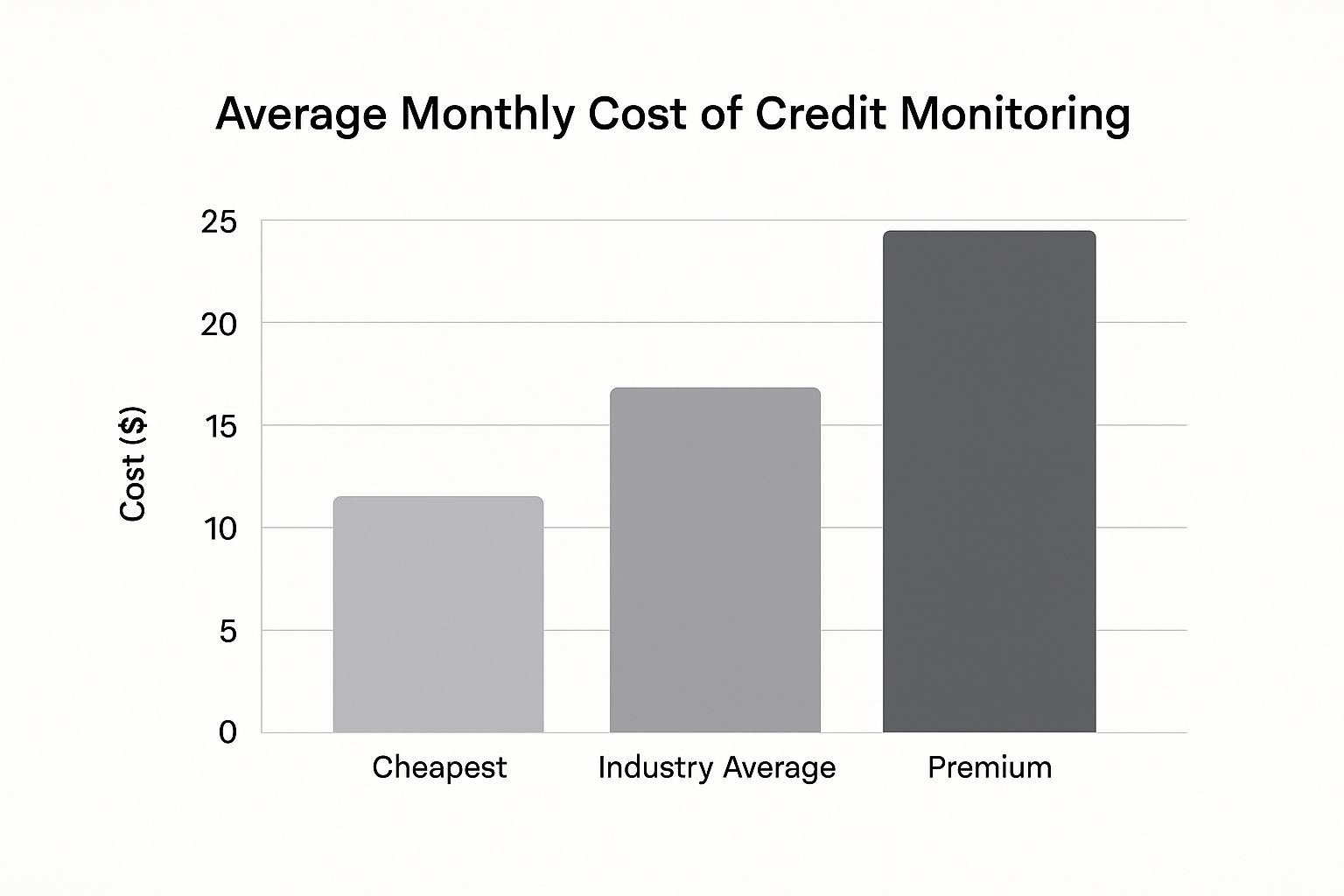

This chart shows just how much monthly costs can vary, and it really highlights the gap between bare-bones plans and premium ones.

As you can see, there's a clear middle ground where you find high-value, truly affordable services. These avoid both the flimsy protection of the "cheapest" options and the sky-high prices of premium tiers.

For instance, some of the most budget-friendly plans pack a serious punch. IdentityIQ has plans starting around 7.44 per month** that include full three-bureau monitoring and even synthetic identity theft protection. Likewise, [Identity Guard](https://www.identityguard.com/) starts at **7.50 per month and adds AI-powered threat detection and a $1 million insurance policy. This proves you don't have to break the bank for comprehensive protection. You can find more details on how these services bundle essential features for a low price at CyberInsider.com.

Free vs High-Value Paid Credit Monitoring

To really see the difference, it helps to put things side-by-side. A free service might give you a tiny peek at your credit world, but a high-value paid service acts like a complete security system for your financial identity.

This table breaks down what you get—and, more importantly, what you give up.

The takeaway is pretty clear. While "free" is always tempting, paying a small, reasonable fee unlocks a level of protection that can save you from a world of financial pain. It's the difference between a leaky umbrella and a fortified shelter in a storm.

How Credit Monitoring Protects Your Finances

Think of credit monitoring as a silent, digital security guard for your financial life. While you're at work, sleeping, or just living your life, these services are busy working 24/7 in the background. They keep a constant watch over your most sensitive information, and their main job is to spot suspicious activity and tell you about it right away. This gives you the power to shut down threats before they can cause any real damage.

This kind of protection is about so much more than just watching your credit score fluctuate. A good service acts like your own personal alarm system, one that's specifically programmed to detect the red flags that almost always signal identity theft.

What Does the Service Actually Watch For?

Real, effective monitoring isn't just a simple score update. It’s about catching the small but dangerous changes to your credit files—the kinds of things you'd never notice on your own until it was far too late. These services are built to alert you to critical events as they happen.

Here are the key alerts you should expect:

Imagine this: it's a Tuesday morning and you get a text alert that says, "A hard inquiry from Big Bank Auto Loans was just added to your Equifax report." You haven't looked for a car in years. That single alert gives you the heads-up you need to call the bank, freeze your credit, and stop a fraudulent loan dead in its tracks.

This is the real value a service like All3Credit provides. It’s not a passive tool you check once a month; it's an active defense system. For a deeper dive into how this all works, check out our full guide on what is credit monitoring and see how it builds the foundation for modern financial safety. The goal, even for the cheapest credit monitoring service, should be to deliver this essential, real-time protection.

The Real Cost of 'Free' Credit Monitoring

That little word, "free," is a powerful magnet, isn't it? Especially when you're trying to find the cheapest credit monitoring service you can. But when it comes to protecting your finances, "free" almost always has hidden costs and some pretty serious trade-offs. What are you really giving up to save a few bucks a month? It's probably more than you think.

The single biggest problem with most free services is how little they actually cover. Think of your credit history as a house with three front doors—one for Experian, one for Equifax, and one for TransUnion. A standard free service usually agrees to watch just one of those doors, leaving the other two wide open. This creates huge blind spots, and believe me, fraudsters know exactly how to use them to their advantage.

How Crooks Exploit the Gaps in Free Monitoring

Let’s look at how this plays out in the real world. A thief nabs your personal details from a data breach and wants to open a credit card with a high limit. They're smart, so they figure you're likely using a free service that only monitors, say, TransUnion.

So, what do they do? They deliberately apply for a credit card from a bank that they know only checks reports from Experian or Equifax. The application gets approved without a hitch, and you have no idea. Why? Your free service saw nothing because the action happened at a door it wasn't watching. By the time you find out, the damage is already done.

This isn't just a theory. The market for credit monitoring has changed a lot, and there are some decent free options out there for casual users. Capital One's CreditWise, for example, watches two bureaus but offers limited detail—it's a good starting point for basic awareness. But if you want truly complete monitoring across all three bureaus with alerts that are detailed and actionable, a paid service is still the only way to go. You can read more about the best credit monitoring services to see how different tiers stack up and why that comprehensive coverage is so crucial.

Beyond just watching one bureau, free services often come up short in other ways that matter:

These shortcomings make it clear that the "cost" of free isn't zero. It's the risk of financial disaster that you're quietly agreeing to take on. A low-cost, comprehensive service like All3Credit eliminates these dangerous gaps for a small, predictable fee, giving you actual peace of mind.

What Really Makes a Credit Monitoring Service a Great Deal?

When you’re on the hunt for the cheapest credit monitoring, it’s all too easy to let the price tag be your only guide. But the truth is, real value isn't just about finding the lowest number. It’s about securing the right protections without overpaying for bells and whistles you don’t actually need. A truly high-value service gives you a core set of non-negotiable features that act as a powerful shield for your financial identity.

The absolute most critical feature is three-bureau monitoring. People often assume their credit history lives in one central database, but it's actually maintained by three distinct agencies: Experian, Equifax, and TransUnion. If your service only watches one bureau, you’re essentially leaving two-thirds of your financial life unguarded. A smart thief knows this and will simply apply for credit with a lender who pulls from one of the bureaus you aren’t watching, leaving you totally in the dark.

Seeing the full picture is everything. We’ve put together a guide explaining why monitoring all three bureaus is so important if you want to dig deeper. This complete visibility is the bedrock of any effective defense.

The Non-Negotiable Feature Checklist

Beyond covering all three bureaus, a few other features are absolute must-haves. Before you even think about signing up for a service, make sure it ticks these boxes.

How Premium Features Become Affordable

What was once considered a premium feature is now becoming the standard, and prices are getting more competitive. For example, even a major player like Experian offers plans starting at $24.99 per month for its Premium tier, which includes three-bureau monitoring and FICO score access. This shift shows that the industry understands consumers demand comprehensive protection. You can explore more on the best credit monitoring services at Money.com to see how different companies package these features.

Our entire philosophy at All3Credit is built around delivering these exact core protections, but without the premium price tag. By focusing on what truly matters for your security, we make sure you’re getting a service that provides genuine peace of mind, making it a smart and truly affordable investment in your financial health.

Choosing the Right Service for Your Budget

When you're looking for a credit monitoring service, it’s easy to get caught up in finding the absolute lowest price. But here's what I've learned from years in this field: the goal isn't just cheap, it's value. You're searching for that sweet spot where a small monthly fee buys you powerful, meaningful protection. After all, a service that costs pennies but doesn't actually protect you isn't a bargain—it's a liability.

We've already touched on why "free" services often fall short. They typically create huge blind spots by watching only one credit bureau, sending alerts long after the damage is done, and offering absolutely no financial help if your identity is stolen. This creates a dangerous false sense of security, leaving the door wide open for thieves to cause havoc where you aren't looking. A truly affordable and effective service closes these gaps.

The Framework for a Smart Decision

Making a confident choice is actually pretty straightforward once you know the essential features to look for. Think of this as your personal checklist for finding a plan that delivers real security without costing a fortune.

In the end, your search for the "cheapest" credit monitoring should really be a search for the best value—which is where a provider like All3Credit comes in. For a reasonable monthly fee, you get all the core protections needed to stop small problems from snowballing into financial catastrophes. It’s a small, predictable investment in your long-term peace of mind.

Answering Your Top Credit Monitoring Questions

When you're looking for affordable credit monitoring, a few practical questions always seem to pop up. It's smart to ask them! Getting these details sorted out is key to choosing a service with confidence.

Let's walk through the most common things people want to know before they sign up. These are the real-world concerns that matter when you're protecting your financial identity without breaking the bank.

Is Credit Monitoring the Same as Identity Theft Protection?

That's a great question, and the answer is that they're closely related, but not quite the same thing. It’s best to think of credit monitoring as a critical part of a complete identity theft protection plan. It focuses squarely on your credit files, watching the three bureaus for red flags like new accounts opened in your name or loan applications you didn't make.

True identity theft protection is a much bigger umbrella. It usually includes everything credit monitoring does, plus several other layers of security. This often means adding services like:

The best services, like All3Credit, don't make you choose. They blend these powerful features together to give you a comprehensive shield against fraud.

How Quickly Will I Actually Get an Alert?

Speed is everything when it comes to stopping fraud in its tracks. While the exact timing can vary, a good paid service should send you an alert well within 24 hours of a major change hitting your credit report. This is a huge contrast to free services, where you might not hear about a problem for days or even weeks—long after the damage is done.

You'll typically get these warnings through email, text message, and push notifications on your phone. This multi-channel approach makes it almost impossible to miss a critical update, so you can act immediately if something looks off.

Can Credit Monitoring Hurt My Credit Score?

Absolutely not. This is a very common myth, but you can put it to rest for good. Signing up for and using a credit monitoring service will never harm your credit score.

Here's why: these services use what's called a "soft inquiry" to view your credit information. A soft inquiry is like checking your own report or getting a pre-approved offer in the mail—it's for your information only and has zero effect on your score. It’s completely different from a "hard inquiry," which is what happens when a lender pulls your credit because you've applied for a new loan or credit card. Those can cause a small, temporary dip in your score.

So go ahead and check your credit with a monitoring service as often as you like. You can do it with complete confidence.

Ready to get the complete picture of your credit health without the premium price? All3Credit offers comprehensive, three-bureau monitoring and timely alerts for just $12.99 a month. Start protecting your financial future today.