Can Checking My Credit Score Lower It? What You Need to Know

Let's get one of the biggest myths in personal finance out of the way right now: checking your own credit score will not hurt it. Not one bit. You can, and should, check your score as often as you want without worrying about causing any damage.

The Truth About Checking Your Credit Score

It’s a fear that keeps too many people in the dark about their own financial health: "Will I lower my score just by looking at it?" This anxiety is completely understandable, but it's rooted in a simple mix-up about how credit checks actually work.

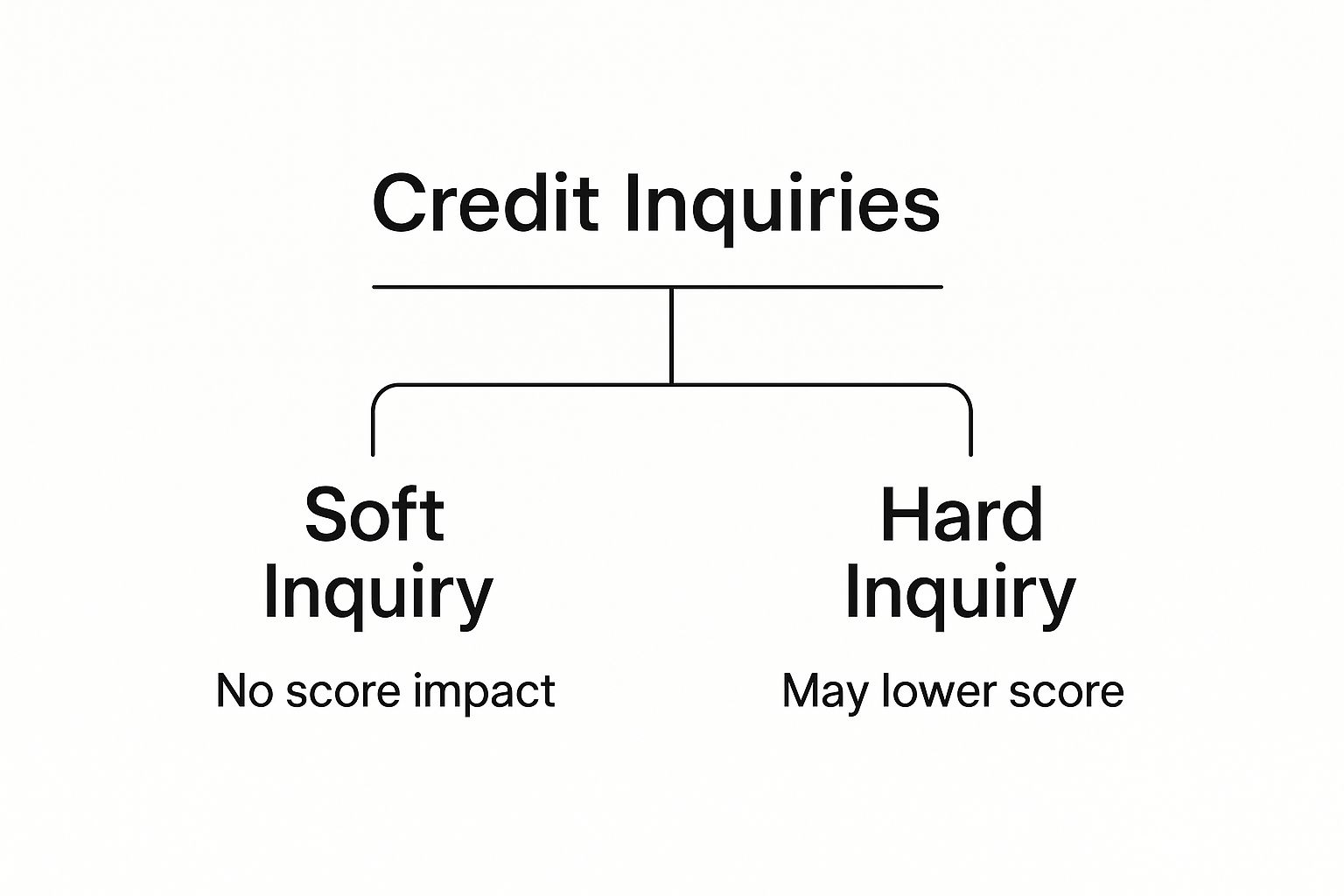

To really get to the bottom of this, we need to talk about the two different ways your credit can be checked: soft inquiries and hard inquiries.

Soft Inquiries: The “Just Looking” Checkup

A soft inquiry is like looking in the mirror. You can do it a hundred times a day, but your reflection doesn't change. It’s just for your own information.

When you check your credit score through a monitoring service like Credit Karma, or even through your own bank or credit card's free tool, that's a soft inquiry. These are totally harmless, completely invisible to lenders, and have zero impact on your credit score.

Hard Inquiries: The Official Application

Now, a hard inquiry is the real deal. This happens when a financial institution pulls your credit report because you’ve officially applied for some form of credit.

Think of things like:

This kind of check tells the credit bureaus you’re actively trying to take on new debt. From their perspective, this can signal a slight increase in risk, at least temporarily.

A single hard inquiry usually isn’t a big deal. According to Experian, it might cause a small, temporary dip of fewer than five points. The effect on your score typically fades within 12 months, even though the inquiry itself will remain visible on your report for two years. You can find more details on this in Experian's credit education resources.

To make this crystal clear, here’s a quick breakdown of common actions and what kind of inquiry they trigger.

Quick Guide to Credit Inquiries

Knowing the difference is freeing. It means you have the green light to monitor your credit as much as you need to. Staying on top of your score is one of the best ways to spot errors, track your progress toward financial goals, and catch any signs of fraud before they become a major problem.

Understanding Soft vs.Hard Inquiries

So, can checking your credit score actually lower it? To get to the bottom of this, we need to talk about the two completely different ways your credit can be checked. It helps to think of them as two different kinds of conversations about your financial past—one is a private peek, and the other is a formal request.

The private peek is what we call a soft inquiry, or a soft pull. This happens when you check your own credit, or when a company pulls it for a background check without you actually applying for a loan or card. The best part? It’s totally harmless. A soft inquiry has zero impact on your credit score, no matter how many times it happens.

This image really clarifies the difference between the two.

As you can see, only one of these has the potential to nudge your credit score.

The Gentle Touch of a Soft Inquiry

Think of a soft inquiry as a look behind the curtain that lenders don't even see. It’s for your information only, or for a company doing a routine screening that isn’t tied to a credit application.

Here are a few common times a soft inquiry occurs:

Because you aren't actively trying to open a new line of credit, these checks don't signal risk to potential lenders. They're a completely safe—and essential—part of managing your financial health. Services that offer credit monitoring across all three bureaus use these soft inquiries to give you a complete and up-to-date look at your credit files without causing any harm.

The Impact of a Hard Inquiry

Now for the other side of the coin: the hard inquiry. This is the formal request. A hard pull only happens when you officially apply for new credit and give a lender permission to pull your full report to make a lending decision.

This type of inquiry gets recorded on your credit report and is visible to any other lender who pulls your file. Lenders watch these closely because a flurry of hard inquiries in a short time can be a red flag. It might signal that you're in financial trouble or about to take on a lot of new debt all at once.

For that reason, a single hard inquiry can cause a small, temporary dip in your credit score—usually fewer than five points. This minor drop is the source of all the confusion. So yes, applying for a loan can ding your score a little, but just checking it yourself? Never.

Real-World Scenarios When Your Credit Is Checked

Okay, let's move past the textbook definitions. Knowing the difference between a soft and hard inquiry is one thing, but seeing how they play out in real life is what truly matters. This is where the knowledge becomes power.

Think about it this way: the real question isn't just "can checking my credit score lower it?" It’s more about who is doing the checking and why they're looking in the first place.

Many of your day-to-day financial activities involve a quick, harmless peek at your credit profile. These are the safe, score-neutral soft inquiries you can welcome without a second thought.

Common Soft Inquiry Scenarios

You probably run into soft inquiries far more often than you realize. They’re standard practice in many situations that have nothing to do with borrowing money, and best of all, they're completely invisible to lenders. This means they have zero impact on your credit score.

Here are a few everyday examples:

When a Hard Inquiry Comes into Play

On the flip side, a hard inquiry only happens when you give a lender your explicit permission to pull your credit as part of an official application. This is the one that matters. It’s the check that can cause a small, temporary dip in your score because it tells the credit bureaus you’re actively shopping for new debt.

These situations are clear-cut triggers for a hard inquiry:

To make this even clearer, let's break down some common actions and what kind of inquiry they typically trigger.

Common Actions and Their Credit Inquiry Type

By connecting these tangible life events to the concepts of soft and hard pulls, you can start managing your credit proactively. You’ll know exactly when an action is just for your own information versus when it might ding your score for a little while.

Why This Common Credit Score Myth Persists

So, if checking your own credit score is perfectly safe, why does this myth have such a death grip on so many of us? It all boils down to a classic case of misinterpreted advice.

For years, financial experts have preached the same warning: be careful about having too many hard inquiries in a short span of time. And they're right. Firing off applications for a bunch of new credit cards and loans at once can look like a sign of financial distress to lenders.

But somewhere along the way, this solid, nuanced advice got watered down. It morphed into a vague, ominous warning: “Don’t let anyone check your credit too often.”

The vital difference between a lender-initiated hard inquiry and a self-initiated soft inquiry simply got lost in translation. And a general fear of any credit check, no matter the type, began to take root.

The Power of Misinformation

This confusion has created a whole cycle of needless anxiety, stopping people from taking one of the most fundamental steps toward financial health. When you're afraid to look at your score, you miss your chance to spot errors, see your progress, or catch the early red flags of identity theft.

It's a surprisingly common blind spot.

This is exactly why so many people get blindsided by a sudden drop in their score—they haven't been keeping an eye on the things that actually move the needle. If you've ever been stumped by a dip, you can check out the common reasons why a credit score might be dropping to see the real culprits.

By busting this myth, you can finally move from a place of fear to one of empowerment, ready to actually use your financial data to your advantage.

How to Monitor Your Credit Health Effectively

Now that you know the difference between a hard and soft pull, you can turn that knowledge into a powerful habit. Monitoring your credit isn't some chore you have to dread—it's one of the best ways to build real financial strength. When you check in regularly, you can catch errors before they become problems, spot the first signs of fraud, and actually watch your hard work pay off.

Think of it like a regular health checkup, but for your finances. A quick look once a month is all it takes to stay informed and in control. This proactive habit ensures there are no nasty surprises waiting for you when it's time to buy a car or a home, transforming your credit score from a mysterious number into something you can actively manage.

Building Your Monitoring Routine

Making credit monitoring a consistent habit is easier than ever, and you don't need to pay a dime. Plenty of free, accessible tools are out there to help you stay on top of things.

Here are the best ways to get started:

It also helps to know when things get updated. Most creditors report your account activity to the bureaus at least once a month. This means your positive actions, like paying down a big credit card balance, should show up on your report and start helping your score in about 30 days. To learn more, you can discover insights about how often your credit score updates on americanexpress.com.

Strategic Times to Check Your Credit

While a monthly glance is a great baseline, there are specific times when you should do a much deeper dive into your full credit reports. Think of these as strategic check-ins before you make a big financial move.

Make sure you pull your full reports a few months before you plan to:

Checking ahead of time gives you a crucial window to dispute any errors you find. This allows the bureaus the time they need to investigate and fix your file before a lender ever sees it. If you're looking for a way to keep an eye on things around the clock, our guide on what is credit monitoring can show you how.

How to Handle Hard Inquiries on Your Credit Report

So, a hard inquiry hits your report. It's easy to panic, but the reality is that its impact is often much smaller and more manageable than most people think. Understanding how they work puts you right back in the driver's seat.

A single hard pull will typically only knock your score down by less than five points. What’s even better is that its influence starts to fade pretty quickly. While the inquiry stays visible on your report for two years, it stops affecting your actual score after just one year.

The bottom line? This temporary dip shouldn't scare you away from finding the best deal on a loan. In fact, the credit scoring systems are built to reward smart shopping.

The Smart Way to "Rate Shop"

Think about it: when you're making a huge financial decision like buying a house or a car, you should compare offers. Credit scoring models get this, which is why they have a built-in grace period for what's called "rate shopping."

This feature lets you apply for multiple loans of the same type in a short window without getting dinged for every single application. All those inquiries get bundled together and treated as just one.

Here’s how it works for major loans: