Get All Three Credit Reports Free Your Easy Guide

Let's get right to the good news: Yes, you can get all three of your credit reports for free, every single week. This isn't some short-term promotion; it’s a permanent program offered by the big three credit bureaus—Equifax, Experian, and TransUnion.

We'll walk you through exactly how this works and why it's a game-changer for managing your finances.

Your Right to Free Weekly Credit Reports

This is one of the most powerful financial tools you have, and honestly, not enough people know about it. While federal law has always given you the right to see your credit information, recent changes have made it incredibly easy to stay on top of your credit health.

What started as a temporary helping hand during the COVID-19 pandemic has now become a permanent fixture. All three major U.S. credit bureaus have committed to offering free weekly online access to your credit reports, a move confirmed by the Federal Trade Commission.

Why Checking Weekly is a Smart Move

Making a habit of checking your reports is one of the simplest, most effective things you can do for your financial well-being. Think of it as your first line of defense against identity theft and the quickest way to catch reporting errors that could be dragging down your score.

Here’s why it really matters:

There's only one place to get these official, free reports: AnnualCreditReport.com. Be sure you're on the right site—it should look exactly like this.

Going directly to that URL is critical. There are plenty of look-alike sites out there designed to trick you into paying for something that is rightfully yours for free. For a complete breakdown of each bureau's role, you might find our guide on https://www.all3credit.com helpful.

Your Free Credit Report Access at a Glance

To make it even clearer, here’s a quick summary of how you can access your free credit reports throughout the year.

This table shows that while the weekly online option is the most frequent, you still have other methods available depending on your needs and preferences. Ultimately, having this level of access puts you firmly in the driver's seat of your financial life.

How to Get Your Free Credit Reports the Right Way

Getting your hands on all three of your credit reports for free is actually pretty straightforward, but you have to know where to look. The one and only place you should go is AnnualCreditReport.com. This is the single, federally authorized website that provides weekly reports from Experian, Equifax, and TransUnion without any cost or strings attached. Steer clear of any look-alike sites or third-party services that promise free reports but then try to sell you a credit monitoring subscription. This is the official, direct source.

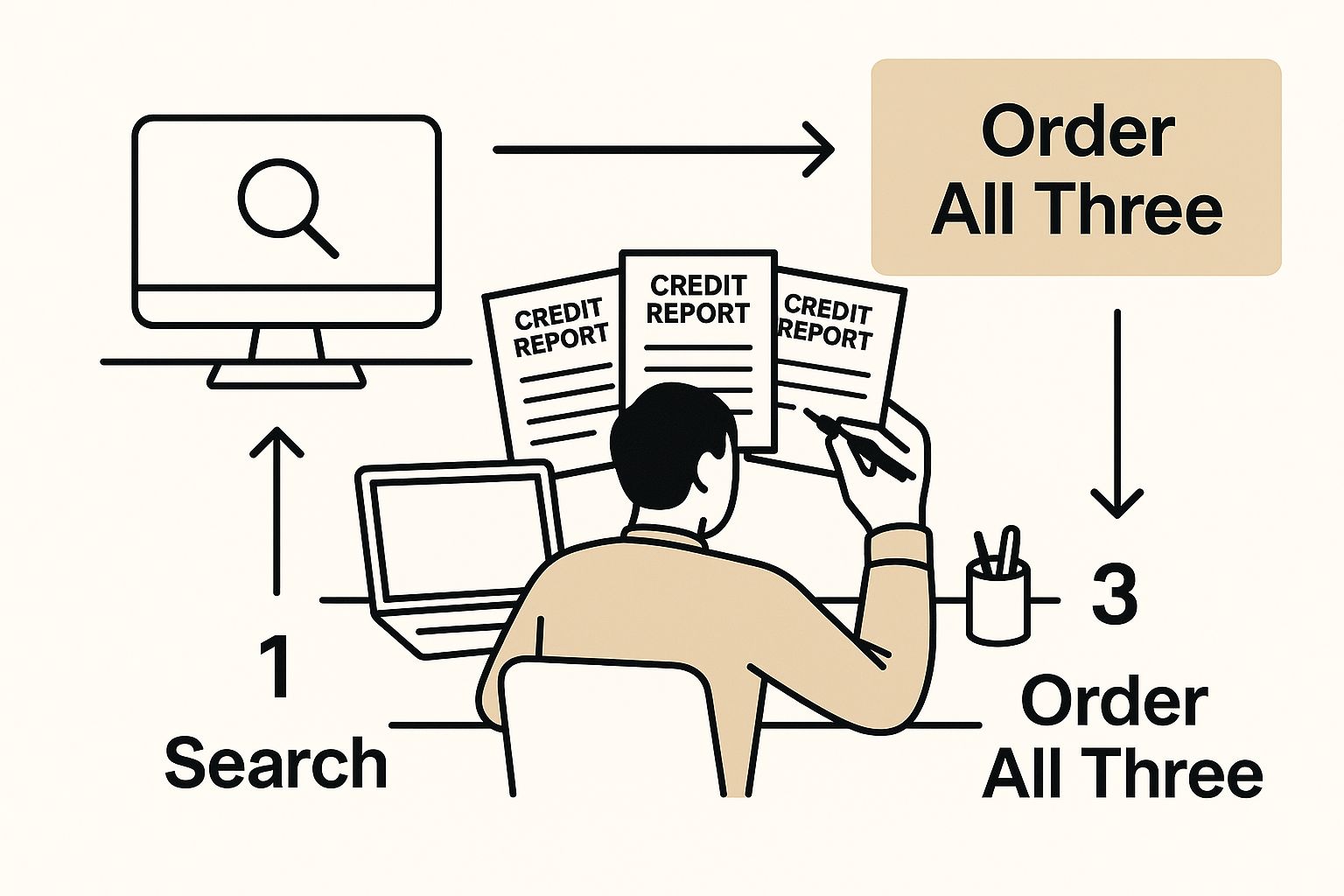

The whole process is designed to be simple, letting you pull all three reports from one central hub. This handy visual breaks it down.

As you can see, it's a direct path from preparing your info to having the reports in your hands.

What You'll Need Before You Start

Do yourself a favor and get a few key pieces of information together before you head to the site. This isn't just about making it go faster; it's about making sure you can pass the identity verification questions without a hitch.

Here's your checklist:

Brace Yourself for the Security Questions

After you plug in your basic info, each credit bureau will hit you with a few multiple-choice questions to prove you're really you. These questions are pulled directly from your credit file, so in theory, only you should know the answers.

For instance, you might see something like: "According to our records, you took out a mortgage around October 2019. Who is the lender?"

I'll be honest, these questions can be surprisingly tough. They often reference old car loans, credit cards you closed years ago, or lenders you've long forgotten. It's a great idea to have some recent bank or loan statements nearby just in case your memory fails you.

And if a question seems totally out of left field? "None of the above" is a very real possibility. Sometimes the question itself is based on an error in your file—which is exactly the kind of thing you're looking to find

Why You Need All Three Credit Bureau Reports

So, you might be thinking, "Why bother with three reports? Isn't one good enough?" It’s a common question, but the answer is a firm no. The most important thing to grasp is that Experian, Equifax, and TransUnion are separate, competing businesses. There’s no law forcing your bank, credit card company, or auto lender to send your account details to all of them.

This creates a situation where the information on each report can—and often does—differ. For example, a car loan from your local credit union might only show up on your Equifax report. That new retail store card you opened? It could be reporting only to Experian. If you don't check all three, you're only seeing a fraction of your financial story.

It’s not just about spotting missing accounts, either. An error, like a payment that was paid on time but mistakenly marked as late, could easily appear on one report but be absent from the others. If you only pull one, you could completely miss a critical issue that's silently dragging down your score with certain lenders.

Real Scenarios Show Why It Matters

Let's get practical. Imagine you're applying for a mortgage—a huge financial step. Lenders almost always pull reports and scores from all three bureaus. If an old, forgotten collection account is lurking only on your TransUnion report, that single negative item could be enough to derail your application or stick you with a much higher interest rate.

This happens more often than you'd think. Maybe a medical bill you never received went to collections and was only reported to one bureau. By reviewing all three reports, you catch these isolated problems and can dispute them before they cause a major headache. For a deeper dive into how each bureau operates, check out our guide on all three credit bureaus.

Getting all three also means you benefit from the unique features each bureau might offer. For instance, TransUnion provides certain users with daily access to their credit reports, which is a fantastic tool for closely monitoring your credit health. Ultimately, checking every report is the only way to ensure nothing falls through the cracks.

Steer Clear of Common Traps and Scams

When you’re looking for your credit reports, you need to be careful. The internet is littered with look-alike websites trying to trick you. It’s a classic bait-and-switch.

These tricky sites often pop up at the top of search results. They use official-sounding names and logos to get you to click. Their goal? To get you to pay for something that is rightfully yours for free.

Here’s their most common play: they’ll offer a "free credit score" with your report but bury the fine print. Before you know it, you’ve handed over your credit card information for a "trial subscription" that quietly starts billing you after a week or two. It’s a headache you don’t need.

The only place you should go is AnnualCreditReport.com. This is the only federally authorized source where you can get your free reports from all three bureaus—Experian, Equifax, and TransUnion. Any other site is just an impersonator.

What to Do If You Can't Get Your Reports Online

It’s a real source of frustration: you follow all the steps online, only to hit a wall when the system says it can't verify who you are. Don’t panic. It's not necessarily your fault, and it happens more often than you'd think.

I’ve seen this trip people up for a few common reasons:

If the online portal gives you trouble, just pivot to another method. The official site provides options for requesting your reports by mail or phone. You can call their toll-free number or print out a request form to mail in. Sure, it’s not as fast as clicking a button, but it works every time and ensures you get the information you’re entitled to, completely free.

Unlocking Extra Free Reports in Special Cases

While the weekly reports from AnnualCreditReport.com are fantastic, there are specific life events that legally entitle you to even more free reports directly from the bureaus. Think of them as special-access passes for when you need to see your credit file the most. A surprising number of people don't know about these rights, but understanding them can make a huge difference during a tough time.

This isn't just a courtesy; it's federal law. The Fair Credit Reporting Act (FCRA) carves out these exceptions to ensure you have the information you need during a critical financial moment. You can get a solid overview of these consumer protections by checking out Equifax's breakdown of your FCRA rights.

When Do You Qualify for More Reports?

So, what exactly are these special situations? The law recognizes that certain circumstances heighten your need for credit information. If you find yourself in one of the scenarios below, you can request an additional free report.

You're likely eligible for an extra free copy if:

After Being Turned Down (Adverse Action)

One of the most common ways to get another free report is after an "adverse action." That's the official term for when a company denies you something based on information in your credit file.

If this happens, the company that denied you is required to send a notice explaining their decision. This notice is your golden ticket. It allows you to request a free copy of the exact report they used to make that decision. For example, if you applied for a car loan and were rejected because of your TransUnion report, you have the right to get a free copy of that specific TransUnion report to see what's going on.

This right kicks in if you've been denied:

It's a crucial protection that gives you the power to check for errors and understand exactly why you were turned down. It's all about fairness and transparency.

Your Questions About Free Credit Reports Answered

It's completely normal to have a few questions, even after walking through the process. We're dealing with your most sensitive financial data here, so it pays to be cautious. Let's dig into some of the most common things people wonder about when they pull their credit reports for the first time.

Getting these details sorted out is the key to feeling confident and in control of your financial health.

Does Checking My Own Credit Hurt My Score?

This is easily the question I hear most often, and I'm happy to say the answer is a firm no. When you pull your own credit reports through an official source like AnnualCreditReport.com, it’s what we call a "soft inquiry."

Soft inquiries are only visible to you. They have absolutely zero effect on your credit scores. So go ahead and check your reports as often as the law allows—it won't cost you a single point.

The inquiries that can cause a small, temporary dip in your score are "hard inquiries." These only happen when a lender pulls your credit because you've applied for a new loan or credit card.

What If I Find an Error on My Report?

First off, don't panic. Finding a mistake is actually a good thing because it means you've caught something that could be unfairly dragging down your score.

If you spot an error, your next move is to file a dispute directly with the credit bureau that's showing the incorrect information. For instance, if you find an issue on your Experian report, you'll need to contact Experian. Don't waste your time telling Equifax or TransUnion about it—go straight to the source.

Each bureau has a dedicated online dispute portal, which is by far the fastest way to get the ball rolling. You'll need to:

By law, the bureaus generally have 30 days to investigate your claim and must correct any information they confirm is inaccurate. For more in-depth strategies on handling disputes, check out the articles on the All3Credit blog.

Do These Free Reports Include My Credit Score?

Nope. The reports you get when you request all three credit reports free are incredibly detailed histories of your credit activity, but they don't come with a credit score.