All Three Credit Bureaus Explained Simply

When you think about your credit, you're really thinking about the information held by all three credit bureaus: Experian, Equifax, and TransUnion. These are the big players in the U.S. financial world, private companies that gather and organize the consumer credit information that shapes almost every major financial move you make.

The Big 3: Your Financial Storytellers

Think of your financial life as a story that's constantly being updated. In this story, there aren't one, but three official storytellers—Experian, Equifax, and TransUnion. They are like meticulous financial librarians, each managing their own library filled with records of your credit history.

These companies don't decide whether you get a loan. Their job is to collect data from lenders—banks, credit card companies, mortgage lenders, and car loan providers—and assemble it into your credit report. When you apply for credit, lenders pull a copy of this story to gauge how reliable you are with money.

Why Are There Three Different Versions of My Credit Story?

It seems like having one central file would be simpler, right? The reason we have three is simple: they are competing businesses. And because they compete, there are subtle but important differences in the information they hold.

This is precisely why your credit report, and by extension your credit score, can look different depending on which bureau you check. It’s not necessarily a mistake—it's just a reflection of three distinct, though very similar, financial portraits.

Seeing the complete picture that lenders see is crucial. This is why many people turn to services that pull all their information into one place. For anyone serious about their financial health, learning how to get a full report from all three credit bureaus isn't just a good idea—it's essential.

Comparing Experian, Equifax, And TransUnion

At first glance, Experian, Equifax, and TransUnion seem to do the exact same thing: they collect and report information about your credit history. While that’s true, it’s a mistake to think of them as interchangeable. They are three separate, competing businesses, and grasping what makes each of them unique is fundamental to taking control of your financial life.

Think of it like this: imagine three different biographers are writing your life story. They'll all cover the major events—your education, career moves, and big life changes. But each biographer might interview different people, focus on different periods, or interpret events in their own unique way. The core story is the same, but the details and nuances will differ. That’s exactly how the all three credit bureaus work.

One bureau might have a stronger reporting relationship with your local credit union, while another gets more frequent updates from your auto loan provider. These small discrepancies are why a mortgage lender can pull your report and see a slightly different financial picture than a credit card company does. Those subtle differences can, and often do, impact your ability to get approved for a loan.

A Deeper Look At Each Bureau

Let's pull back the curtain on each of the big three to see what sets them apart.

Comparing The Bureaus Side-By-Side

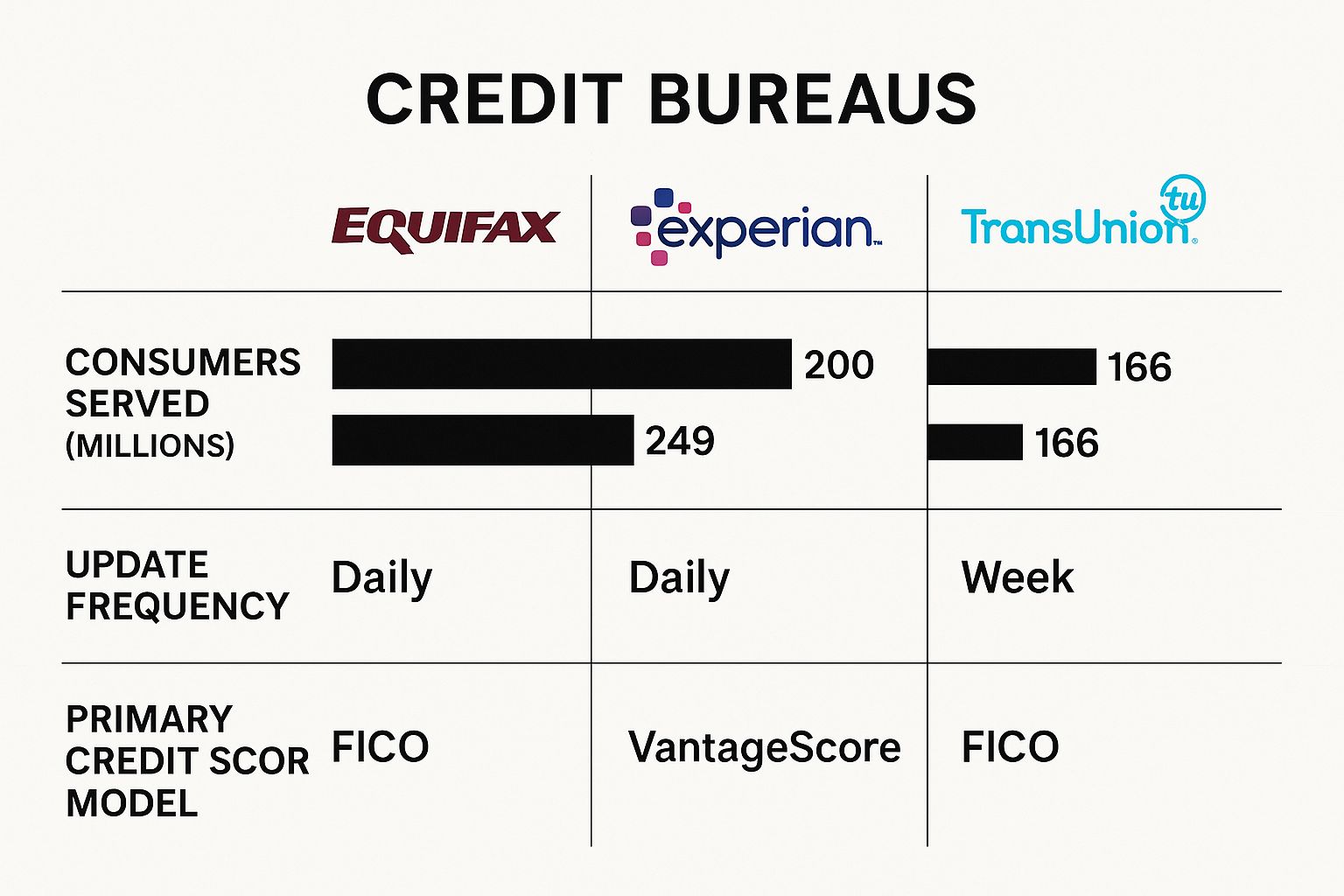

To make sense of the key differences, it helps to see them laid out. This table compares the signature features and common scoring models for each bureau.

While they share the same fundamental purpose, their unique tools and data mean the credit score you get from one can be different from the others.

As the chart illustrates, these aren't small operations. The U.S. credit agency market was valued at an enormous 18.63 billion** in 2025 and is projected to climb to **24.81 billion by 2030. This growth underscores just how critical their role is in the modern economy, helping lenders, investors, and financial markets gauge risk. If you're interested in the economics behind the industry, you can learn more about the U.S. credit agency market's future growth and see what's driving this expansion.

How to Get Your Free Credit Reports

Getting a look at your own financial story isn't just a smart move—it’s a right you're guaranteed by federal law. You are entitled to a free copy of your credit report from each of the three major bureaus every single week. This is the best, most direct way to see what lenders see and stay on top of your financial health.

The only place to do this, officially and for free, is AnnualCreditReport.com. This is the single, government-authorized source. It's important to go directly there, as many other sites have similar names and will try to sell you services or subscriptions you don't actually need.

The Official Way to Get Your Reports

Getting your reports online is quick and easy. It gives you instant access, so you can see your information right away.

Other Times You Get a Free Report

Beyond the weekly freebies, there are a few other specific situations where the law says you can get a free report.

You're legally entitled to another free copy if:

Pulling your reports from all three credit bureaus is the absolute bedrock of good credit management. It’s the only way to catch reporting errors, spot early signs of fraud, and get a complete picture of the financial story that’s being told about you.

How To Read Your Credit Reports

https://www.youtube.com/embed/RwApIRqVCNw

Getting your hands on your credit reports from all three bureaus is the first step. The next is figuring out what they actually say. At first glance, they can look like a wall of text, packed with confusing codes, dates, and jargon. Don't let that intimidate you.

Learning to read your credit report is like learning to read a map of your financial life. It shows you exactly where you've been, which helps you chart a course for where you want to go.

Think of each report as being broken down into four main parts. The layout might look a little different depending on whether you're looking at your Experian, Equifax, or TransUnion file, but the essential information is always the same.

The Four Key Sections of a Credit Report

Breaking your report down into these four sections makes it much less overwhelming and easier to understand.

What To Look For When Reviewing

As you go through each section, you have two main goals: confirm everything is accurate and look for anything that seems out of place. Pay special attention to your payment history. Even a single late payment that's been reported by mistake can do real damage to your credit score.

The entire credit system is built on data, and consumer credit products are what feed it. The rise in credit card applications, which climbed from 26.5% in 2021 to 27.1% in 2022, directly increases the need for accurate data from the bureaus. This shows how our day-to-day financial decisions are what power this massive industry. You can discover more about how consumer credit trends impact the market to get a sense of the bigger picture.

Be on the lookout for red flags like an account you don't recognize, a balance that looks wrong, or a hard inquiry from a company you never contacted. Finding these discrepancies means you need to act fast by filing a dispute with the specific bureau showing the error to protect your financial standing.

Why You Have to Monitor All Three Bureaus

Relying on just one credit report is like locking only one of three doors to your house. It gives you a false sense of security, leaving you wide open to problems you never see coming. Lenders can pull your file from any of the bureaus, so monitoring all three credit bureaus isn't just a good idea—it’s a non-negotiable part of a smart financial defense.

Taking this comprehensive approach is the only way to get a true 360-degree view of your credit health. It ensures that no matter which "door" a lender, landlord, or even a potential employer decides to check, the information they find is accurate, current, and clean.

The Real-World Risks of Only Watching One Report

Let's imagine you're about to apply for a mortgage. You’ve been keeping a close eye on your Experian report, and everything looks fantastic. What you don't know is that an old medical bill was mistakenly sent to collections and is now sitting on your Equifax report, silently dragging that specific score down.

When the mortgage lender pulls your file, they happen to pull the one from Equifax. They see the collection account, and suddenly the great interest rate you were expecting is much higher. Worse, they might deny your application altogether. This single, undiscovered error on one report could easily cost you thousands of dollars over the life of the loan. Trust me, this scenario plays out far more often than you'd think.

Key Benefits of Keeping Tabs on All Three

Staying on top of your reports from Experian, Equifax, and TransUnion gives you some serious advantages.

The global credit bureaus market is a massive industry, which really shows how central it is to our economy. Valued at about 109.59 billion** in 2024, it's projected to climb to nearly **191.22 billion by 2029. This explosive growth comes from the ever-increasing demand for accurate financial data from both lenders and consumers like us. If you're curious about the economic forces at play, you can explore detailed insights into the credit bureaus market growth.

Common Questions About Credit Bureaus

Even when you think you have a handle on the credit system, questions always pop up. It's totally normal. Getting to know how Experian, Equifax, and TransUnion work is a marathon, not a sprint, but getting answers to a few common questions can clear up a lot of the confusion.

Think of this section as your quick reference guide. We’ve compiled answers to the questions we hear all the time to help you manage your credit with more confidence.

Why Are My Credit Scores Different Across The Bureaus?

This is probably the biggest surprise for most people when they first pull their reports. You look at your scores and see one number from Experian, a different one from Equifax, and yet another from TransUnion. Don't panic—this is completely normal.

It happens for a few reasons. First, lenders aren't required to report your activity to all three credit bureaus. Your local bank or credit union might only send your auto loan payment history to TransUnion, for instance. That means your perfect track record on that loan is invisible to Experian and Equifax.

Timing is another factor. One bureau might get and update your latest credit card payment a full week before another one does. And finally, each bureau uses slightly different credit scoring models (like different versions of FICO® or VantageScore®). Each model weighs your financial data a bit differently, which naturally leads to different scores. These little variations are exactly why you need to keep an eye on all three.

What Should I Do if I Find an Error on My Report?

Spotting an error on your credit report can definitely make your heart skip a beat. Whether it’s an account you don’t recognize or a late payment you know you paid on time, the good news is there's a clear, legally protected process to fix it. You have to dispute the mistake directly with the specific credit bureau reporting it.

The process is free, but it won't happen on its own. You have to take the first step. Ignoring an error can seriously hurt your ability to get a loan, a good insurance rate, or even a job.

How Often Should I Check My Credit Reports?

A good rule of thumb is to check your full credit reports from all three bureaus at least once a year. This gives you a solid annual check-up to catch errors and see where you stand. But depending on your financial goals, you might want to check more often.

Consider checking more frequently if you are:

For more in-depth strategies and tips on managing your credit, you can find a wealth of information on our All3Credit blog.

Ready to see the complete picture of your financial health? With All3Credit, you get real-time access to your scores and reports from all three credit bureaus on a single, easy-to-use dashboard for just $12.99 a month. Stop guessing and start knowing exactly where you stand. Sign up for All3Credit today and take control of your credit.